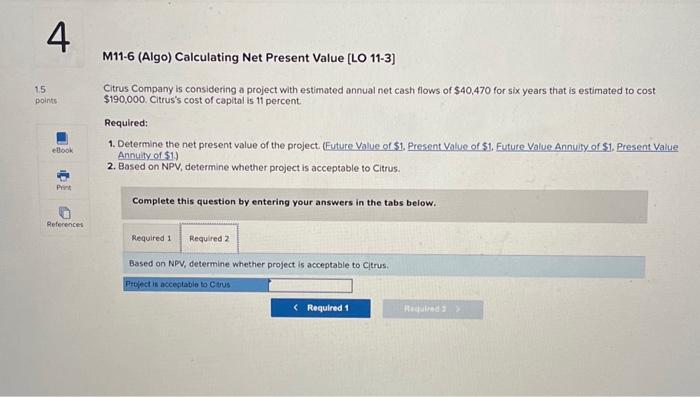

Question: 4 M11-6 (Algo) Calculating Net Present Value [LO 11-3] 15 points eBook Print References Citrus Company is considering a project with estimated annual net

![4 M11-6 (Algo) Calculating Net Present Value [LO 11-3] 15 points eBook](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/05/664310a5e5f64_205664310a5e27ba.jpg)

4 M11-6 (Algo) Calculating Net Present Value [LO 11-3] 15 points eBook Print References Citrus Company is considering a project with estimated annual net cash flows of $40,470 for six years that is estimated to cost $190,000. Citrus's cost of capital is 11 percent. Required: 1. Determine the net present value of the project. (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1) 2. Based on NPV, determine whether project is acceptable to Citrus. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the net present value of the project. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) Note: Use appropriate factor(s) from the tables provided. Negative amounts should be indicated by a minus sign. Round your final answer to 2 decimal places. Net Present Value Required 1 Required 2 > Show less & 4 M11-6 (Algo) Calculating Net Present Value [LO 11-3] 1.5 points ellook Print References Citrus Company is considering a project with estimated annual net cash flows of $40,470 for six years that is estimated to cost $190,000. Citrus's cost of capital is 11 percent. Required: 1. Determine the net present value of the project. (Euture Value of $1. Present Value of $1. Euture Value Annuity of $1. Present Value Annuity of $1) 2. Based on NPV, determine whether project is acceptable to Citrus. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Based on NPV, determine whether project is acceptable to Citrus. Project is acceptable to Citrus >

Step by Step Solution

There are 3 Steps involved in it

Required 1 From the Present Value Annuity Table the Present value of 1 ... View full answer

Get step-by-step solutions from verified subject matter experts