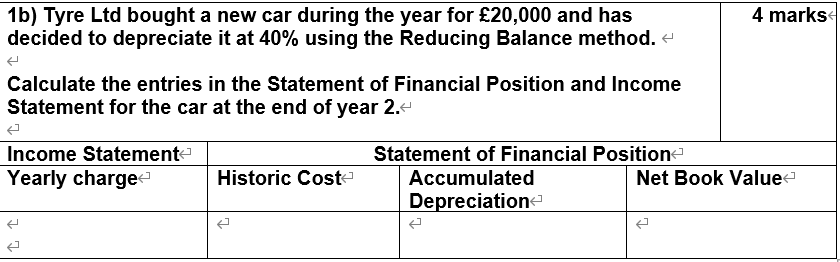

Question: 4 marks 1b) Tyre Ltd bought a new car during the year for 20,000 and has decided to depreciate it at 40% using the Reducing

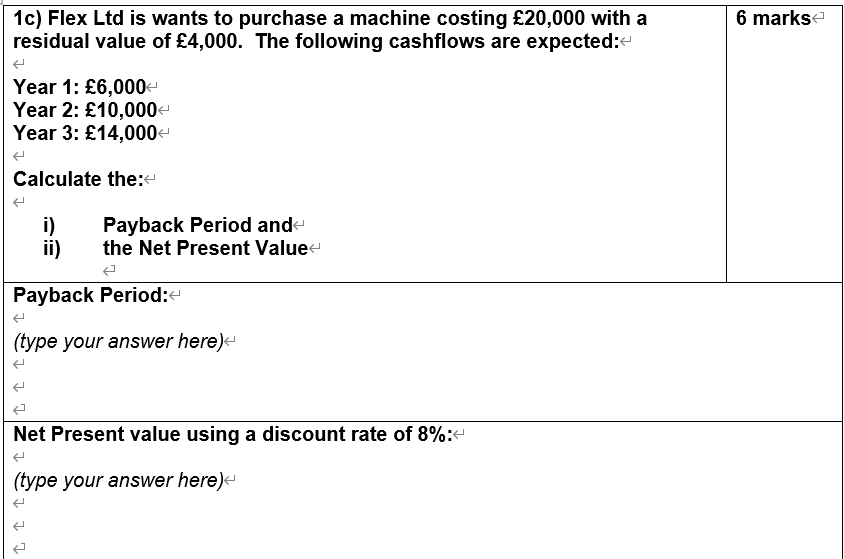

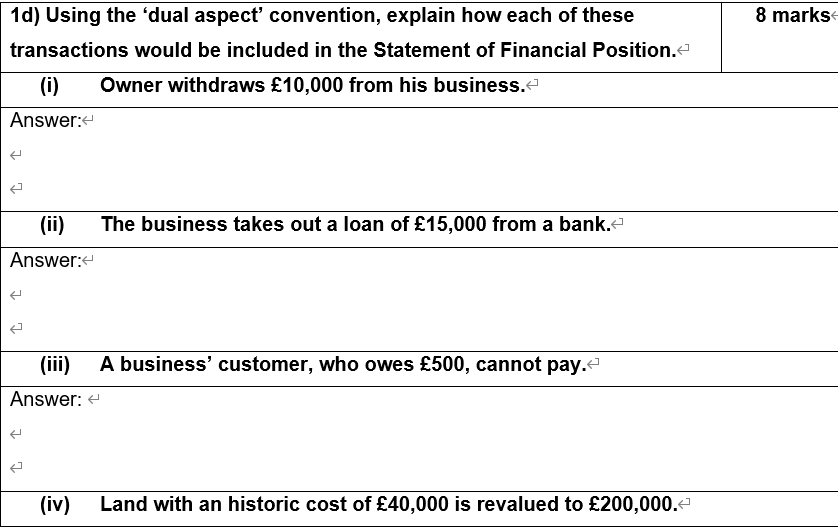

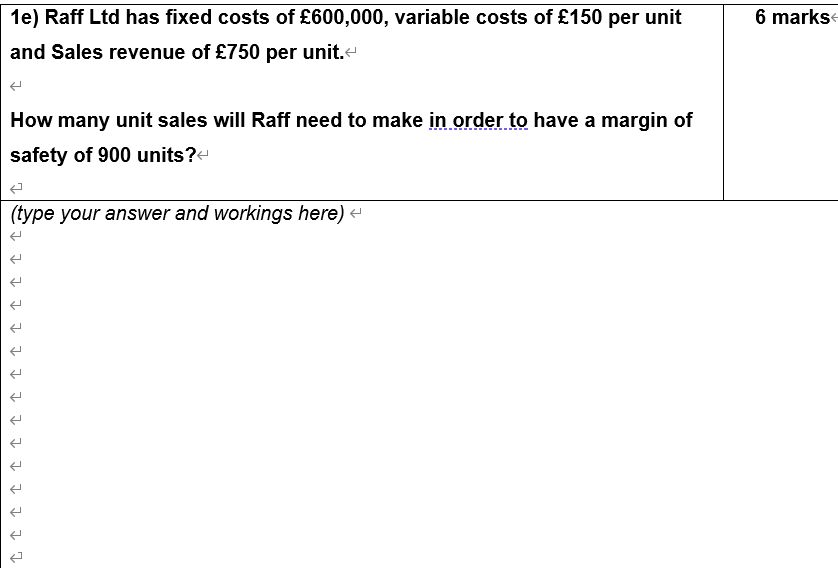

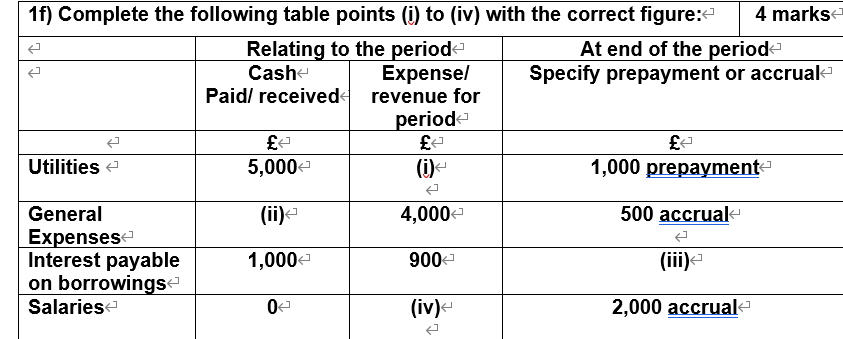

4 marks 1b) Tyre Ltd bought a new car during the year for 20,000 and has decided to depreciate it at 40% using the Reducing Balance method. + + Calculate the entries in the Statement of Financial Position and Income Statement for the car at the end of year 2.4 Income Statement Yearly charge Historic Cost Statement of Financial Position Accumulated Net Book Value Depreciation 6 marks 1c) Flex Ltd is wants to purchase a machine costing 20,000 with a residual value of 4,000. The following cashflows are expected: Year 1: 6,000 Year 2: 10,000 Year 3: 14,000 Calculate the: i) ii) Payback Period and the Net Present Value- Payback Period: (type your answer here) Net Present value using a discount rate of 8%:- (type your answer here) 8 marks 1d) Using the 'dual aspect' convention, explain how each of these transactions would be included in the Statement of Financial Position. (i) Owner withdraws 10,000 from his business. Answer:- The business takes out a loan of 15,000 from a bank. (ii) Answer: (iii) A business' customer, who owes 500, cannot pay. Answer: - (iv) Land with an historic cost of 40,000 is revalued to 200,000.- 6 marks 1e) Raff Ltd has fixed costs of 600,000, variable costs of 150 per unit and Sales revenue of 750 per unit. How many unit sales will Raff need to make in order to have a margin of safety of 900 units?- (type your answer and workings here) ? ? ? ? ? ? ? 1f) Complete the following table points (i) to (iv) with the correct figure: 4 marks Relating to the period At end of the period Cash Expensel Specify prepayment or accrual Paid/ received revenue for period Utilities 5,000 (1) 1,000 prepayment- 4,000 500 accrual General Expenses Interest payable on borrowings Salaries 1,000+ 900 (iii) 0 (iv) 2,000 accrual

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts