Question: X, X? A. A.EE 2 O O V & Net Present Value-Unequal Lives Project 1 requires an original investment of $54,700. The project will yield

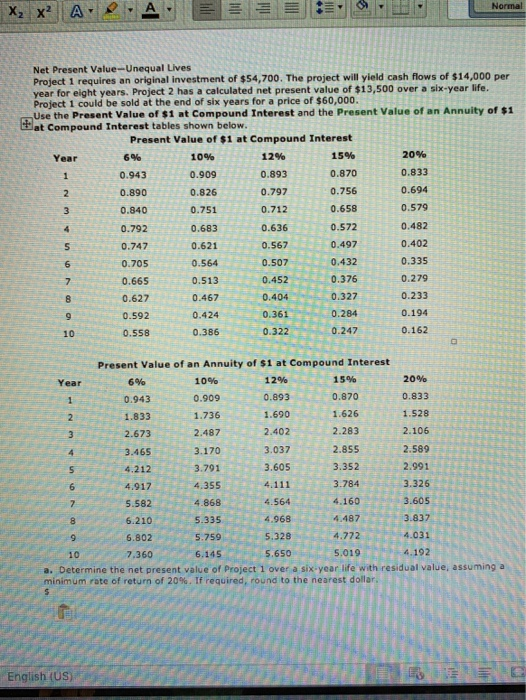

X, X? A. A.EE 2 O O V & Net Present Value-Unequal Lives Project 1 requires an original investment of $54,700. The project will yield cash flows of $14,000 per year for eight years. Project 2 has a calculated net present value of $13,500 over a six-year life. Project 1 could be sold at the end of six years for a price of $60,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 Flat Compound Interest tables shown below. Present Value of $1 at Compound Interest 6% 10% 12% 0.943 0.909 0.890 0.826 0.840 0.751 0.792 0.683 0.747 0.705 0.665 0.627 0.467 0.592 0.424 0.424 0.361 0.194 0.558 0.386 0.322 0.247 0.162 wN O NOOOOOOO wino O 6 R NON O 621 8 O m 0.513 O O O ANNA Present Value of an Annuity 28 0.943 No in No NON No - 39 9 600 W un No NN O N N MM o No 890 G 8 6.210 9 GB02 5250 10 10 7 .360 6.145 a. Determine the net present value of minimum rate of return of 20%. If required, round Ab ssuming English (US)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts