Question: 4. Part B Develop a matlab code to compute the price of call and a put options according to the multi-period binomial model. As input

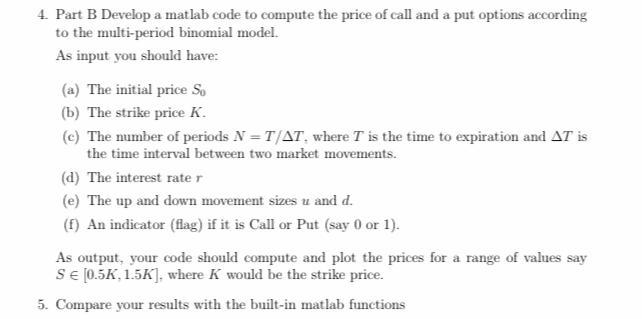

4. Part B Develop a matlab code to compute the price of call and a put options according to the multi-period binomial model. As input you should have: (a) The initial price so (b) The strike price K. (c) The number of periods N=T/AT. where T is the time to expiration and AT is the time interval between two market movements. (d) The interest rater (e) The up and down movement sizes u and d. (1) An indicator (flag) if it is Call or Put (say 0 or 1). As output, your code should compute and plot the prices for a range of values say SE [0.5K, 1.5K], where K would be the strike price. 5. Compare your results with the built-in matlab functions 4. Part B Develop a matlab code to compute the price of call and a put options according to the multi-period binomial model. As input you should have: (a) The initial price so (b) The strike price K. (c) The number of periods N=T/AT. where T is the time to expiration and AT is the time interval between two market movements. (d) The interest rater (e) The up and down movement sizes u and d. (1) An indicator (flag) if it is Call or Put (say 0 or 1). As output, your code should compute and plot the prices for a range of values say SE [0.5K, 1.5K], where K would be the strike price. 5. Compare your results with the built-in matlab functions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts