Question: I also need help with form 540 2020 and with indvidual tax formula if possible hopefully these are much more clearer i apologize for the

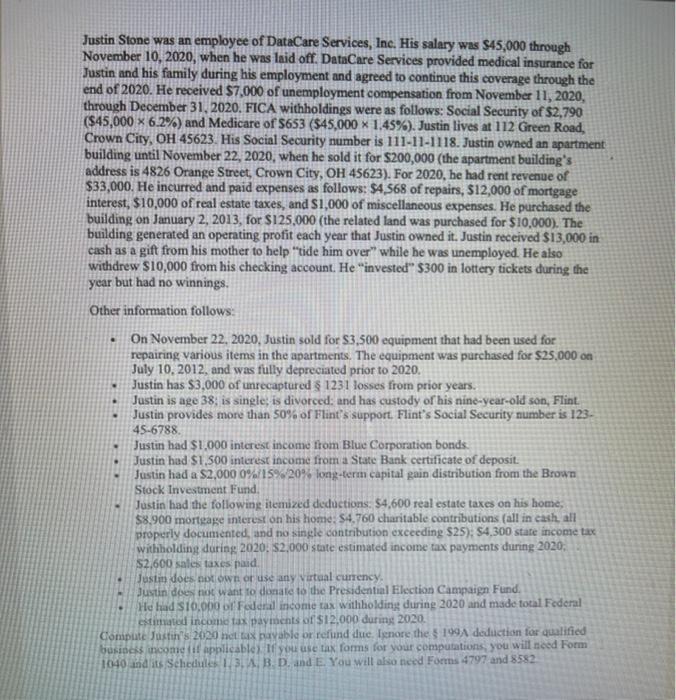

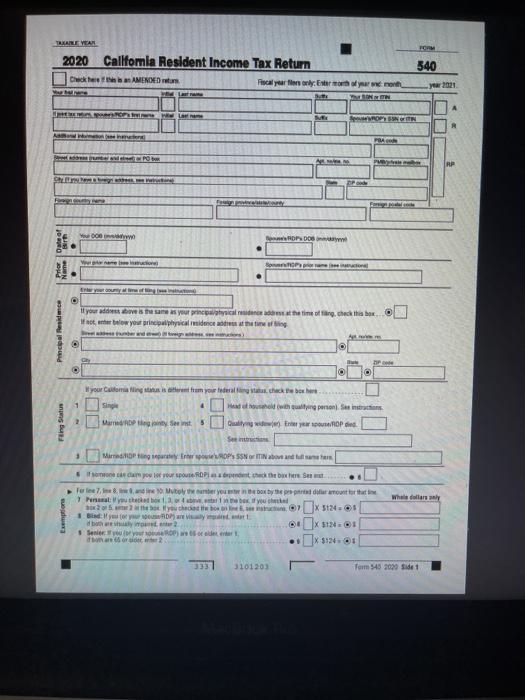

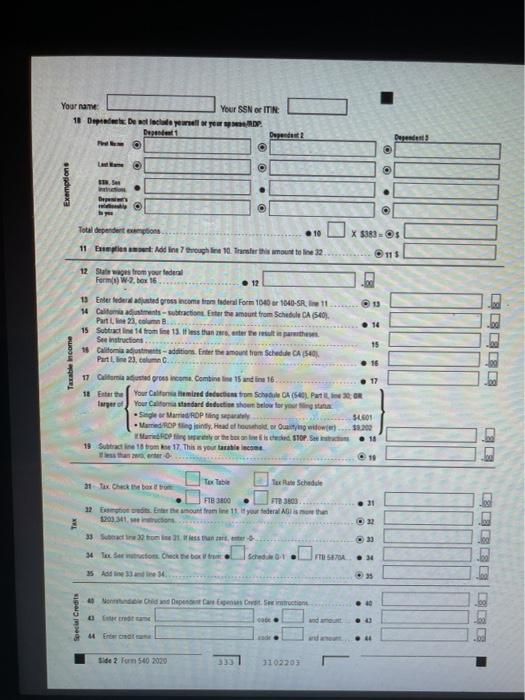

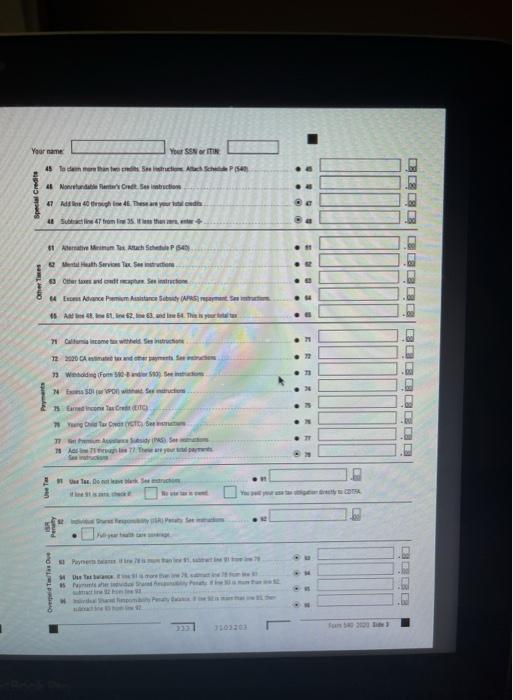

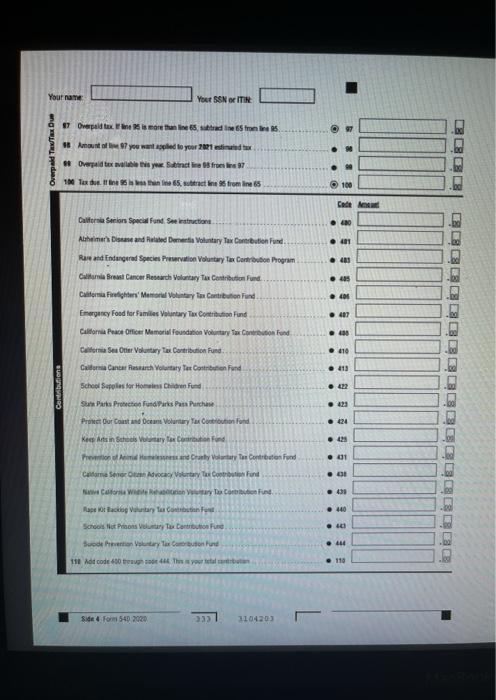

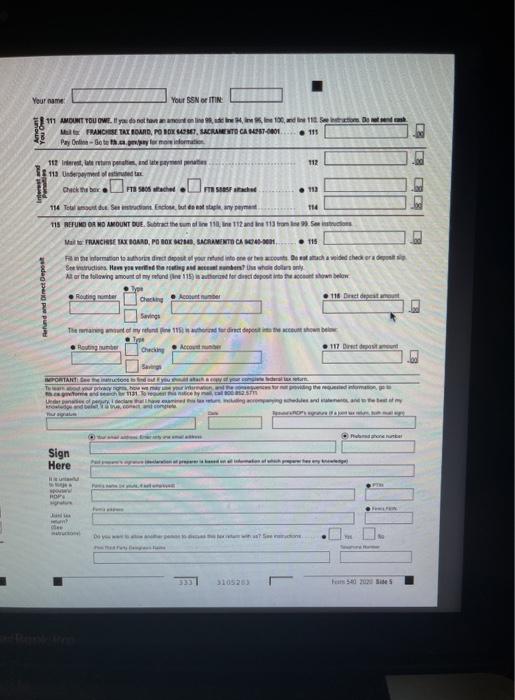

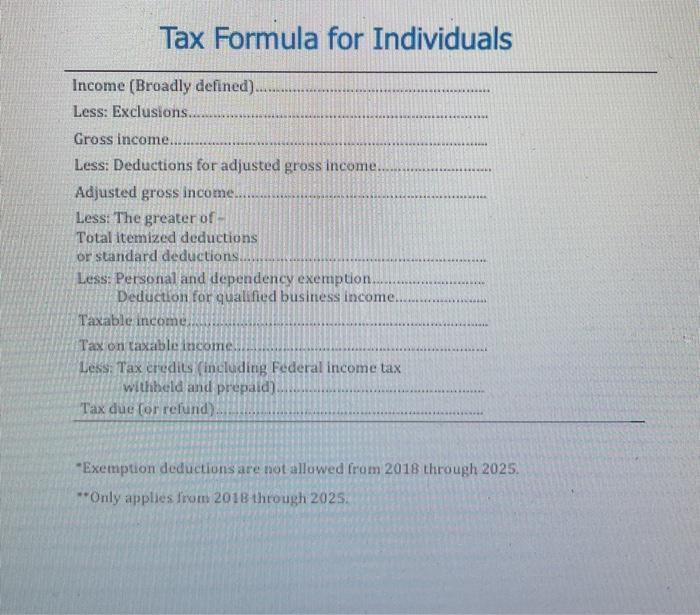

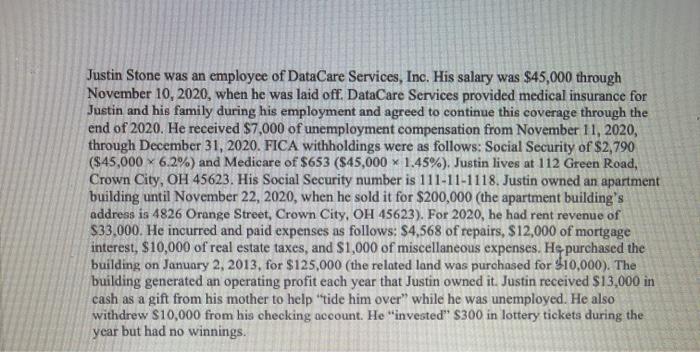

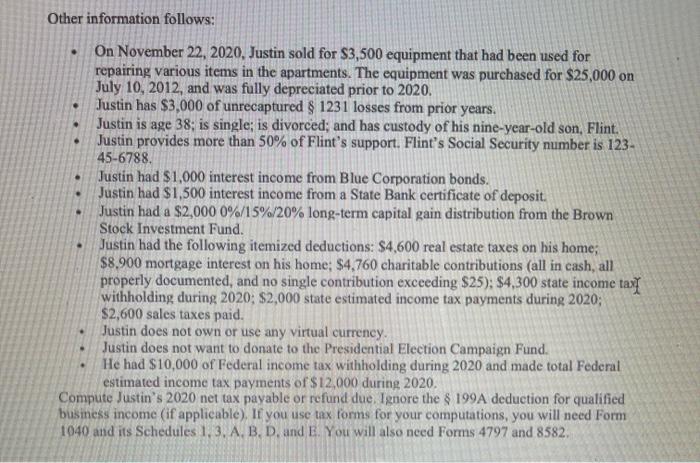

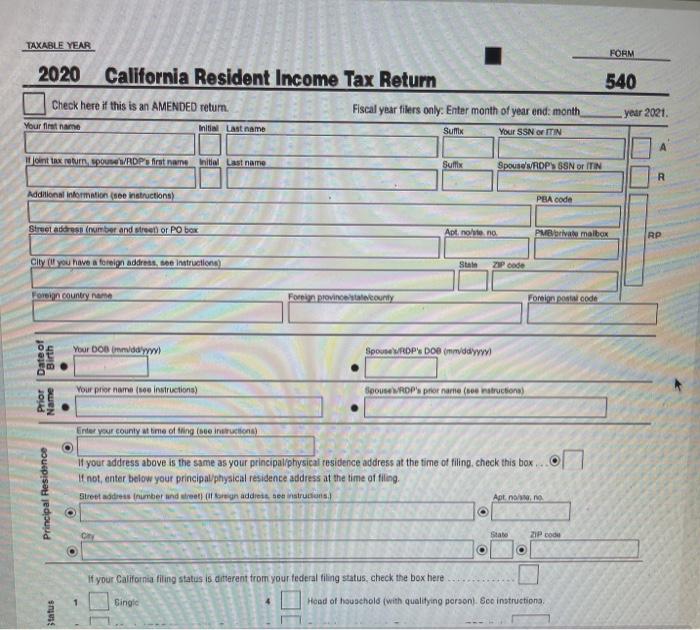

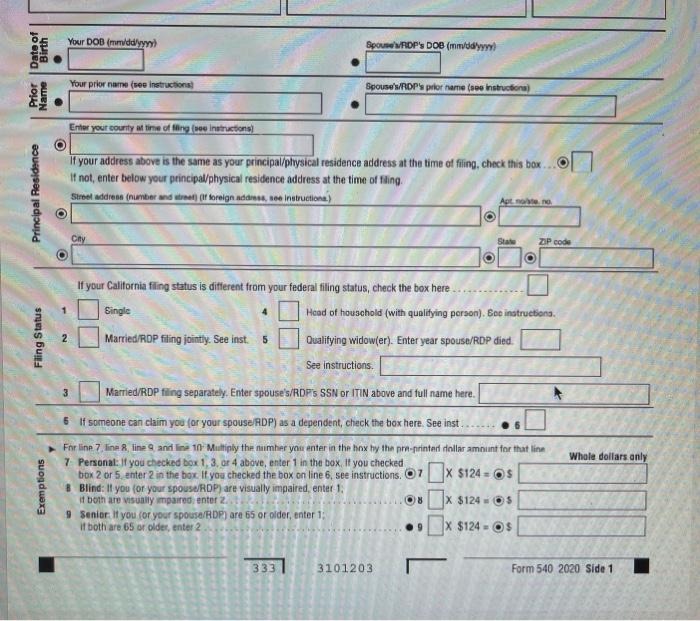

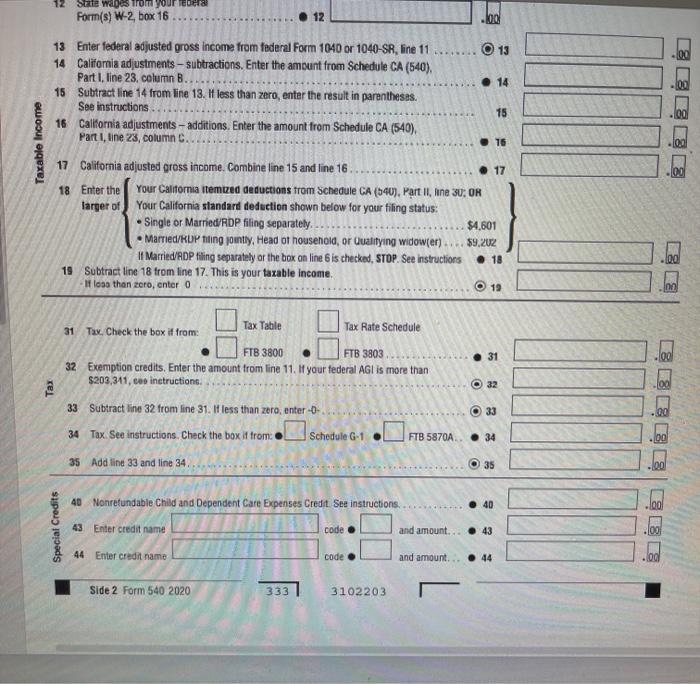

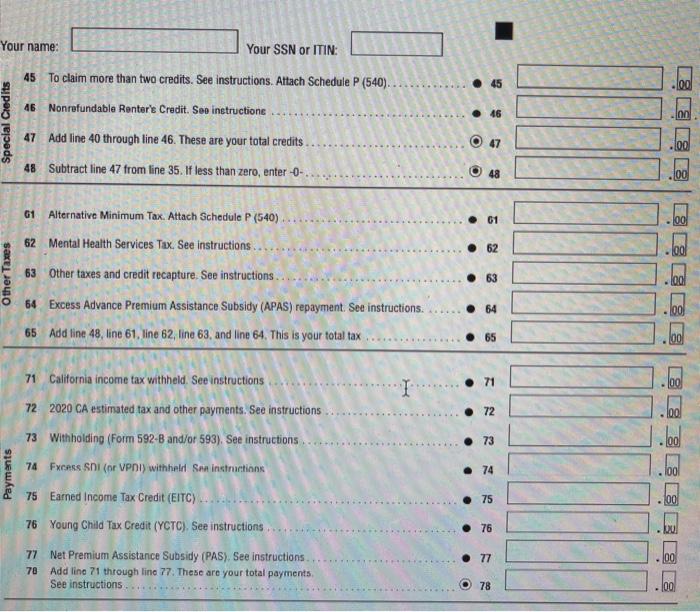

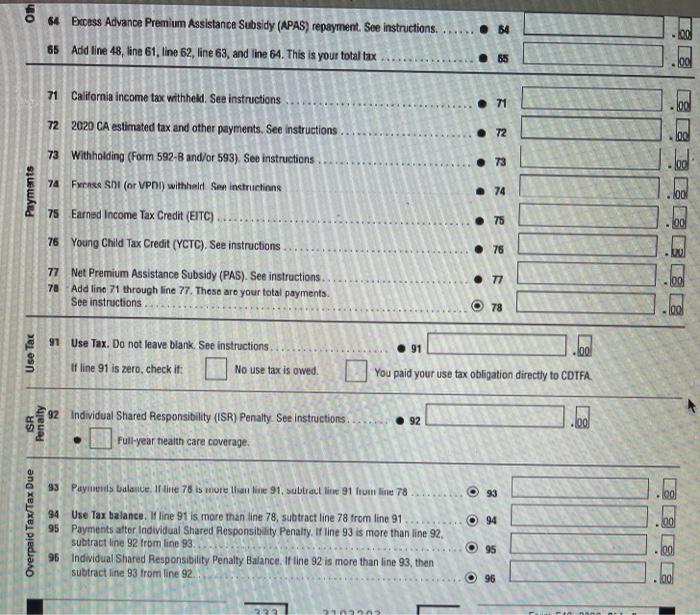

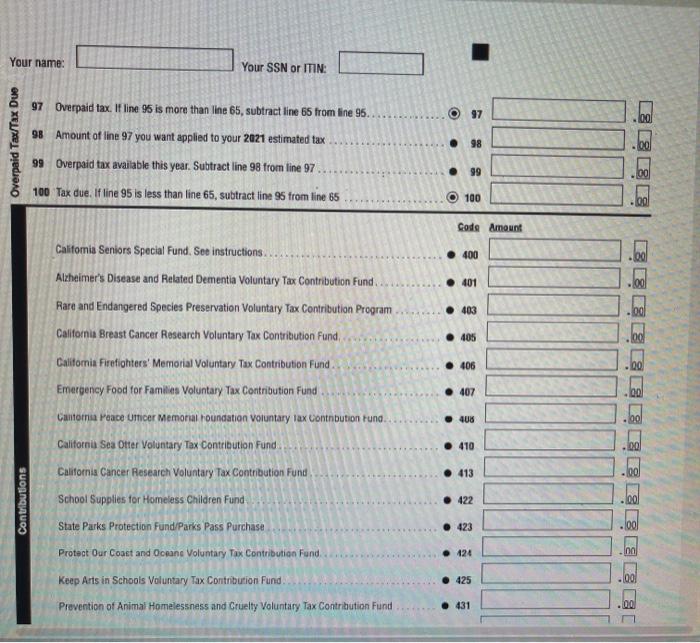

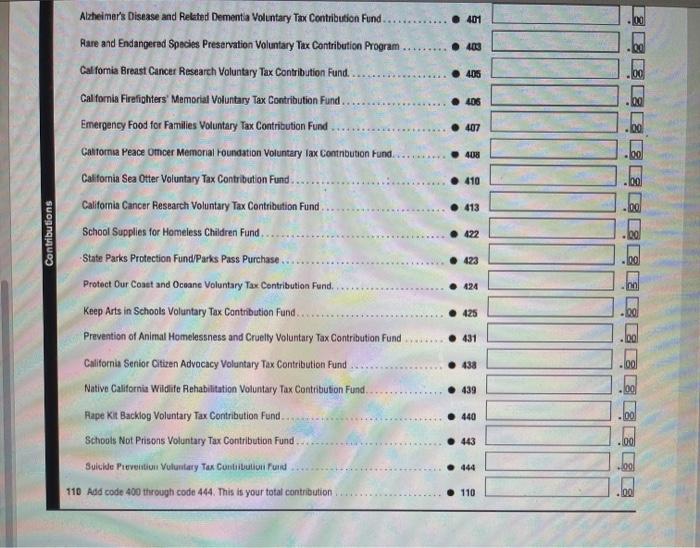

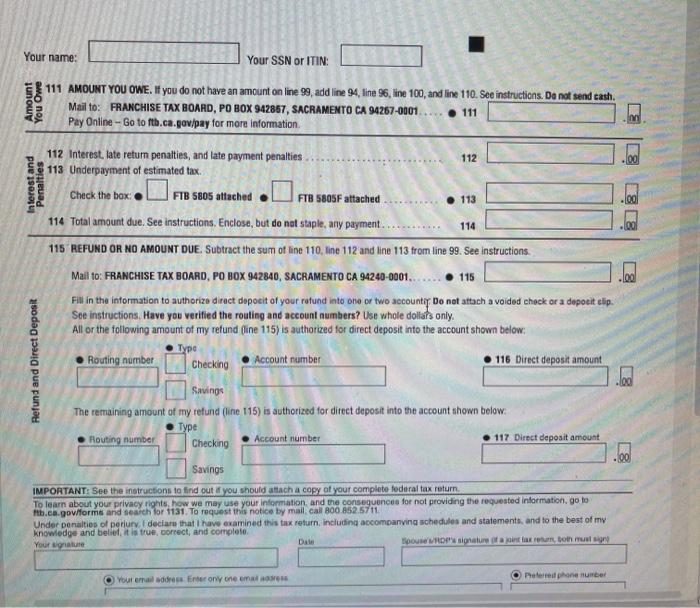

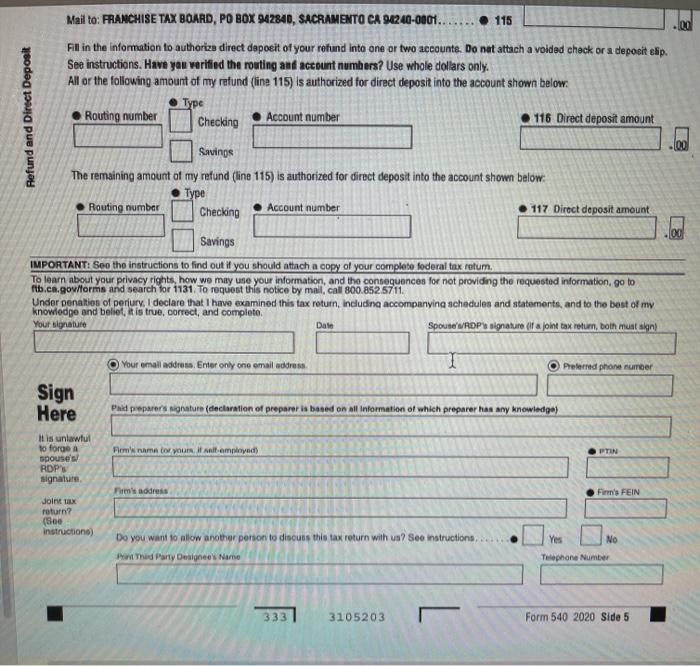

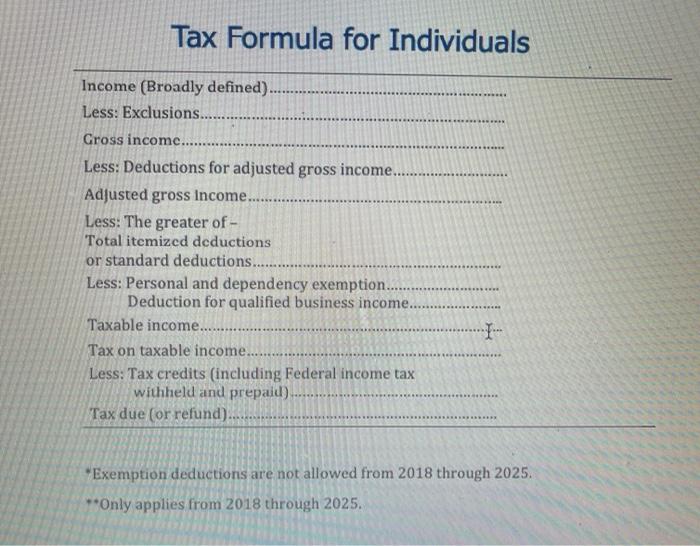

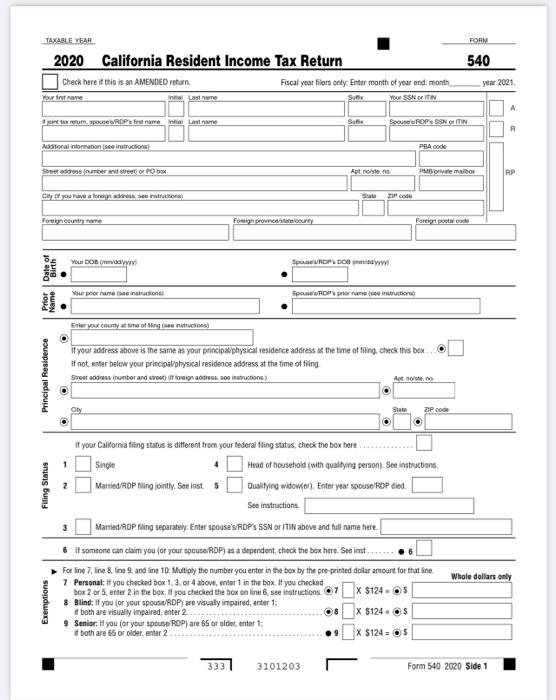

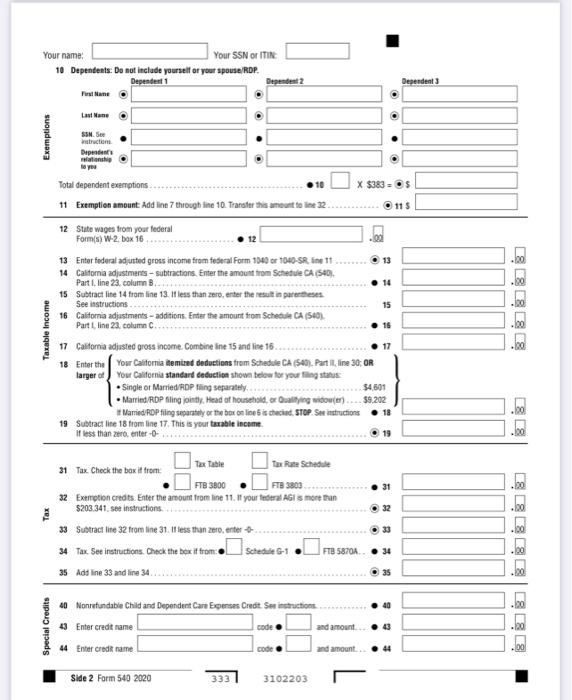

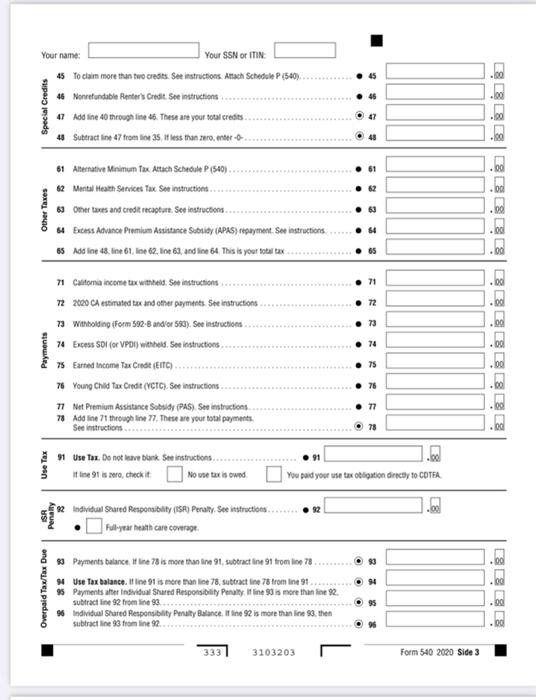

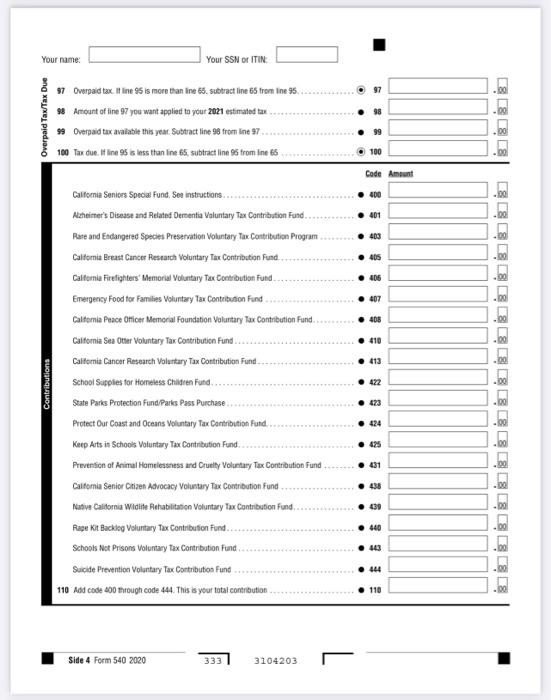

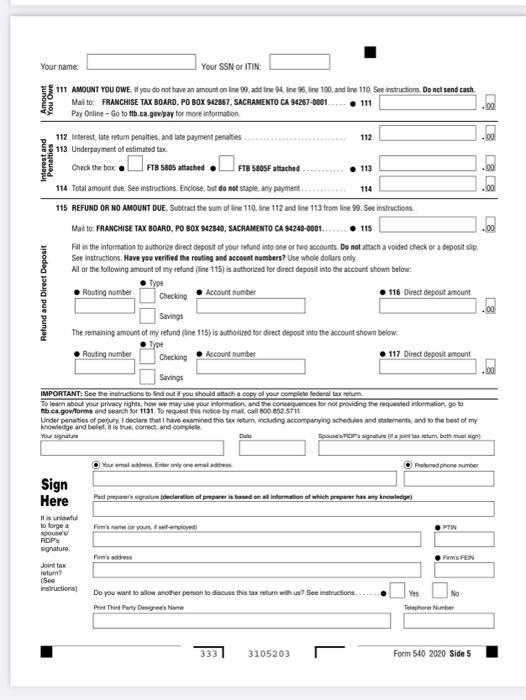

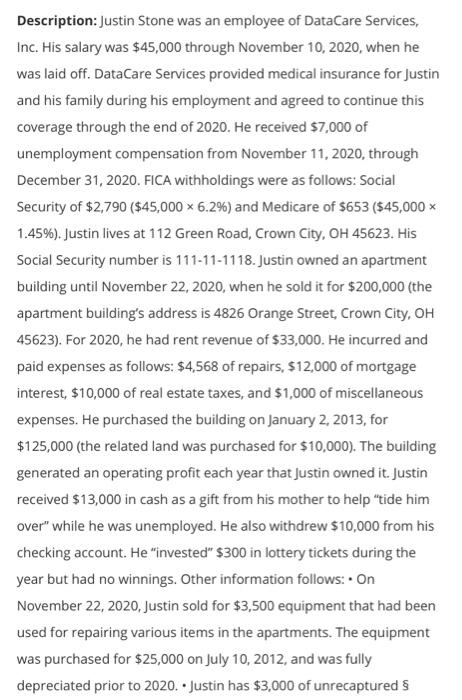

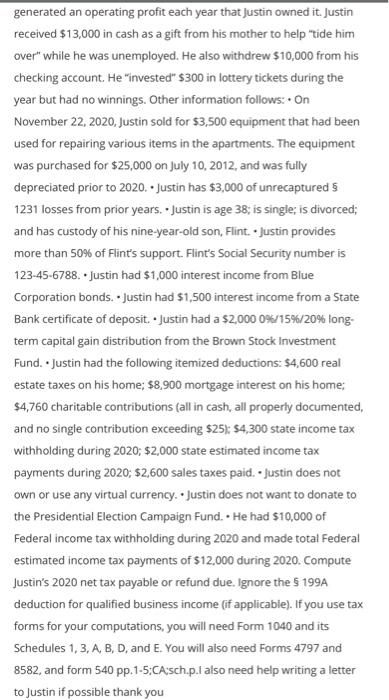

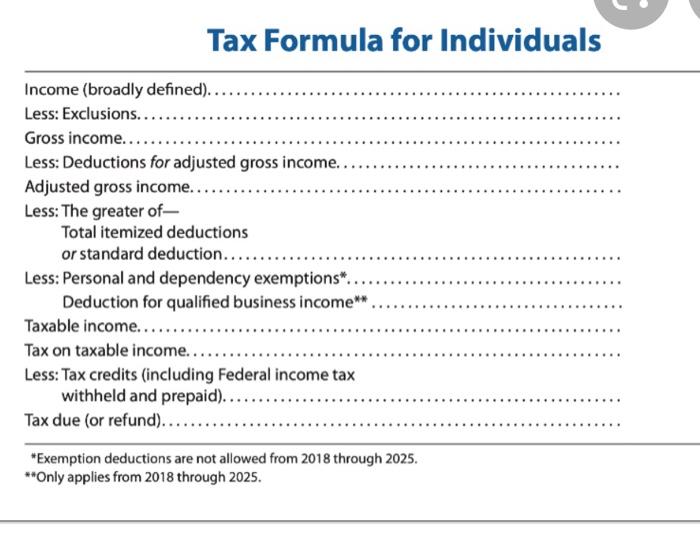

. Justin Stone was an employee of DataCare Services, Inc. His salary was $45,000 through November 10, 2020, when he was laid off. DataCare Services provided medical insurance for Justin and his family during his employment and agreed to continue this coverage through the end of 2020. He received $7,000 of unemployment compensation from November 11, 2020, through December 31, 2020. FICA withholdings were as follows: Social Security of $2,790 ($45,000 X 6.2%) and Medicare of 5653 ($45,000 x 1.45%). Justin lives at 112 Green Road, Crown City, OH 45623. His Social Security number is 111-11-1118. Justin owned an apartment building until November 22, 2020, when he sold it for $200,000 (the apartment building's address is 4826 Orange Street, Crown City, OH 45623). For 2020, he had rent revenue of $33,000. He incurred and paid expenses as follows: $4,568 of repairs, $12,000 of mortgage interest, $10,000 of real estate taxes, and $1,000 of miscellaneous expenses. He purchased the building on January 2, 2013, for $125,000 (the related land was purchased for $10,000). The building generated an operating profit each year that Justin owned it. Justin received $13,000 in cash as a gift from his mother to help "tide him over" while he was unemployed. He also withdrew $10,000 from his checking account. He "invested" $300 in lottery tickets during the year but had no winnings Other information follows: On November 22, 2020, Justin sold for $3,500 equipment that had been used for repairing various items in the apartments. The equipment was purchased for $25,000 on July 10, 2012, and was fully depreciated prior to 2020. Justin has $3,000 of unrecaptured 8 1231 losses from prior years. Justin is age 38. is single, is divorced: and has custody of his nine-year-old son, Flint Justin provides more than 50% of Flint's support. Flint's Social Security number is 123- 45-6788 Justin had $1.000 interest income from Blue Corporation bonds. Justin had $1.500 interest income from a State Bank certificate of deposit. Justin had a $2.000 0% 15% 20% long-term capital gain distribution from the Brown Stock Investment Fund Justin had the following itemized deductions. $4,600 real estate taxes on his home, $8.900 mortgage interest on his home: $4,760 charitable contributions (all in cash all properly documented, and no single contribution exceeding $25): $4,300 state income tax withholding during 2020. $2,000 state estimated income tax payments during 2020, 52.600 sales taxes paid Justin does not own or use any Virtual currency Justin does not want to donate to the Presidential Election Campaign Fund. He had s10,000 of Federal income tax withholding during 2020 and made total Federal estimated income tax payments of $12,000 during 2020 Compute Justus 2020 net tas navable or refund due. Ignore the 5 199A deduction for qualified business income if applicable. If you use tax forms for your computations, you will need Form 1040 and its Schedules 1. LABD and E. You will also need Fons 4797 and 8582 TRARLE YEAR 2020 Callfomla Resident Income Tax Return Check here AMENDED Fiscal years only Erman 340 year 2021 WEL ROBIN AL PG YO POS Soon! Il your addresses the same as your principalment the time of ting, check this box not your principali caldence the fing Principal Rece Feng Status your Coming from your check the besh 4 Singe Howy pro Seins Wand Desert 5 Quality BOP died See 3 Mirreding operasy w www OP SW IT above and we are here campos oor Picture Sam Exemptions Tore, to the the box by the prostora na watoto If you So you the Sindy bentur See you 65 sentar ma X 5124 = 1 x 311 3351 3101203 Form 540 200 de Your name: Your SSN ITIN 10 De Desoladeyen yew MDP Dependent O Exemptions . . w Total dependent options . 10 X 8383 11 Add line 7 through line 10. Transfer this wountine 32 115 Taxable income 12 Stages from your federal FormW-2. box 16 12 15 Enter der sted gross incombros del Form 1040 or 1040-5R, 11 13 14 California - Subtraction statement from Schedule CA (540) Parte 23.com . 14 15 Subtine 14 from line 13. fess that there is the See instruction 15 16 California adjust additions. Enter the amount to schedule CA (540) Part 2), column 16 17 Qorated gross incom. Combinatie 15 and line 16 17 18 the Your Californemind den Schule A ( Part 2 Your Conand deduction below for your Singer Marie RDP hings SLO MedOP inity Head of the buying widow $9.00 boxed STOPS 19 Sun 18 om 17. This is Textube Texas Schedule 31 FB300 12. Enter the mountain 11 your deal 120341 22 33 Subtitless than * We sa vatrason Check the belown. escormor.ru TO SETOA .34 5 Add . SESTERS 4 Wonders Stone fpecul Credits ora 44 Side 2 for 540 2020 333 3102203 Your name: Your SNN 45 sammanhand Section ASP 540 4 Nonda 5 bruction Special Crete 47 401 4. Theseydi US from the 61 Amative in Touch SP 54 Metal Health Services Tax Stran Othere wonderin Eco Advance Puma byt Alleine, de This 88 COBEDD . . 1 . Pets 1. Calme with Search 12 2000 AS Wolde Fomento NEW Serwis 75 Cameron Test Tower AIS The you Ovidas ou SELBER 45 11030 Your name Your SSN ITIN Overpaid toxines are the trainers Overpakd Tax Tax Due . # Amount of you wanted to your 2021 editor Overed to be a Strain fro7 99 104 Tex due to 5. stract from line 65 100 Cade . 40 .401 41 California Series Special Fund Seestruction Alzheimer Die and wated Deerde Voluntary Tax Contribution Fund Rare and Entengered Species Preservation Voluntary Tax Dort Program Galeria Brew Cancer Research Voluntary Tax Contribution Fund Califorlighters' Menon Voluntary Clin Fund Emergency Food toramites Voluntary Tax Contribution and . Bagai .40 407 California Peace Om Mim Foundation Voluntary Tax Control . 410 . 13 Contibutione California Sud Ouer Voluntary Tax Contribution and California Cantar fastanh Voluntary Pet Contributin Fund School Supplies for Homeless Children Fund Sur Parts Protection Fund Paris Pass Purchase Protor Constance Voluntary Tax Cotton Fund .43 425 Kees Metin Schools Voluntary Tax Confund Pretion of Animond Carly Voluntary on Contribute Fund 41 Candom See Advocacy Voluntary Corbund . .43 Corona w To Come Find Rape tace Voluntary las Cortina Schools Het Pons try to contribution 440 . .444 Bodentary lastenlund 110 Add code the 4th your team . 110 Side Form 540 2000 23 1104203 Your name Your SSN ITIN Tour You o 111 AMOUNT TOU OWE. Il you do notan 100, 11. romDe FRANCESE TAK ROAD, PO BOX SM, SACRAMENTO GA 14257-0001 Pay On they for more info s.O. 117 In the topics, Indeeltes 112 113 Under Checkbox FTI SOS . 114 Tour du Station, but does nye 114 TIS REFUND OR NO AMOUNT DUE. Subtract the sum of line 11, in 112 113 frames Mal E FRANCHISE HAY BOARD, PO BOKSET, SACRAMENTO CA 10-20, .. 115 Rhe internation to train de your tad not be consided heder So trudio y Viswak dolany At or the following amount of my stund line 119) and for den positiewe below Pelund and Direct Depost Route 11 Dect deposit Savings They end 11 w forint how Route Checking 117. Det IGNTARIOER Bachelor Tu prethodno 111 to Up the odw.com Sign Here 333 31052) Tax Formula for Individuals Income (Broadly defined).... Less: Exclusions. Gross income. Less: Deductions for adjusted gross income. Adjusted gross income... Less: The greater of Total itemized deductions or standard deductions. Less: Personal and dependency exemption Deduction for qualified business income..................... Taxable income Tax on taxable income.. Less Tax credits (including Federal income tax withheld and prepaid). Tax due or refund). *Exemption deductions are not allowed from 2018 through 2025. **Only applies from 2018 through 2025. Justin Stone was an employee of DataCare Services, Inc. His salary was $45,000 through November 10, 2020, when he was laid off. DataCare Services provided medical insurance for Justin and his family during his employment and agreed to continue this coverage through the end of 2020. He received $7,000 of unemployment compensation from November 11, 2020, through December 31, 2020. FICA withholdings were as follows: Social Security of $2,790 ($45,000 6.2%) and Medicare of $653 (845,000 * 1.45%). Justin lives at 112 Green Road, Crown City, OH 45623. His Social Security number is 111-11-1118. Justin owned an apartment building until November 22, 2020, when he sold it for $200,000 (the apartment building's address is 4826 Orange Street, Crown City, OH 45623). For 2020, he had rent revenue of $33,000. He incurred and paid expenses as follows: $4,568 of repairs, $12,000 of mortgage interest, $10,000 of real estate taxes, and $1,000 of miscellaneous expenses. He purchased the building on January 2, 2013, for $125,000 (the related land was purchased for $10,000). The building generated an operating profit each year that Justin owned it. Justin received $13,000 in cash as a gift from his mother to help "tide him over" while he was unemployed. He also withdrew $10,000 from his checking account. He "invested" $300 in lottery tickets during the year but had no winnings. Other information follows: . . On November 22, 2020, Justin sold for $3,500 equipment that had been used for repairing various items in the apartments. The equipment was purchased for $25,000 on July 10, 2012, and was fully depreciated prior to 2020. Justin has $3,000 of unrecaptured 1231 losses from prior years. Justin is age 38; is single; is divorced; and has custody of his nine-year-old son, Flint. Justin provides more than 50% of Flint's support. Flint's Social Security number is 123- 45-6788. Justin had $1,000 interest income from Blue Corporation bonds. Justin had $1,500 interest income from a State Bank certificate of deposit. Justin had a $2,000 0%/15%/20% long-term capital gain distribution from the Brown Stock Investment Fund. Justin had the following itemized deductions: $4,600 real estate taxes on his home; $8.900 mortgage interest on his home; $4,760 charitable contributions (all in cash, all properly documented, and no single contribution exceeding $25); $4,300 state income tax withholding during 2020; $2,000 state estimated income tax payments during 2020; $2,600 sales taxes paid. Justin does not own or use any virtual currency. Justin does not want to donate to the Presidential Election Campaign Fund. He had $10,000 of Federal income tax withholding during 2020 and made total Federal estimated income tax payments of $12,000 during 2020. Compute Justin's 2020 net tax payable or refund due. Ignore the $ 199A deduction for qualified business income (if applicable). If you use tax forms for your computations, you will need Form 1040 and its Schedules 1.3. A B. D. and E. You will also need Forms 4797 and 8582 . . TAXABLE YEAR FORM 540 2020 California Resident Income Tax Return Check here if this is an AMENDED return. Fiscal year timers only: Enter month of year end month Your first name year 2021 Initi Last name Suffix Your SSN ITIN point tax return pou'w/RDP's first me with Last name Suffix Spouse'ROPS 3 SN or ITIN R Additional information (100 instruction) PEA code Stret adresimber and streer or PO box Apt no no PMB briva malbox RP City (Ul you have a foreign address, so instruction) Stan ZIP code Foreign country name Foreign province only Foreign postatoode Your bobimnday) Spouse WROPU DOB ddy Birth Prior Date of Name Your prior nomo (noe inotruction) Spouse RDP's prior name (o instruction) . Enter your county at time of filing (ou naructions Principal Residence if your address above is the same as your principal physical residence address at the time of filling, check this box If not enter below your principal/physical residence address at the time of filing. Street address number and street for addit, se instructions Apt. non O State ZIP cod O If your California filing status is different from your federal filing status check the box here 1 Gingi Head of household (with qualitying person. Soo instructions. 3tatus Your DOB (mm/dd/yyyy) Spouw VROP's DOB (mm/dd/yyyy! . Birth Prior Date of Name Your prior wrw (see instruction Spouse's/RDP's prior name (see Instruction) O Principal Residence Enter your county of time of filing (uos instructions) if your address above is the same as your principal/physical residence address at the time of filing, check this box If not, enter below your principal/physical residence address at the time of filing Strelddren (number and treat of foreign Adams, intruction) Apt. mote, no . Sta ZIP Code o . . If your California filing status is different from your federal filing status, check the box here Single Head of household (with qualifying person). So instructions, Fling Status 2 Married/RDP filing jointly. See inst. 5 Qualifying widow(er). Enter year spouse/RDP died. See instructions 3 Married/RDP filing separately. Enter spouse's/RDP's SSN or ITIN above and full name here, Whale dollars only Exemptions 6 If someone can claim you for your spouse/ADP) as a dependent, check the box here. See inst For line 7, line 8. line 9 and line 10 Multiply the number you enter in the box hy the pre-printer dollar amount for that line 7 Personal: If you checked box 1, 3, or 4 above, enter 1 in the box. If you checked box 2 or 5 unter 2 in the box. If you checked the box on line 6, see instructions. O x $124 = Os 8 Blind: If you for your spouse/RDP) are visually impaired, enter 1 it both are visually impaired, entor 2 x $124 - os 9 Senior. If you for your spouse/BDP) are 65 or older, enter 1: if both are 65 or older, enter 2 X $124 - $ 333 3101203 D Form 540 2020 Side 1 Your name: Your SSN or ITIN: 10 Dependents: Do not include yourself or your spouse/RDP. Dependant 1 Dependent 2 First Name Dependenta o O O O O Last Name O Exemptions . . SSN. Sed Instructions Dependent mlationship . o you Total dependent exemptions 10 X $383 - OS 11 $ 11 Exemption amount: Add line 7 through line 10. Transfer this amount to line 32 12 State wages from your federal Form(s) W-2, box 16 12 13 00 . 14 100 13 Enter federal adjusted gross income from federal Form 1040 or 1040-SR, line 11 14 California adjustments - subtractions. Enter the amount from Schedule CA (540), Part I. line 23. column B. 15 Subtract line 14 from line 13. If less than zero, enter the result in parentheses See instructions 16 California adjustments - additions. Enter the amount from Schedule CA (540), Part , line 23, column C. 15 100 16 00 Taxable income 17 California adjusted gross income. Combine line 15 and line 16 17 18 Enfer the Your California itemized deductions from Schedule LA (540). Part II, line 3u; OR larger of Your California standard deduction shown below for your filing status: Single or Married/RDP filing separately. $4,601 Married/KDP ning jointly, Head of household, or Cualifying widower).. $9,202 It Married ROP fling separately or the box on line 6 is checked, STOP. See instructions 18 19 Subtract line 18 trom line 17. This is your taxable income it less than acro, enter D 19 100 an Tax Table Tax Rate Schedule 31 Tax. Check the box if from: FTB 3800 FTB 3803 31 .00 Sate wees Trom your bra! Form(s) W-2 box 16 12 O 13 00 13 Enter federal adjusted gross income from federal Form 1040 or 1040-SR, line 11 14 California adjustments - subtractions. Enter the amount from Schedule CA (540) Part I. line 23. column B. 15 Subtract line 14 from line 13. If less than zero, enter the result in parentheses. See instructions 16 California adjustments - additions. Enter the amount from Schedule CA (540). Part I, line 23, column C ...... 14 15 00 Taxable income 16 100 17 California adjusted gross income. Combine line 15 and line 16 17 18 Enter the Your California itemized deductions from Schedule CA (540), Part II, line 30: OR larger of Your California standard deduction shown below for your filing status: Single or Married RDP filing separately $4,601 Married/RDP filing jointly, Head of household, or Qualifying widower) $9.202 If Married RDP filing separately or the box on line 6 is thecked, STOP. See instructions 18 19 Subtract line 18 from line 17. This is your taxable income loss than zaro, enter 0 19 02 Tax Table 31 Tuy. Check the box it from: Tax Rate Schedule FTB 3800 FTB 3803 31 32 Exemption credits. Enter the amount trom line 11. If your federal AGI is more than $203, 311, ces instruction 33 Subtract line 32 from line 31. I less than zero, enter --- O 33 34 Tax. See instructions. Check the box it trom. FTB 5870A 34 rel O 32 Schedule G-1 100 35 Add line 33 and line 34 35 40 Nonrefundable Child and Dependent Care Expenses Credit. See instructions. 40 Special Credits 43 Enter credit name code and amount... 43 100 44 Enter credit name code and amount 44 Side 2 Form 540 2020 333 3102203 Oth B4 64 Excess Advance Premium Assistance Subsidy (APAS) repayment. See instructions. 65 Adid line 48, line 61, line 62, line 63, and line 64. This is your total tax 85 71 . 72 100 73 Payments 71 California income tax withhell. See instructions 72 2020 CA estimated tax and other payments. See instructions .. 73 Withholding (Form 592-B and/or 593). See instructions 14 Fees SNI (or VPNI) withheld San indtructions 75 Earned Income Tax Credit (EITC) 76 Young Child Tax Credit (YCTC). See instructions 74 100 ..... 75 ... 76 T7 100 77 Net Premium Assistance Subsidy (PAS). See instructions 70 Add line 71 through line 77. These are your total payments. See instructions 78 Use Tac 91 Use Tax. Do not leave blank. See instructions If line 91 is zero, check it: No use tax is owed. 91 100 You paid your use tax obligation directly to COTFA 92 Individual Shared Responsibility (ISR) Penalty. See instructions SR Penalty . 92 Full-year health care coverage. 93 Overpaid Tax/Tax Due O 94 93 Payments balance. If ne 78 is more than line 91, subtract line 91 from line 78 94 Use Tax balance. If line 91 is more than line 78, subtract line 78 from line 91 95 Payments after Individual Shared Responsibility Penalty. If line 93 is more than line 92 subtract line 92 from line 93 96 Individual Shared Responsibility Penalty Balance. If line 92 is more than line 93, then subtract line 93 from line 92 8888 95 96 Tin ni Your name: Your SSN or ITIN: o 97 97 Overpaid tax. If line 95 is more than line 65, subtract line 65 from line 96 38 Amount of line 97 you want applied to your 2021 estimated tax 100) Overpaid Tax/Tax Due 98 99 Overpaid tax available this year. Subtract line 98 from line 97 99 100 Tax due. If line 95 is less than line 65, subtract line 96 from line 65 O 100 Code Amount 400 . 401 200 Caitomis Seniors Special Fund. See instructions Alzheimer's Disease and Related Dementia Voluntary Tax Contribution Fund Rare and Endangered Species Preservation Voluntary Tax Contribution Program California Breast Cancer Research Voluntary Tax Contribution Fund, 403 00 405 00 California Firefighters' Memorial Voluntary Tax Contribution Fund 406 00 Emergency Food for Families Voluntary Tax Contribution Fund 407 00 Cantora Peace Ufficer Memorial Foundation Voluntary Tax Contbution Fund 408 fool California Sea Otter Voluntary Tax Contribution Fund 410 ..00 413 100 Contributions 422 00) California Cancer Research Voluntary Tax Contribution Fund, School Supplies for Homeless Children Fund State Parks Protection Fund/Parks Pass Purchase Protect Our Coast and Orang Voluntary Tax Contribution Fund 423 .00 424 Ino 425 00 Keep Arts in Schools Voluntary Tax Contribution Fund. Prevention of Animal Homelessness and Cruelty Voluntary Tax Contribution Fund 431 00 401 409 405 405 407 408 00 410 100 413 00 Contributions Alzheimer's Disease and Related Dementia Voluntary Tax Contribution Fund ........ Rare and Endangered Species Preservation Voluntary Tax Contribution Program California Breast Cancer Research Voluntary Tax Contribution Fund. Calfornia Firefighters' Memorial Voluntary Tax Contribution Fund Emergency Food for Families Voluntary Tax Contribution Fund Calfornia Peace moer Memonal Foundation Voluntary Tax Contrbution Fund California Sea Otter Voluntary Tax Contribution Fund California Cancer Research Voluntary Tax Contribution Fund School Supplies for Homeless Children Fund State Parks Protection Fund/Parks Pass Purchase Protect Our Couet and Oceane Voluntary Tax Contribution Fund. Keep Arts in Schools Voluntary Tax Contribution Fund. Prevention of Animal Homelessness and Cruelty Voluntary Tax Contribution Fund California Senior Citizen Advocacy Voluntary Tax Contribution Fund Native California Wildlife Rehabilitation Voluntary Tax Contribution Fund Rape Kit Backlog Voluntary Tax Contribution Fund.. Schools Not Prisons Voluntary Tax Contribution Fund 122 423 424 425 431 438 439 440 00 443 00 Suicide Prevention Voluntary Tax Contribution und 444 .00 110 Add code 400 through code 444. This is your total contribution 110 Amount You Owe 112 Interest and Penalties Check the box: 1 Your name: Your SSN or ITIN 111 AMOUNT YOU OWE. If you do not have an amount on line 99, add line 94, line 96, line 100, and line 110. See instructions. Do not send cash. Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001... 111 Pay Online - Go to tb.ca.gov/pay for more information 112 Interest, late return penalties, and late payment penalties 113 Underpayment of estimated tax FTB 680s attached 114 Total amount due. See instructions, Encloso, but do nat staple, any payment. 115 REFUND OR NO AMOUNT DUE. Subtract the sum of line 110, line 112 and line 113 from line 99. See Instructions. Mall to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0001 115 Fill in the information to authoriza direct deposit of your rotund into one or two accountif Do not attach a voided check or a deposit clip. See instructions. Have you verified the routing and account numbers? Use whole dollats only. All or the following amount of my refund (line 115) is authorized for direct deposit into the account shown below: Type Routing number Checking Account number 116 Direct deposit amount FH 5805F attached 113 100 114 .100 Refund and Direct Deposit Savings The remaining amount of my refund (line 115) is authorized for direct deposit into the account shown below: Type Routing number Account number 117 Direct deposit amount Checking 100 Savings IMPORTANT: See the instructions to find out you should attach a copy of your complete federal tax return To learn about your privacy rights, how we may use your information and the consequences for not providing the requested information, go to Ith.ca.gov/forms and search for 1131. To request this notice by mail. Cal 800 852.5711 Under penalties of periury, I deciare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct, and complete Your in Date Nous signature an, both maligne Your email address only one mai Preferred phone number Refund and Direct Deposit Mail to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0001........ 115 Fill in the information to authoriza direct depoeit of your refund into one or two accounte. Do not attach a voided check or a deposit elip. See instructions. Have you verified the routing and account numbers? Use whole dollars only. All or the following amount of my refund (line 115) is authorized for direct deposit into the account shown below: Type Routing number Checking Account number 116 Direct deposit amount Savings The remaining amount of my refund (line 115) is authorized for direct deposit into the account shown below. Type Routing number Checking Account number 117 Direct deposit amount Savings IMPORTANT: Seo the instructions to find out if you should attach a copy of your complete federal tax rotum. To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to fb.ca.gov/forms and search for 1131. To request this notice by mail, call 800.8525711 Under penaltion of periury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and beliet, it is true, correct, and complete Your signature Date Spoute'WRDP's signature (lf a joint tax return, both must kn) Your email address Enter only one email address Preferred phone number Sign Here Pald preparer's signature (declaration of preparar is based on all information of which preparer has any knowledge) Flem'm or your intempland) PTION It is unlawful to forge spouse's RDP signature m's dress Firm's FEIN Joint TX return? (500 instruction) Yes No Do you want to allow another person to discuss this tax return with us? See Instructions, Par Third Party Designee's Name Telephone Number 333 3105203 Form 540 2020 Side 5 Tax Formula for Individuals Income (Broadly defined). Less: Exclusions......... Gross income. Less: Deductions for adjusted gross income.... Adjusted gross income.. Less: The greater of - Total itemized deductions or standard deductions... Less: Personal and dependency exemption.... Deduction for qualified business income... Taxable income.. Tax on taxable income.. Less: Tax credits (including Federal income tax withheld and prepaid). Tax due (or refund). 1 ***** *Exemption deductions are not allowed from 2018 through 2025. **Only applies from 2018 through 2025. FORM TAXASLE YEAR 2020 California Resident Income Tax Return Check here if this is an AMENDED return Fiscal year filers only. Enter month of year end month 540 year 2001 You are Laste Sutta You SSNOIN in tan renam spouse RDP sfrutarrental Laste Sut Sou ROPANG TIN Additional information instructions PBA code Street des frumber and on Apt. mosten Private mailbox RP cay you have a foreigt de serruction Zipcode Foriyuriya Fonsignprovnice County Forever postal code Your DODO Spous DPD Birth Your prorrate entico Prioramento hor Name . Enter your county at time of fing antructions Principal Residence if your address above is the same as your principal physical residence address at the time of filing, check this box If not enter below your principal physical residence address at the time of fing Srout address unter and other in the structions . State ZIP Filing Status if your California filing status is different from your federal filing status, check the box bere Single Head of household (with qualitying person. See instructions Marted/RDP Sling jointly. Set inst5 Qualifying widower). Enter year spouse/ROP died. See instructions Married ADP rling separately. Enter spouse's/RDP'S SSN or ITIN above and full name here. 6 lt somtone can claim you for your spouse RDP) as a dependent, check the box here. See inst For Ine 7, ine 8 int 9, and lint 10. Multiply the number you enter in the box by the pre-printed dollar amount for that in 7 Personal: If you checked box 1.3 or above, enter in the box. If you checked box 2 or 5, enter 2 in the box. If you checked the box on line 6. see instructions. 7 X $124 OS & Blind: If you (or your spouse/RDP) are visually impaired, enter 1: both are visually impaired, enter 2 X $124.5 9 Senior. If you for your spouse/RDP) are 65 or oldet, enter 1: both are 65 or older, enter 2 X $124 $ Whole dollars only Exemptions 333 3101203 Form 540 2020 Side 1 Your name: Your SSN or ITIN 10 Dependents: Do not include yourself or your spouse/RDP. Dependent 1 Dependent First Name Dependent Exemptions . . SS5 Instruction Dipende nie to you O X $383 = Total dependent exemptions 11 Exemption amount Add line 7 through line 10. Transfer this amount to line 32 115 12 State Wages from your federal Formis) W-2 box 16 Taxable income 13 Enter federal adjusted gross income from federal Form 1500 or 1040-SR line 11 . 13 14 California adjustments - subtractions. Enter the amount from Schedule CA (540) Part I. line 23.column B. 14 15 Subtract line 14 from lint 13. less than zero, enter the result in parentheses See instructions 15 16 California adjustments - additions. Enter the amount from Schedule CA (540) Part, line 23.column C. 16 17 California adjusted gross income. Combine line 15 and line 15 18 Enter the Your California itemized deductions from Schedule CA (540). Part I. line 30. OR larger of Your California standard deduction shown below for your fing status Single or Married RDP filing separately. 34601 Married ADP filing jointly. Head of household, or Quality widower 59.202 Married RDP hiling separately or the box on line is chociad. STOP. Se instructions 18 19 Subtract line 18 from line 17. This is your taxable income if less than zero, enter- Tax Sched 31 Tax Check the box it from FTB 3800 FIB 3803 32 Exemption credits. Enter the amount from line 11. If your federal Almore than $203.341. See Instructions 33 Subtract line 32 from tine 31. in less than zero, enter 34 Tax. See instructions. Check the box it from: FTB 5870A 35 Add Iine 33 and line 34 34 Special Credits 40 Nonretundable Child and Dependent Care Expenses Credit See instruction 43 Enter credit rame code and amount 44 Enter credame code and amount 44 Side 2 Form 540 2020 333 3102203 00 Special Credits Your name: Your SSNOR ITIN 45 To claim more than to credits. See instructions. Attach Schedule P (540) 46 Norefundable Renter's Credit Soe instructions 47 Add line 40 through line 46. These are your total credits 45 Subtract line 47 from line 35t less than zero, enter- Other Taxes 8 888 61 Alternative Minimum Tax Attach Schedule P(540) 82 Mestal Health Services Tax Soe instructions One taxes and credit recaptort. See lestructions 4 Excess Advance Premium Assistance Subsidy (APA) repayment. See instructions 65 Add in 48 line 61. line 62, line 63 and line 64. This is your totaltex 71 Cattoma income tax withheldSoe instructions 72 2000 CA estimated to and other payments. See irstructions Withholding Form 592-8 and/or 598). See instructions 74 Excess SDI (or VPOI) withheld. Soe instructions 75 Earted tncome Tax Crode (Eitc).... 76 Young Child Tax Credt (VCTC). See instructions 77 Net Premium Assistance Subsidy (PAS) See instructions 78 Add line 71 through line 77. These are your total payments. 38 8 8 be Payments 888 See instructions 91 1 Use Tar. Do not have blank Ste instructions If line 91 is zero, check it No he tax is owned You paid your use tax obligation directly to COTEA ISA Individual Shared Responsibility (SA) Penany See instructions Fubyear health care coverage Overpaid Tax/Tax Due Payments balance. It line 73 is more than line 91, subtract line 91 from line 78 # Use Tax balance. It line 91 is more than line 78, subtract line 76 tromline 51 95 Payments after individual Shared Responsibility Penalty it line is more than fee 92 Subtract line 92 from line 90 Individual Shared Responsibility Penalty Balance. It ise 2 is more than line 98. then Subtract line 93 from line 92 333 3103203 Form 540 2020 Side 3 Your name: Your SSN or ITIN Overpaid Tax/Tax Due 97 Overpad tax. It ine 95 is more than line 65, subtract line 6s from Ine 95 * Antount of line 97 you want applied to your 2021 estimated to 99 Overpaid tax available this year. Subtract line 98 from Ine 97 100 Tax due. It line 95 is less than line 65, subtract line 95 from Ine 65 100 Code Amount 400 .00 401 403 405 407 408 410 413 Contributions California Seniors Special Fund. See instructions Alzheimer's Disease and Related Dementia Voluntary Tax Contribution Fund. Rate and Endangered Species Preservation Voluntary Tax Contribution Program California Breast Cancer Research Voluntary Tax Contribution Fund California Firefighters Memorial Voluntary Tax Contribution Fund Emergency Food for Families Voluntary Tax Contribution Fund Caltomia Peace Officer Memorial Foundation Voluntary Tax Contribution Fund. California Sea Other Voluntary Tax Contribution Fund Caltomis Cancer Research Voluntary Tax Contribution Fund School Supplies for Homeless Children Fund... State Parks Protection Fund Paris Pass Purchase Protect Our Coast and Oceans Voluntary Tax Contribution Fund. Korp Ats is Schools Voluntary Tax Contribution Fund Prevention of Animal Homelessness and Cruelty Voluntary Tax Contribution Fund California Senior Citizen Advocacy Voluntary Tax Contribution Fund Native California Widite Rehabilitation Voluntary Tax Contribution Fund, Rape Kit Backlog Voluntary Tax Contribution Fund. Schools Net Prisons Voluntary Tax Contribution Fund Suicide Prevention Voluntary Tax Contribution Fund 110 Add code 400 through code 444. This is your total contribution 424 . 425 431 440 403 444 110 Side 4 Form 540 2020 333 3104203 Your name: Amount You Owe 112 .00 Interest and Penalties Your SSNO ITIN 111 AMOUNT YOU OWE #you do not have an amount on line 99 add fine line %line 100 and line 110 See Instructions. Do not send cash. Mail to: FRANCHISE TAX BOARD, PO BOX S42367, SACRAMENTO CA 94287-0001... 111 Pay Online - Go to fb.ca.gow pay for more information 112 Interest, lateretum penalties, and the payment penalties 113 Underpayment of estimated tax Check the bar FTB 5805 attached FTS 5805F attached 113 114 Total amount doe. See instructions Enclose, but do not staple, any payment 114 115 REFUND OR NO AMOUNT OUE. Subtract the sum of line 110, line 112 and line 113 from line 98. See instructions Mail to: FRANCHISE TAX BOARO, PO BOX S42340, SACRAMENTO CAS4240-0001.... 115 Fill in the information to authorize direct deposit of your refund into one or two accounts. Do not attach a voided check or a deposit si See instructions. Have you verified the routing and account numbers? Use whole dollars only All or the following amount of my refund (line 115) is authorized for direct deposit into the account shown below Type Routing number Checking Account number 116 Direct depot amount Refund and Direct Deposit Savings The remaining amount of my refund (line 115) is authorized for direct deposit into the account shown below. Type Routing number Checking Account number 117 Direct deposit amount Savings IMPORTANT: See e instructions to find out if you should stach a copy of your complete federal taxonum To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to Mb.ca.gov/forms and search for 1131 To request this notice by mall, call 800 652.571 Under penalties of pory declare that have and this to return including accompanying schedules and statements, and to the best of my knowledge and belet, Il Core, and complete Youture Da pomagaletum, both at mally real Pretend phone number Padarytur declaration of preparar inte dintortion which proper has my knowledge Sign Here It is to forge a RDP signature For your PTIN PFEN (Sco instructions Do you want to allow another person to discuss this tax return with us? See instructions Put The Party Der Name No Telephone Number 333 3105203 Form 540 2020 Side 1 Description: Justin Stone was an employee of DataCare Services, Inc. His salary was $45,000 through November 10, 2020, when he was laid off. DataCare Services provided medical insurance for Justin and his family during his employment and agreed to continue this coverage through the end of 2020. He received $7,000 of unemployment compensation from November 11, 2020, through December 31, 2020. FICA withholdings were as follows: Social Security of $2,790 ($45,000 * 6.2%) and Medicare of $653 ($45,000 1.45%). Justin lives at 112 Green Road, Crown City, OH 45623. His Social Security number is 111-11-1118. Justin owned an apartment building until November 22, 2020, when he sold it for $200,000 (the apartment building's address is 4826 Orange Street, Crown City, OH 45623). For 2020, he had rent revenue of $33,000. He incurred and paid expenses as follows: $4,568 of repairs, $12,000 of mortgage interest, $10,000 of real estate taxes, and $1,000 of miscellaneous expenses. He purchased the building on January 2, 2013, for $125,000 (the related land was purchased for $10,000). The building generated an operating profit each year that Justin owned it. Justin received $13,000 in cash as a gift from his mother to help "tide him over" while he was unemployed. He also withdrew $10,000 from his checking account. He "invested" $300 in lottery tickets during the year but had no winnings. Other information follows: On November 22, 2020, Justin sold for $3,500 equipment that had been used for repairing various items in the apartments. The equipment was purchased for $25,000 on July 10, 2012, and was fully depreciated prior to 2020. Justin has $3,000 of unrecaptured $ generated an operating profit each year that Justin owned it. Justin received $13,000 in cash as a gift from his mother to help "tide him over" while he was unemployed. He also withdrew $10,000 from his checking account. He invested" $300 in lottery tickets during the year but had no winnings. Other information follows:. On November 22, 2020, Justin sold for $3,500 equipment that had been used for repairing various items in the apartments. The equipment was purchased for $25,000 on July 10, 2012, and was fully depreciated prior to 2020. Justin has $3,000 of unrecaptured 5 1231 losses from prior years.. Justin is age 38; is single; is divorced; and has custody of his nine-year-old son, Flint. Justin provides more than 50% of Flint's support. Flint's Social Security number is 123-45-6788.. Justin had $1,000 interest income from Blue Corporation bonds. Justin had $1,500 interest income from a State Bank certificate of deposit.. Justin had a $2,000 0%/154/20% long- term capital gain distribution from the Brown Stock Investment Fund. Justin had the following itemized deductions: 54,600 real estate taxes on his home; $8,900 mortgage interest on his home: $4,760 charitable contributions (all in cash, all property documented, and no single contribution exceeding $25): $4,300 state income tax withholding during 2020; $2,000 state estimated income tax payments during 2020; $2,600 sales taxes paid.. justin does not own or use any virtual currency. Justin does not want to donate to the Presidential Election Campaign Fund.. He had $10,000 of Federal income tax withholding during 2020 and made total Federal estimated income tax payments of $12,000 during 2020. Compute Justin's 2020 net tax payable or refund due. Ignore the $ 199A deduction for qualified business income (if applicable). If you use tax forms for your computations, you will need Form 1040 and its Schedules 1, 3, A, B, D, and E. You will also need Forms 4797 and 8582, and form 540 pp.1-5;CA:sch.p.I also need help writing a letter to Justin if possible thank you Tax Formula for Individuals Income (broadly defined)..... Less: Exclusions.... Gross income..... Less: Deductions for adjusted gross income.. Adjusted gross income........ Less: The greater of Total itemized deductions or standard deduction......... Less: Personal and dependency exemptions".. Deduction for qualified business income** Taxable income..... Tax on taxable income.. Less: Tax credits (including Federal income tax withheld and prepaid)..... Tax due (or refund)........ *Exemption deductions are not allowed from 2018 through 2025. **Only applies from 2018 through 2025. . Justin Stone was an employee of DataCare Services, Inc. His salary was $45,000 through November 10, 2020, when he was laid off. DataCare Services provided medical insurance for Justin and his family during his employment and agreed to continue this coverage through the end of 2020. He received $7,000 of unemployment compensation from November 11, 2020, through December 31, 2020. FICA withholdings were as follows: Social Security of $2,790 ($45,000 X 6.2%) and Medicare of 5653 ($45,000 x 1.45%). Justin lives at 112 Green Road, Crown City, OH 45623. His Social Security number is 111-11-1118. Justin owned an apartment building until November 22, 2020, when he sold it for $200,000 (the apartment building's address is 4826 Orange Street, Crown City, OH 45623). For 2020, he had rent revenue of $33,000. He incurred and paid expenses as follows: $4,568 of repairs, $12,000 of mortgage interest, $10,000 of real estate taxes, and $1,000 of miscellaneous expenses. He purchased the building on January 2, 2013, for $125,000 (the related land was purchased for $10,000). The building generated an operating profit each year that Justin owned it. Justin received $13,000 in cash as a gift from his mother to help "tide him over" while he was unemployed. He also withdrew $10,000 from his checking account. He "invested" $300 in lottery tickets during the year but had no winnings Other information follows: On November 22, 2020, Justin sold for $3,500 equipment that had been used for repairing various items in the apartments. The equipment was purchased for $25,000 on July 10, 2012, and was fully depreciated prior to 2020. Justin has $3,000 of unrecaptured 8 1231 losses from prior years. Justin is age 38. is single, is divorced: and has custody of his nine-year-old son, Flint Justin provides more than 50% of Flint's support. Flint's Social Security number is 123- 45-6788 Justin had $1.000 interest income from Blue Corporation bonds. Justin had $1.500 interest income from a State Bank certificate of deposit. Justin had a $2.000 0% 15% 20% long-term capital gain distribution from the Brown Stock Investment Fund Justin had the following itemized deductions. $4,600 real estate taxes on his home, $8.900 mortgage interest on his home: $4,760 charitable contributions (all in cash all properly documented, and no single contribution exceeding $25): $4,300 state income tax withholding during 2020. $2,000 state estimated income tax payments during 2020, 52.600 sales taxes paid Justin does not own or use any Virtual currency Justin does not want to donate to the Presidential Election Campaign Fund. He had s10,000 of Federal income tax withholding during 2020 and made total Federal estimated income tax payments of $12,000 during 2020 Compute Justus 2020 net tas navable or refund due. Ignore the 5 199A deduction for qualified business income if applicable. If you use tax forms for your computations, you will need Form 1040 and its Schedules 1. LABD and E. You will also need Fons 4797 and 8582 TRARLE YEAR 2020 Callfomla Resident Income Tax Return Check here AMENDED Fiscal years only Erman 340 year 2021 WEL ROBIN AL PG YO POS Soon! Il your addresses the same as your principalment the time of ting, check this box not your principali caldence the fing Principal Rece Feng Status your Coming from your check the besh 4 Singe Howy pro Seins Wand Desert 5 Quality BOP died See 3 Mirreding operasy w www OP SW IT above and we are here campos oor Picture Sam Exemptions Tore, to the the box by the prostora na watoto If you So you the Sindy bentur See you 65 sentar ma X 5124 = 1 x 311 3351 3101203 Form 540 200 de Your name: Your SSN ITIN 10 De Desoladeyen yew MDP Dependent O Exemptions . . w Total dependent options . 10 X 8383 11 Add line 7 through line 10. Transfer this wountine 32 115 Taxable income 12 Stages from your federal FormW-2. box 16 12 15 Enter der sted gross incombros del Form 1040 or 1040-5R, 11 13 14 California - Subtraction statement from Schedule CA (540) Parte 23.com . 14 15 Subtine 14 from line 13. fess that there is the See instruction 15 16 California adjust additions. Enter the amount to schedule CA (540) Part 2), column 16 17 Qorated gross incom. Combinatie 15 and line 16 17 18 the Your Californemind den Schule A ( Part 2 Your Conand deduction below for your Singer Marie RDP hings SLO MedOP inity Head of the buying widow $9.00 boxed STOPS 19 Sun 18 om 17. This is Textube Texas Schedule 31 FB300 12. Enter the mountain 11 your deal 120341 22 33 Subtitless than * We sa vatrason Check the belown. escormor.ru TO SETOA .34 5 Add . SESTERS 4 Wonders Stone fpecul Credits ora 44 Side 2 for 540 2020 333 3102203 Your name: Your SNN 45 sammanhand Section ASP 540 4 Nonda 5 bruction Special Crete 47 401 4. Theseydi US from the 61 Amative in Touch SP 54 Metal Health Services Tax Stran Othere wonderin Eco Advance Puma byt Alleine, de This 88 COBEDD . . 1 . Pets 1. Calme with Search 12 2000 AS Wolde Fomento NEW Serwis 75 Cameron Test Tower AIS The you Ovidas ou SELBER 45 11030 Your name Your SSN ITIN Overpaid toxines are the trainers Overpakd Tax Tax Due . # Amount of you wanted to your 2021 editor Overed to be a Strain fro7 99 104 Tex due to 5. stract from line 65 100 Cade . 40 .401 41 California Series Special Fund Seestruction Alzheimer Die and wated Deerde Voluntary Tax Contribution Fund Rare and Entengered Species Preservation Voluntary Tax Dort Program Galeria Brew Cancer Research Voluntary Tax Contribution Fund Califorlighters' Menon Voluntary Clin Fund Emergency Food toramites Voluntary Tax Contribution and . Bagai .40 407 California Peace Om Mim Foundation Voluntary Tax Control . 410 . 13 Contibutione California Sud Ouer Voluntary Tax Contribution and California Cantar fastanh Voluntary Pet Contributin Fund School Supplies for Homeless Children Fund Sur Parts Protection Fund Paris Pass Purchase Protor Constance Voluntary Tax Cotton Fund .43 425 Kees Metin Schools Voluntary Tax Confund Pretion of Animond Carly Voluntary on Contribute Fund 41 Candom See Advocacy Voluntary Corbund . .43 Corona w To Come Find Rape tace Voluntary las Cortina Schools Het Pons try to contribution 440 . .444 Bodentary lastenlund 110 Add code the 4th your team . 110 Side Form 540 2000 23 1104203 Your name Your SSN ITIN Tour You o 111 AMOUNT TOU OWE. Il you do notan 100, 11. romDe FRANCESE TAK ROAD, PO BOX SM, SACRAMENTO GA 14257-0001 Pay On they for more info s.O. 117 In the topics, Indeeltes 112 113 Under Checkbox FTI SOS . 114 Tour du Station, but does nye 114 TIS REFUND OR NO AMOUNT DUE. Subtract the sum of line 11, in 112 113 frames Mal E FRANCHISE HAY BOARD, PO BOKSET, SACRAMENTO CA 10-20, .. 115 Rhe internation to train de your tad not be consided heder So trudio y Viswak dolany At or the following amount of my stund line 119) and for den positiewe below Pelund and Direct Depost Route 11 Dect deposit Savings They end 11 w forint how Route Checking 117. Det IGNTARIOER Bachelor Tu prethodno 111 to Up the odw.com Sign Here 333 31052) Tax Formula for Individuals Income (Broadly defined).... Less: Exclusions. Gross income. Less: Deductions for adjusted gross income. Adjusted gross income... Less: The greater of Total itemized deductions or standard deductions. Less: Personal and dependency exemption Deduction for qualified business income..................... Taxable income Tax on taxable income.. Less Tax credits (including Federal income tax withheld and prepaid). Tax due or refund). *Exemption deductions are not allowed from 2018 through 2025. **Only applies from 2018 through 2025. Justin Stone was an employee of DataCare Services, Inc. His salary was $45,000 through November 10, 2020, when he was laid off. DataCare Services provided medical insurance for Justin and his family during his employment and agreed to continue this coverage through the end of 2020. He received $7,000 of unemployment compensation from November 11, 2020, through December 31, 2020. FICA withholdings were as follows: Social Security of $2,790 ($45,000 6.2%) and Medicare of $653 (845,000 * 1.45%). Justin lives at 112 Green Road, Crown City, OH 45623. His Social Security number is 111-11-1118. Justin owned an apartment building until November 22, 2020, when he sold it for $200,000 (the apartment building's address is 4826 Orange Street, Crown City, OH 45623). For 2020, he had rent revenue of $33,000. He incurred and paid expenses as follows: $4,568 of repairs, $12,000 of mortgage interest, $10,000 of real estate taxes, and $1,000 of miscellaneous expenses. He purchased the building on January 2, 2013, for $125,000 (the related land was purchased for $10,000). The building generated an operating profit each year that Justin owned it. Justin received $13,000 in cash as a gift from his mother to help "tide him over" while he was unemployed. He also withdrew $10,000 from his checking account. He "invested" $300 in lottery tickets during the year but had no winnings. Other information follows: . . On November 22, 2020, Justin sold for $3,500 equipment that had been used for repairing various items in the apartments. The equipment was purchased for $25,000 on July 10, 2012, and was fully depreciated prior to 2020. Justin has $3,000 of unrecaptured 1231 losses from prior years. Justin is age 38; is single; is divorced; and has custody of his nine-year-old son, Flint. Justin provides more than 50% of Flint's support. Flint's Social Security number is 123- 45-6788. Justin had $1,000 interest income from Blue Corporation bonds. Justin had $1,500 interest income from a State Bank certificate of deposit. Justin had a $2,000 0%/15%/20% long-term capital gain distribution from the Brown Stock Investment Fund. Justin had the following itemized deductions: $4,600 real estate taxes on his home; $8.900 mortgage interest on his home; $4,760 charitable contributions (all in cash, all properly documented, and no single contribution exceeding $25); $4,300 state income tax withholding during 2020; $2,000 state estimated income tax payments during 2020; $2,600 sales taxes paid. Justin does not own or use any virtual currency. Justin does not want to donate to the Presidential Election Campaign Fund. He had $10,000 of Federal income tax withholding during 2020 and made total Federal estimated income tax payments of $12,000 during 2020. Compute Justin's 2020 net tax payable or refund due. Ignore the $ 199A deduction for qualified business income (if applicable). If you use tax forms for your computations, you will need Form 1040 and its Schedules 1.3. A B. D. and E. You will also need Forms 4797 and 8582 . . TAXABLE YEAR FORM 540 2020 California Resident Income Tax Return Check here if this is an AMENDED return. Fiscal year timers only: Enter month of year end month Your first name year 2021 Initi Last name Suffix Your SSN ITIN point tax return pou'w/RDP's first me with Last name Suffix Spouse'ROPS 3 SN or ITIN R Additional information (100 instruction) PEA code Stret adresimber and streer or PO box Apt no no PMB briva malbox RP City (Ul you have a foreign address, so instruction) Stan ZIP code Foreign country name Foreign province only Foreign postatoode Your bobimnday) Spouse WROPU DOB ddy Birth Prior Date of Name Your prior nomo (noe inotruction) Spouse RDP's prior name (o instruction) . Enter your county at time of filing (ou naructions Principal Residence if your address above is the same as your principal physical residence address at the time of filling, check this box If not enter below your principal/physical residence address at the time of filing. Street address number and street for addit, se instructions Apt. non O State ZIP cod O If your California filing status is different from your federal filing status check the box here 1 Gingi Head of household (with qualitying person. Soo instructions. 3tatus Your DOB (mm/dd/yyyy) Spouw VROP's DOB (mm/dd/yyyy! . Birth Prior Date of Name Your prior wrw (see instruction Spouse's/RDP's prior name (see Instruction) O Principal Residence Enter your county of time of filing (uos instructions) if your address above is the same as your principal/physical residence address at the time of filing, check this box If not, enter below your principal/physical residence address at the time of filing Strelddren (number and treat of foreign Adams, intruction) Apt. mote, no . Sta ZIP Code o . . If your California filing status is different from your federal filing status, check the box here Single Head of household (with qualifying person). So instructions, Fling Status 2 Married/RDP filing jointly. See inst. 5 Qualifying widow(er). Enter year spouse/RDP died. See instructions 3 Married/RDP filing separately. Enter spouse's/RDP's SSN or ITIN above and full name here, Whale dollars only Exemptions 6 If someone can claim you for your spouse/ADP) as a dependent, check the box here. See inst For line 7, line 8. line 9 and line 10 Multiply the number you enter in the box hy the pre-printer dollar amount for that line 7 Personal: If you checked box 1, 3, or 4 above, enter 1 in the box. If you checked box 2 or 5 unter 2 in the box. If you checked the box on line 6, see instructions. O x $124 = Os 8 Blind: If you for your spouse/RDP) are visually impaired, enter 1 it both are visually impaired, entor 2 x $124 - os 9 Senior. If you for your spouse/BDP) are 65 or older, enter 1: if both are 65 or older, enter 2 X $124 - $ 333 3101203 D Form 540 2020 Side 1 Your name: Your SSN or ITIN: 10 Dependents: Do not include yourself or your spouse/RDP. Dependant 1 Dependent 2 First Name Dependenta o O O O O Last Name O Exemptions . . SSN. Sed Instructions Dependent mlationship . o you Total dependent exemptions 10 X $383 - OS 11 $ 11 Exemption amount: Add line 7 through line 10. Transfer this amount to line 32 12 State wages from your federal Form(s) W-2, box 16 12 13 00 . 14 100 13 Enter federal adjusted gross income from federal Form 1040 or 1040-SR, line 11 14 California adjustments - subtractions. Enter the amount from Schedule CA (540), Part I. line 23. column B. 15 Subtract line 14 from line 13. If less than zero, enter the result in parentheses See instructions 16 California adjustments - additions. Enter the amount from Schedule CA (540), Part , line 23, column C. 15 100 16 00 Taxable income 17 California adjusted gross income. Combine line 15 and line 16 17 18 Enfer the Your California itemized deductions from Schedule LA (540). Part II, line 3u; OR larger of Your California standard deduction shown below for your filing status: Single or Married/RDP filing separately. $4,601 Married/KDP ning jointly, Head of household, or Cualifying widower).. $9,202 It Married ROP fling separately or the box on line 6 is checked, STOP. See instructions 18 19 Subtract line 18 trom line 17. This is your taxable income it less than acro, enter D 19 100 an Tax Table Tax Rate Schedule 31 Tax. Check the box if from: FTB 3800 FTB 3803 31 .00 Sate wees Trom your bra! Form(s) W-2 box 16 12 O 13 00 13 Enter federal adjusted gross income from federal Form 1040 or 1040-SR, line 11 14 California adjustments - subtractions. Enter the amount from Schedule CA (540) Part I. line 23. column B. 15 Subtract line 14 from line 13. If less than zero, enter the result in parentheses. See instructions 16 California adjustments - additions. Enter the amount from Schedule CA (540). Part I, line 23, column C ...... 14 15 00 Taxable income 16 100 17 California adjusted gross income. Combine line 15 and line 16 17 18 Enter the Your California itemized deductions from Schedule CA (540), Part II, line 30: OR larger of Your California standard deduction shown below for your filing status: Single or Married RDP filing separately $4,601 Married/RDP filing jointly, Head of household, or Qualifying widower) $9.202 If Married RDP filing separately or the box on line 6 is thecked, STOP. See instructions 18 19 Subtract line 18 from line 17. This is your taxable income loss than zaro, enter 0 19 02 Tax Table 31 Tuy. Check the box it from: Tax Rate Schedule FTB 3800 FTB 3803 31 32 Exemption credits. Enter the amount trom line 11. If your federal AGI is more than $203, 311, ces instruction 33 Subtract line 32 from line 31. I less than zero, enter --- O 33 34 Tax. See instructions. Check the box it trom. FTB 5870A 34 rel O 32 Schedule G-1 100 35 Add line 33 and line 34 35 40 Nonrefundable Child and Dependent Care Expenses Credit. See instructions. 40 Special Credits 43 Enter credit name code and amount... 43 100 44 Enter credit name code and amount 44 Side 2 Form 540 2020 333 3102203 Oth B4 64 Excess Advance Premium Assistance Subsidy (APAS) repayment. See instructions. 65 Adid line 48, line 61, line 62, line 63, and line 64. This is your total tax 85 71 . 72 100 73 Payments 71 California income tax withhell. See instructions 72 2020 CA estimated tax and other payments. See instructions .. 73 Withholding (Form 592-B and/or 593). See instructions 14 Fees SNI (or VPNI) withheld San indtructions 75 Earned Income Tax Credit (EITC) 76 Young Child Tax Credit (YCTC). See instructions 74 100 ..... 75 ... 76 T7 100 77 Net Premium Assistance Subsidy (PAS). See instructions 70 Add line 71 through line 77. These are your total payments. See instructions 78 Use Tac 91 Use Tax. Do not leave blank. See instructions If line 91 is zero, check it: No use tax is owed. 91 100 You paid your use tax obligation directly to COTFA 92 Individual Shared Responsibility (ISR) Penalty. See instructions SR Penalty . 92 Full-year health care coverage. 93 Overpaid Tax/Tax Due O 94 93 Payments balance. If ne 78 is more than line 91, subtract line 91 from line 78 94 Use Tax balance. If line 91 is more than line 78, subtract line 78 from line 91 95 Payments after Individual Shared Responsibility Penalty. If line 93 is more than line 92 subtract line 92 from line 93 96 Individual Shared Responsibility Penalty Balance. If line 92 is more than line 93, then subtract line 93 from line 92 8888 95 96 Tin ni Your name: Your SSN or ITIN: o 97 97 Overpaid tax. If line 95 is more than line 65, subtract line 65 from line 96 38 Amount of line 97 you want applied to your 2021 estimated tax 100) Overpaid Tax/Tax Due 98 99 Overpaid tax available this year. Subtract line 98 from line 97 99 100 Tax due. If line 95 is less than line 65, subtract line 96 from line 65 O 100 Code Amount 400 . 401 200 Caitomis Seniors Special Fund. See instructions Alzheimer's Disease and Related Dementia Voluntary Tax Contribution Fund Rare and Endangered Species Preservation Voluntary Tax Contribution Program California Breast Cancer Research Voluntary Tax Contribution Fund, 403 00 405 00 California Firefighters' Memorial Voluntary Tax Contribution Fund 406 00 Emergency Food for Families Voluntary Tax Contribution Fund 407 00 Cantora Peace Ufficer Memorial Foundation Voluntary Tax Contbution Fund 408 fool California Sea Otter Voluntary Tax Contribution Fund 410 ..00 413 100 Contributions 422 00) California Cancer Research Voluntary Tax Contribution Fund, School Supplies for Homeless Children Fund State Parks Protection Fund/Parks Pass Purchase Protect Our Coast and Orang Voluntary Tax Contribution Fund 423 .00 424 Ino 425 00 Keep Arts in Schools Voluntary Tax Contribution Fund. Prevention of Animal Homelessness and Cruelty Voluntary Tax Contribution Fund 431 00 401 409 405 405 407 408 00 410 100 413 00 Contributions Alzheimer's Disease and Related Dementia Voluntary Tax Contribution Fund ........ Rare and Endangered Species Preservation Voluntary Tax Contribution Program California Breast Cancer Research Voluntary Tax Contribution Fund. Calfornia Firefighters' Memorial Voluntary Tax Contribution Fund Emergency Food for Families Voluntary Tax Contribution Fund Calfornia Peace moer Memonal Foundation Voluntary Tax Contrbution Fund California Sea Otter Voluntary Tax Contribution Fund California Cancer Research Voluntary Tax Contribution Fund School Supplies for Homeless Children Fund State Parks Protection Fund/Parks Pass Purchase Protect Our Couet and Oceane Voluntary Tax Contribution Fund. Keep Arts in Schools Voluntary Tax Contribution Fund. Prevention of Animal Homelessness and Cruelty Voluntary Tax Contribution Fund California Senior Citizen Advocacy Voluntary Tax Contribution Fund Native California Wildlife Rehabilitation Voluntary Tax Contribution Fund Rape Kit Backlog Voluntary Tax Contribution Fund.. Schools Not Prisons Voluntary Tax Contribution Fund 122 423 424 425 431 438 439 440 00 443 00 Suicide Prevention Voluntary Tax Contribution und 444 .00 110 Add code 400 through code 444. This is your total contribution 110 Amount You Owe 112 Interest and Penalties Check the box: 1 Your name: Your SSN or ITIN 111 AMOUNT YOU OWE. If you do not have an amount on line 99, add line 94, line 96, line 100, and line 110. See instructions. Do not send cash. Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001... 111 Pay Online - Go to tb.ca.gov/pay for more information 112 Interest, late return penalties, and late payment penalties 113 Underpayment of estimated tax FTB 680s attached 114 Total amount due. See instructions, Encloso, but do nat staple, any payment. 115 REFUND OR NO AMOUNT DUE. Subtract the sum of line 110, line 112 and line 113 from line 99. See Instructions. Mall to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0001 115 Fill in the information to authoriza

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts