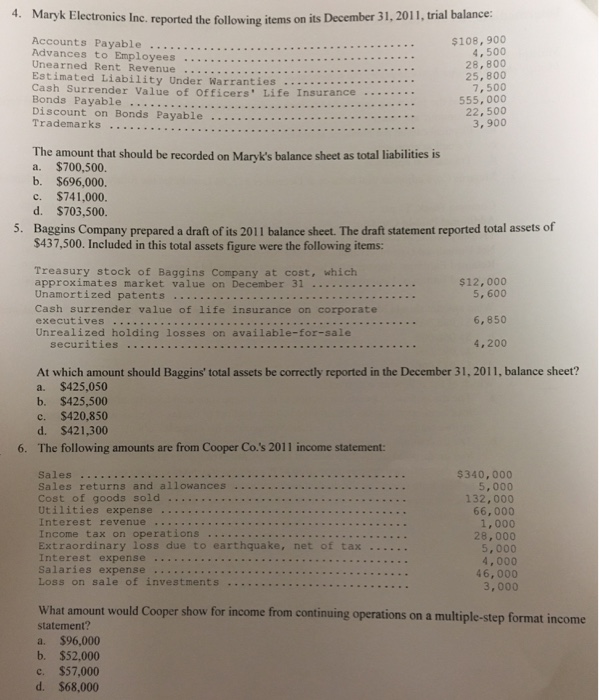

Question: 4. Maryk Electronics Inc. reported the following items on its December 31, 2011, trial balance: Accounts Payable $108, 900 4, 500 28, 800 25, 800

4. Maryk Electronics Inc. reported the following items on its December 31, 2011, trial balance: Accounts Payable $108, 900 4, 500 28, 800 25, 800 7,500 555, 000 22, 500 3, 900 Advances to Employees Unearned Rent Revenue Estimated Liability Under Warranties ash Surrender Value of officers' Life Insurance . Bonds Payable piacountkon Bonds Payable.. The amount that should be recorded on Marvk's balance sheet as total liabilities is a. $700,500 b. $696,000. c. $741,000 d. $703,500 Baggins Company prepared a draft of its 2011 balance sheet. The draft statement reported total assets of $437,500. Included in this total assets figure were the following items: 5. Treasury stock of Baggins Company at cost, which approximates market value on December 31 $12,000 5, 600 6, 850 4,200 Cash surrender value of life insurance on corporate executives Unrealized holding losses on available-for-sale securities At which amount should Baggins' total assets be correctly reported in the December 31, 2011, balance sheet? a. $425,050 b. $425,500 c. $420,850 d. $421,300 The following amounts are from Cooper Co.'s 2011 income statement: 6. $340, 000 5,000 132,000 66,000 1,000 28,000 5,000 4,000 46,000 3,000 Sales returns and allowances Cost of goods sold Utilities expense Income tax on operations Extraordinary loss due to earthquake, net of tax Salaries expense Loss on sale of investments What amount would Cooper show for income from continuing operations on a multiple-step format income statement? a. $96,000 b. $52,000 c. $57,000 d. $68,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts