Question: 4 Net Present Value-Unequal Lives Project 1 requires an original investment of $33,700. The project will yield cash flows of $9,000 per year for 6

4

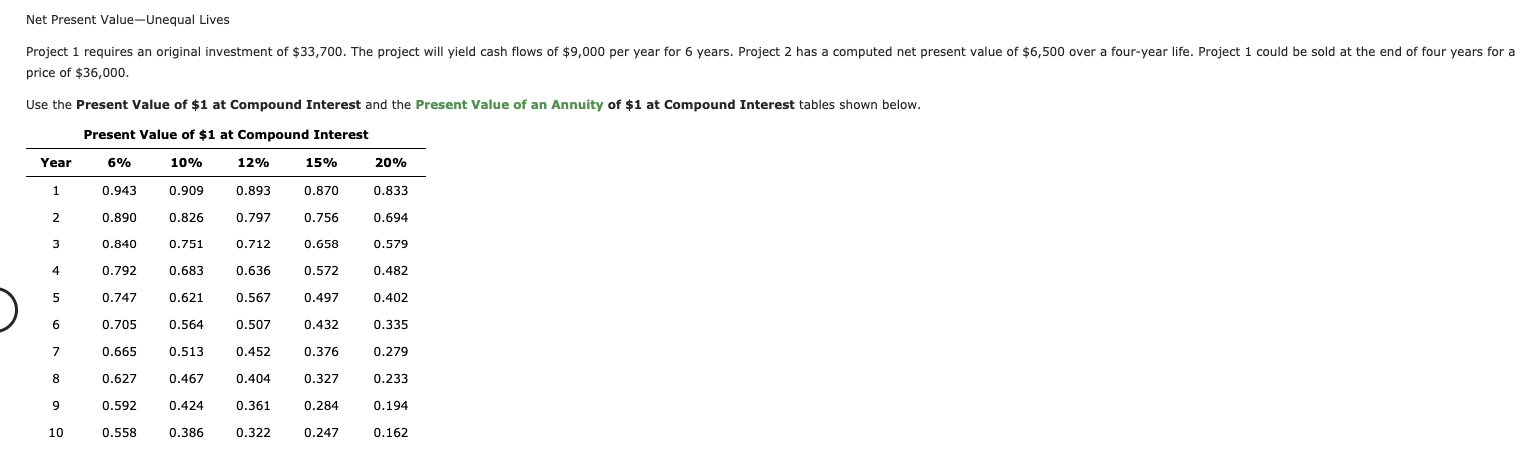

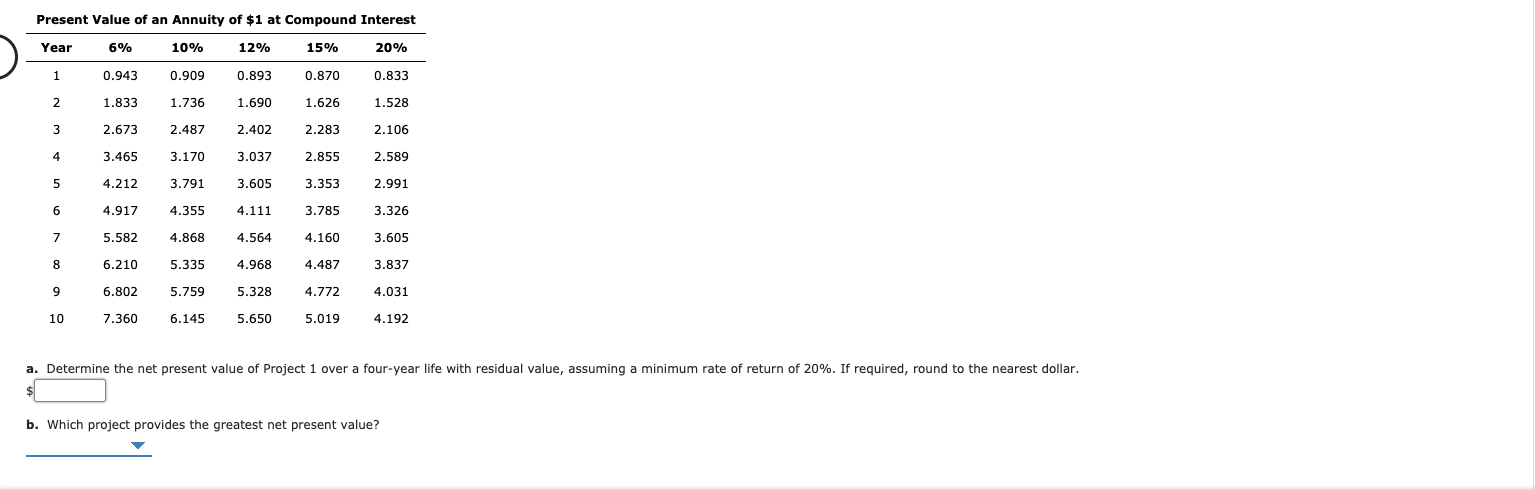

Net Present Value-Unequal Lives Project 1 requires an original investment of $33,700. The project will yield cash flows of $9,000 per year for 6 years. Project 2 has a computed net present value of $6,500 over a four-year life. Project 1 could be sold at the end of four years for a price of $36,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below. Year Present Value of $1 at Compound Interest 6% 10% 12% 15% 20% 0.943 0.9090.893 0.870 0.833 0.890 0.826 0.797 0.756 0.694 0.840 0.751 0.712 0.658 0.579 0.792 0.683 0.636 0.572 0.482 0.747 0.621 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 0.665 0.513 0.452 0.376 0.279 0.627 0.467 0.404 0.327 0.233 0.592 0.424 0.361 0.284 0.194 0.558 0.386 0.322 0.247 0.162 10 2.855 Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.9090.893 0.870 0.833 1.833 1.736 1.690 1.626 1.528 2.673 2.487 2.402 2.283 2.106 3.465 3.170 3.037 2.589 4.212 3.791 3.605 3.353 2.991 4.917 4.355 4.111 3.785 3.326 4.868 4.564 4.160 3.605 5.335 4.968 4.487 3.837 6.802 5.328 4.772 4.031 107.360 6.145 5.6505.0194.192 5.582 6.210 5.759 a. Determine the net present value of Project 1 over a four-year life with residual value, assuming a minimum rate of return of 20%. If required, round to the nearest dollar. b. Which project provides the greatest net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts