Question: 4. Och Inc, is considering a project that will result in after-tax cash saving of $3.5 million per year indefinitely. The firm has a target

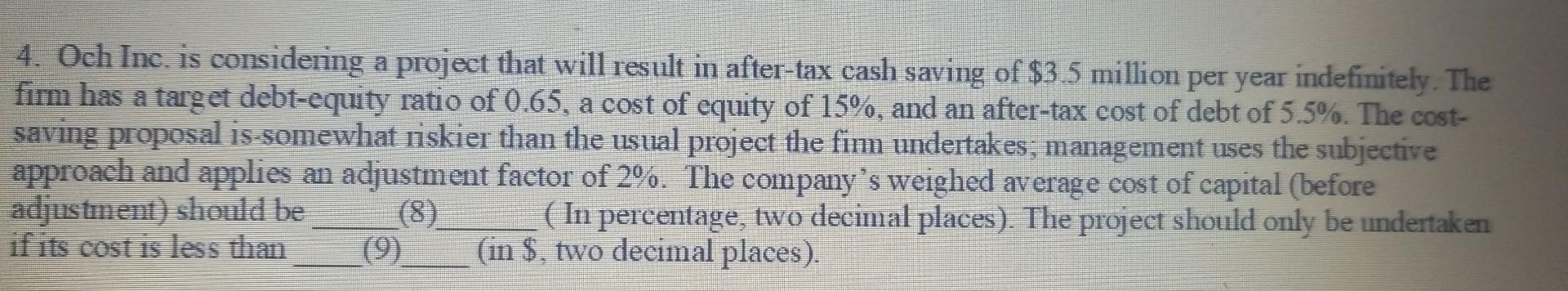

4. Och Inc, is considering a project that will result in after-tax cash saving of $3.5 million per year indefinitely. The firm has a target debt-equity ratio of 0.65 , a cost of equity of 15%, and an after-tax cost of debt of 5.5%. The costsaving proposal is-somewhat riskier than the usual project the fim undertakes; management uses the subjective approach and applies an adjustment factor of 2%. The company's weighed average cost of capital (before adjustment) should be (8) (In percentage, two decimal places). The project should only be undertaken if its cost is less than (9) (in $, two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts