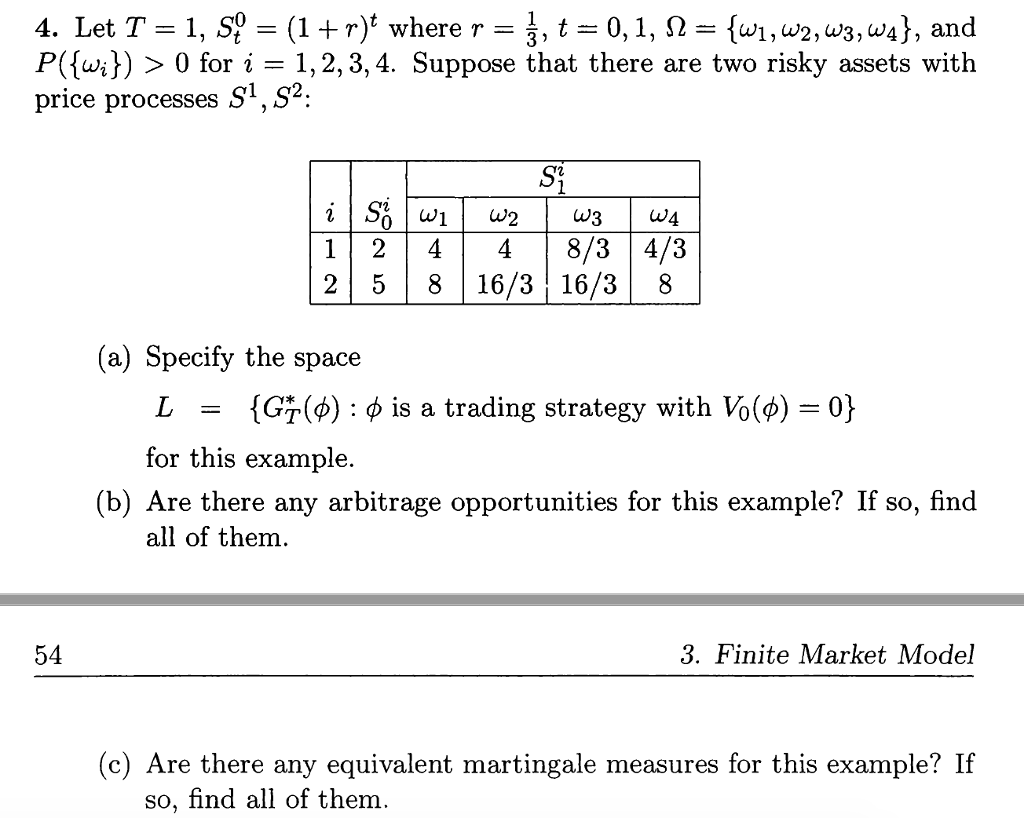

Question: 4. Let T = 1, sp = (1 + r)t where r = : t-0, 1, P-, u 2,a/3, u 4}, and P({w,) > 0

4. Let T = 1, sp = (1 + r)t where r = : t-0, 1, P-, u 2,a/3, u 4}, and P({w,) > 0 for i = 1, 2, 3, 4, Suppose that there are two risky assets with price processes S1,s2 W3 W4 12448/34/3 2 5816/3 16/38 (a) Specify the space = L = {G ) : is a trading strategy with Vol for this example (b) Are there any arbitrage opportunities for this example? If so, find all of them 54 3. Finite Market Model Are there any equivalent martingale measures for this example so, find all of them 4. Let T = 1, sp = (1 + r)t where r = : t-0, 1, P-, u 2,a/3, u 4}, and P({w,) > 0 for i = 1, 2, 3, 4, Suppose that there are two risky assets with price processes S1,s2 W3 W4 12448/34/3 2 5816/3 16/38 (a) Specify the space = L = {G ) : is a trading strategy with Vol for this example (b) Are there any arbitrage opportunities for this example? If so, find all of them 54 3. Finite Market Model Are there any equivalent martingale measures for this example so, find all of them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts