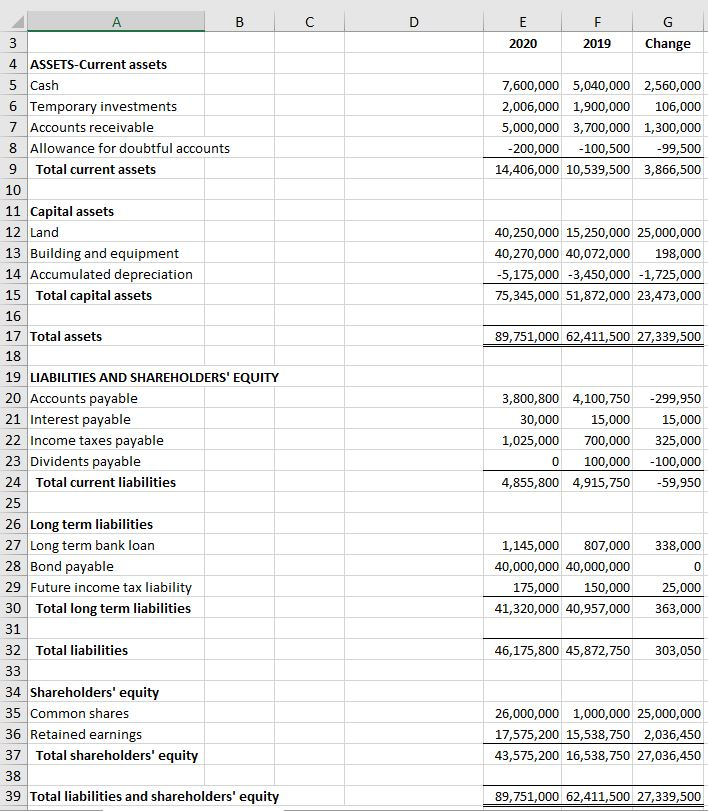

Question: A B C D E LL G 2020 2019 Change 7,600,000 5,040,000 2,560,000 2,006,000 1,900,000 106,000 5,000,000 3,700,000 1,300,000 -200,000 -100,500 -99,500 14,406,000 10,539,500 3,866,500

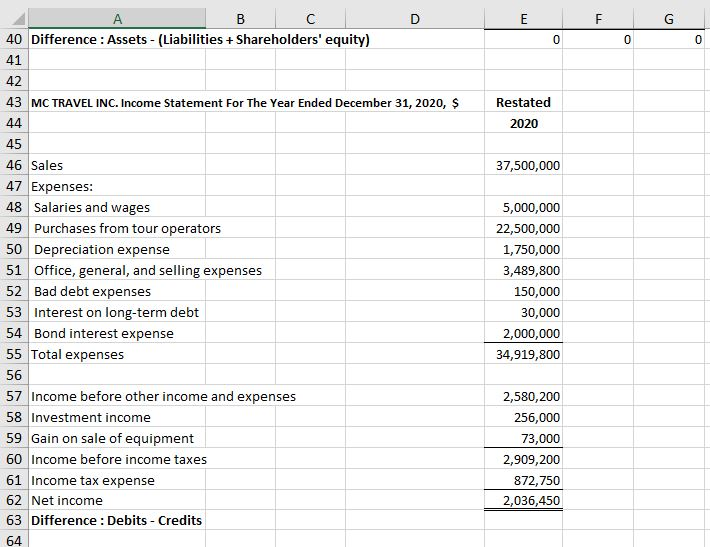

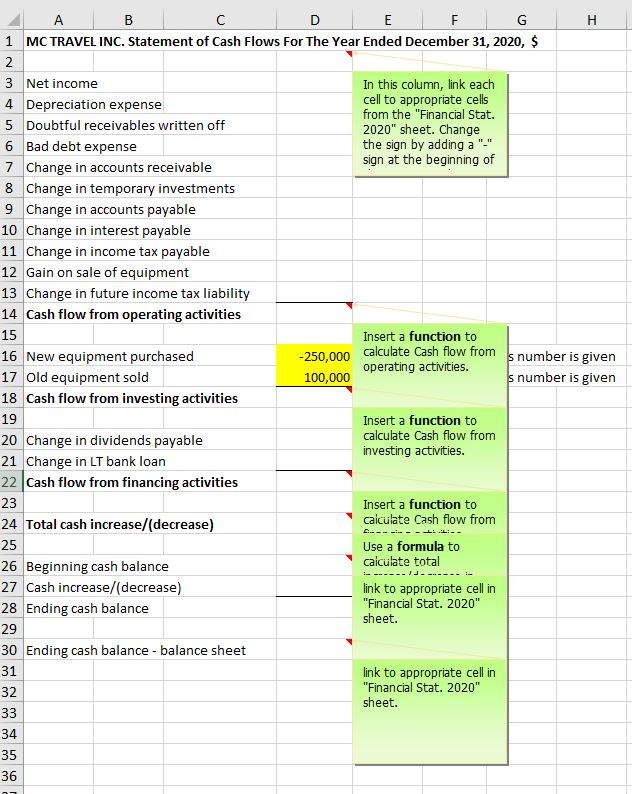

A B C D E LL G 2020 2019 Change 7,600,000 5,040,000 2,560,000 2,006,000 1,900,000 106,000 5,000,000 3,700,000 1,300,000 -200,000 -100,500 -99,500 14,406,000 10,539,500 3,866,500 40,250,000 15,250,000 25,000,000 40,270,000 40,072,000 198,000 -5,175,000 -3,450,000 -1,725,000 75,345,000 51,872,000 23,473,000 89,751,000 62,411,500 27,339,500 3 4 ASSETS-Current assets 5 Cash 6 Temporary investments 7 Accounts receivable 8 Allowance for doubtful accounts 9 Total current assets 10 11 Capital assets 12 Land 13 Building and equipment 14 Accumulated depreciation 15 Total capital assets 16 17 Total assets 18 19 LIABILITIES AND SHAREHOLDERS' EQUITY 20 Accounts payable 21 Interest payable 22 Income taxes payable 23 Dividents payable 24 Total current liabilities 25 26 Long term liabilities 27 Long term bank loan 28 Bond payable 29 Future income tax liability 30 Total long term liabilities 31 32 Total liabilities 33 34 Shareholders' equity 35 Common shares 36 Retained earnings 37 Total shareholders' equity 38 39 Total liabilities and shareholders' equity 3,800,800 4,100,750 30,000 15,000 1,025,000 700,000 0 100,000 4,855,800 4,915,750 -299,950 15,000 325,000 - 100,000 -59,950 338,000 0 1,145,000 807,000 40,000,000 40,000,000 175,000 150,000 41,320,000 40,957,000 25,000 363,000 46,175,800 45,872,750 303,050 26,000,000 1,000,000 25,000,000 17,575,200 15,538,750 2,036,450 43,575,200 16,538,750 27,036,450 89,751,000 62,411,500 27,339,500 E F G 0 0 0 Restated 2020 37,500,000 A B C D 40 Difference: Assets - (Liabilities + Shareholders' equity) 41 42 43 MC TRAVEL INC. Income Statement For The Year Ended December 31, 2020, $ 44 45 46 Sales 47 Expenses: 48 Salaries and wages 49 Purchases from tour operators 50 Depreciation expense 51 Office, general, and selling expenses 52 Bad debt expenses 53 Interest on long-term debt 54 Bond interest expense 55 Total expenses 56 57 Income before other income and expenses 58 Investment income 59 Gain on sale of equipment 60 Income before income taxes 61 Income tax expense 62 Net income 63 Difference: Debits - Credits 64 5,000,000 22,500,000 1,750,000 3,489,800 150,000 30,000 2,000,000 34,919,800 2,580,200 256,000 73,000 2,909,200 872,750 2,036,450 B D F G H 1 MC TRAVEL INC. Statement of Cash Flows For The Year Ended December 31, 2020, $ 2 3 Net income In this column, link each 4 Depreciation expense cell to appropriate cells from the "Financial Stat. 5 Doubtful receivables written off 2020" sheet. Change 6 Bad debt expense the sign by adding a "- 7 Change in accounts receivable sign at the beginning of 8 Change in temporary investments 9 Change in accounts payable 10 Change in interest payable 11 Change in income tax payable 12 Gain on sale of equipment 13 Change in future income tax liability 14 Cash flow from operating activities Insert a function to 16 New equipment purchased -250,000 calculate Cash flow from s number is given operating activities. 17 Old equipment sold 100,000 s number is given 18 Cash flow from investing activities 19 Insert a function to 20 Change in dividends payable calculate Cash flow from investing activities. 21 Change in LT bank loan 22 Cash flow from financing activities 23 Insert a function to 24 Total cash increase/(decrease) calculate Cash flow from Use a formula to 26 Beginning cash balance calculate total 27 Cash increase/(decrease) link to appropriate cell in 28 Ending cash balance "Financial Stat. 2020" sheet. 15 --- 25 29 link to appropriate cell in "Financial Stat. 2020" sheet. 30 Ending cash balance - balance sheet 31 32 33 34 35 36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts