Question: please solve the questions.... 4. Ms. Busch has gathered these data about her finances: Salary 140,000 Taxable interest received 2,500 Municipal bond interest received 15,000

please solve the questions....

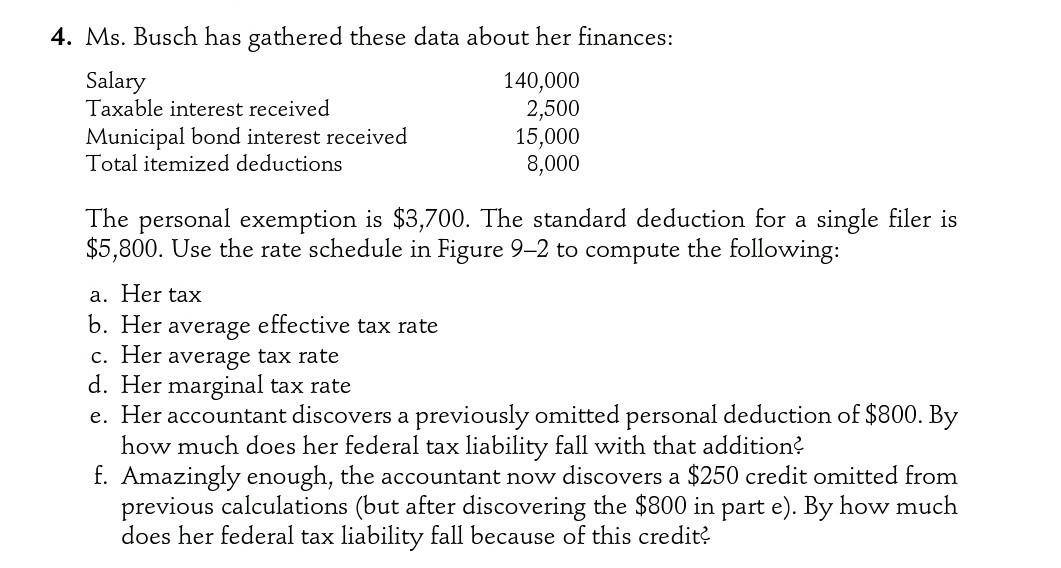

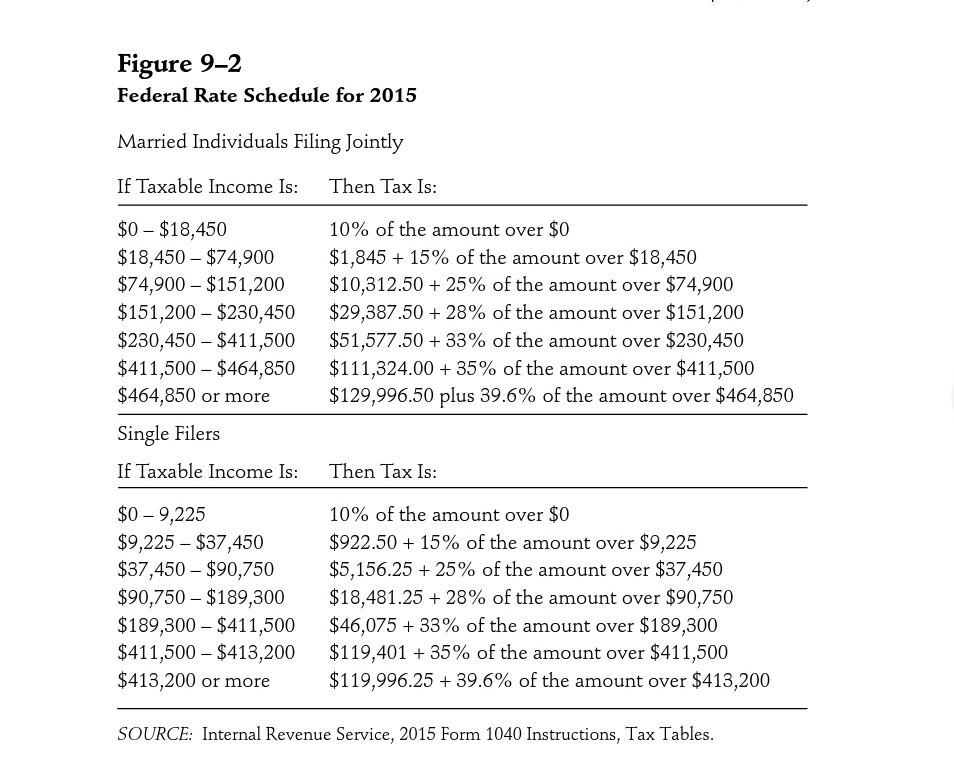

4. Ms. Busch has gathered these data about her finances: Salary 140,000 Taxable interest received 2,500 Municipal bond interest received 15,000 Total itemized deductions 8,000 The personal exemption is $3,700. The standard deduction for a single filer is $5,800. Use the rate schedule in Figure 92 to compute the following: a. Her tax b. Her average effective tax rate c. Her average tax rate d. Her marginal tax rate e. Her accountant discovers a previously omitted personal deduction of $800. By how much does her federal tax liability fall with that addition? f. Amazingly enough, the accountant now discovers a $250 credit omitted from previous calculations (but after discovering the $800 in part e). By how much does her federal tax liability fall because of this credit? a Figure 9-2 Federal Rate Schedule for 2015 Married Individuals Filing Jointly If Taxable Income Is: Then Tax Is: $0-$18,450 $18,450 - $74,900 $74,900 - $151,200 $151,200 - $230,450 $230,450 - $411,500 $411,500 - $464,850 $464,850 or more Single Filers If Taxable income is: 10% of the amount over $0 $1,845 + 15% of the amount over $18,450 $10,312.50 + 25% of the amount over $74,900 $29,387.50 + 28% of the amount over $151,200 $51,577.50 + 33% of the amount over $230,450 $111,324.00 + 35% of the amount over $411,500 $129,996.50 plus 39.6% of the amount over $464,850 Then Tax Is: $0 - 9,225 $9,225 - $37,450 $37,450 - $90,750 $90,750 - $189,300 $189,300 - $411,500 $411,500 - $413,200 $413,200 or more 10% of the amount over $0 $922.50 + 15% of the amount over $9,225 $5,156.25 + 25% of the amount over $37,450 $18,481.25 + 28% of the amount over $90,750 $46,075 + 33% of the amount over $189,300 $119,401 + 35% of the amount over $411,500 $119,996.25 + 39.6% of the amount over $413,200 SOURCE: Internal Revenue Service, 2015 Form 1040 Instructions, Tax Tables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts