Question: 4. Ms. Busch has gathered these data about her finances: Salary Taxable interest received Municipal bond interest received Total itemized deductions 140,000 2,500 15,000 8,000

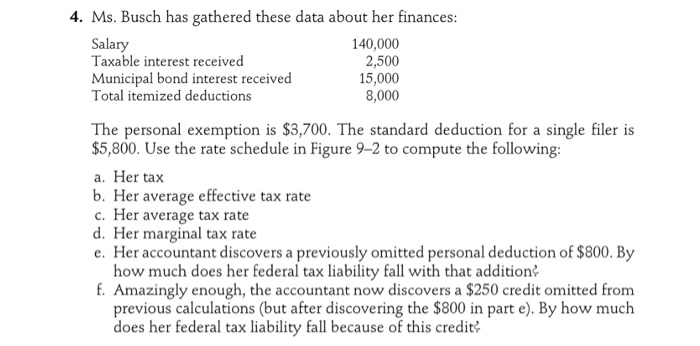

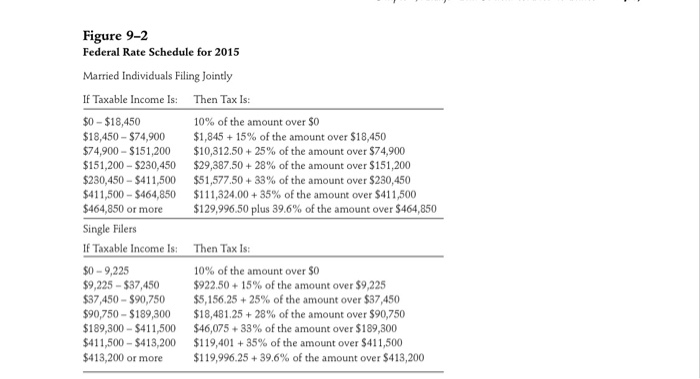

4. Ms. Busch has gathered these data about her finances: Salary Taxable interest received Municipal bond interest received Total itemized deductions 140,000 2,500 15,000 8,000 The personal exemption is $3,700. The standard deduction for a single filer is $5,800. Use the rate schedule in Figure 9-2 to compute the following: a. Her tax b. Her average effective tax rate c. Her average tax rate d. Her marginal tax rate e. Her accountant discovers a previously omitted personal deduction of $800. By how much does her federal tax liability fall with that addition E. Amazingly enough, the accountant now discovers a $250 credit omitted from previous calculations (but after discovering the S800 in part e). By how much does her federal tax liability fall because of this credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts