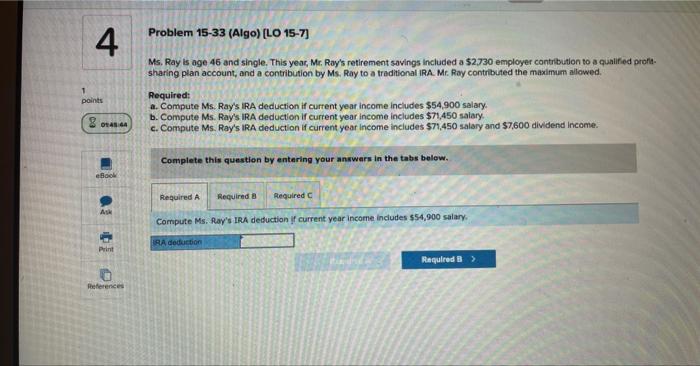

Question: #4 Ms, Ray is age 46 and single. This year, Mr. Ray's retirement sovings included a $2.730 employer contribution to a qualifed profitsharing plan account,

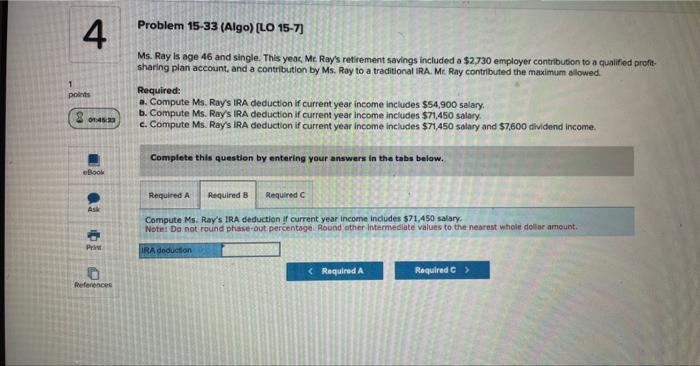

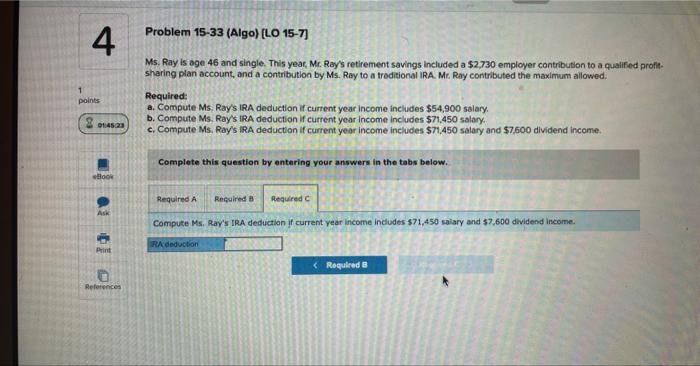

Ms, Ray is age 46 and single. This year, Mr. Ray's retirement sovings included a $2.730 employer contribution to a qualifed profitsharing plan account, and a contribution by Ms. Ray to a treditional IRA. Mr. Ray contributed the maximum allowed. Required: a. Compute Ms. Ray's IRA deduction if current year income includes $54,900 salary. b. Compute Ms. Ray's IRA deduction if current year income includes $71,450 salary. c. Compute Ms. Ray's IRA deduction if current year income includes $71,450 salary and $7,600 dividend income. Complete this question by entering your anwwars in the tabs below. Compute Ms, fay's IRA deduction if current year income indudes $54,900 salary. Ms. Ray is age 46 and single. This yeac, Mc Ray's retirement savings included a $2,730 employer contribution to a qualified profitsharing plan account, and a contribution by Ms. Ray to a traditional IRA. Mr. Ray contributed the maximum alowed. Required: a. Compute Ms. Ray's IRA deduction if current year income includes 554,900 salary, b. Compute Ms. Ray's IRA deduction if current year income includes $71,450 salary. c. Compute Ms. Ray's IRA deduction if current year income includes $71,450 salary and $7,600 dividend income. Complete this question by entering your answers in the tabs below. Compute Ms. Ray's IRA deduction if current year income indudes $71,450 salary. Note: Da not round phase-out percentage. Roond other intermedlate values to the nearest whole dollar ameunt. Ms. Ray is age 46 and single. This year, Mr. Ray's retirement savings included a $2,730 employer contribution to a qualifed profit. sharing plan account, and a contribution by Ms. Ray to a treditional IRA. Mz. Ray contributed the maximum allowed. Required: a. Compute Ms. Ray's IRA deduction if current year income includes $54,900 salary. b. Compute Ms. Ray's iRA deduction if current year income includes $71,450 salary. c. Compute Ms. Ray's IRA deduction if current year income includes $71,450 salary and $7,600 dividend income. Complete this question by entaring your answers in the tabs below. Compute Ms, Ray's IRA deduction if current year income includes $71,450 saiary and $7,600 dividend income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts