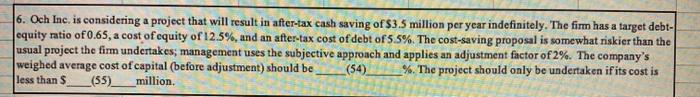

Question: 6. Och Inc. is considering a project that will result in after-tax cash saving of $3,5 million per year indefinitely. The firm has a target

6. Och Inc. is considering a project that will result in after-tax cash saving of $3,5 million per year indefinitely. The firm has a target debt- equity ratio of 0.65, a cost of equity of 12.5%, and an after-tax cost of debt of 5.5%. The cost saving proposal is somewhat riskier than the usual project the firm undertakes, management uses the subjective approach and applies an adjustment factor of 2%. The company's weighed average cost of capital (before adjustment) should be (54) %. The project should only be undertaken if its cost is less than _(55)__million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts