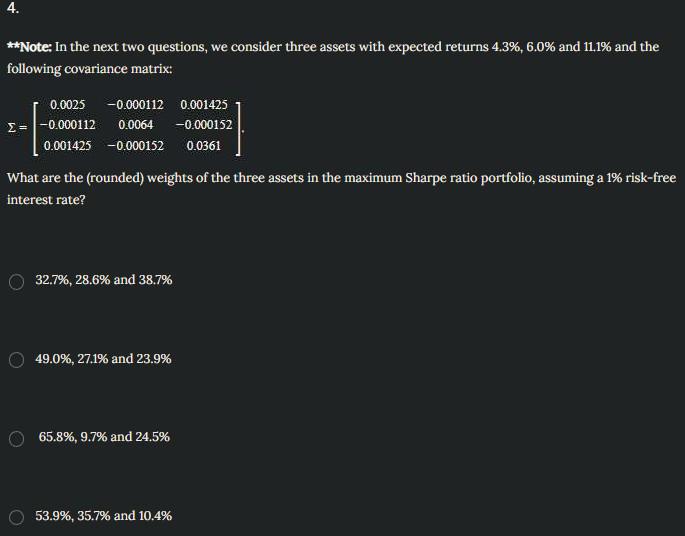

Question: 4. ** Note: In the next two questions, we consider three assets with expected returns 4.3%,6.0% and 11.1% and the following covariance matrix: =0.00250.0001120.0014250.0001120.00640.0001520.0014250.0001520.0361 What

4. ** Note: In the next two questions, we consider three assets with expected returns 4.3%,6.0% and 11.1% and the following covariance matrix: =0.00250.0001120.0014250.0001120.00640.0001520.0014250.0001520.0361 What are the (rounded) weights of the three assets in the maximum Sharpe ratio portfolio, assuming a 1\% risk-free interest rate? 32.7%,28.6% and 38.7% 49.0%,27.1% and 23.9% 65.8%,9.7% and 24.5% 53.9%,35.7% and 10.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts