Question: #4 Please , if you could explain that would be great. Thank you The risk-return characteristics of a convertible bond depend on the underlying share

#4 Please , if you could explain that would be great. Thank you

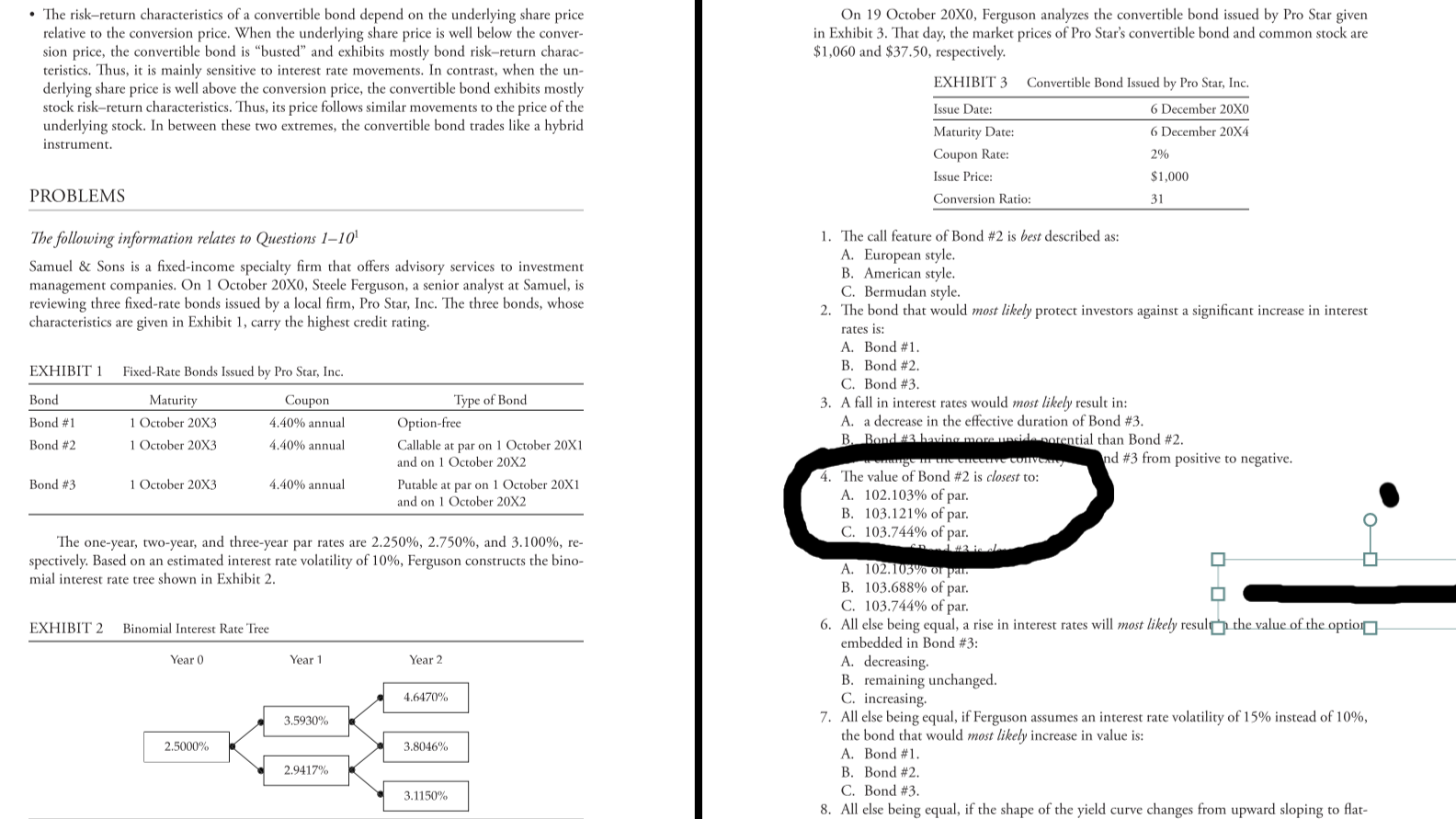

The risk-return characteristics of a convertible bond depend on the underlying share price relative to the conversion price. When the underlying share price is well below the conver- sion price, the convertible bond is "busted and exhibits mostly bond risk-return charac- teristics. Thus, it is mainly sensitive to interest rate movements. In contrast, when the un- derlying share price is well above the conversion price, the convertible bond exhibits mostly stock risk-return characteristics. Thus, its price follows similar movements to the price of the underlying stock. In between these two extremes, the convertible bond trades like a hybrid instrument. On 19 October 20X0, Ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the market prices of Pro Star's convertible bond and common stock are $1,060 and $37.50, respectively. EXHIBIT 3 Convertible Bond Issued by Pro Star, Inc. Issue Date: 6 6 December 20X0 Maturity Date: 6 December 20X4 Coupon Rate: Issue Price: $1,000 Conversion Ratio: 31 2% PROBLEMS The following information relates to Questions 1-10 Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. On 1 October 20X0, Steele Ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, Inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating, EXHIBIT 1 Fixed-Rate Bonds Issued by Pro Star, Inc. - Bond Maturity Coupon Bond #1 1 October 20X3 4.40% annual Bond #2 1 October 20X3 4.40% annual 1. The call feature of Bond #2 is best described as: A. European style. B. American style. C. Bermudan style. 2. The bond that would most likely protect investors against a significant increase in interest rates is: A. Bond #1. B. Bond #2. C. Bond #3. 3. A fall in interest rates would most likely result in: A. a decrease in the effective duration of Bond #3. B. Bond #2.having more mide notential than Bond #2. gume CONVEN nd #3 from positive to negative. 4. The value of Bond #2 is closest to: A. 102.103% of par. B. 103.121% of par. C. 103.744% of par. Type of Bond Option-free Callable at par on 1 October 20X1 and on 1 October 20X2 Putable at par on 1 October 20X1 and on 1 October 20X2 Bond #3 1 October 20X3 4.40% annual The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, re- spectively. Based on an estimated interest rate volatility of 10%, Ferguson constructs the bino- mial interest rate tree shown in Exhibit 2. 2 EXHIBIT 2 Binomial Interest Rate Tree Year 0 Year 1 1 Year 2 A. 102.10340 on pau. B. 103.688% of par. C. 103.744% of par. 6. All else being equal, a rise in interest rates will most likely result the value of the option embedded in Bond #3: A. decreasing. B. remaining unchanged. C. increasing 7. All else being equal, if Ferguson assumes an interest rate volatility of 15% instead of 10%, the bond that would most likely increase in value is: A. Bond #1. B. Bond #2. C. Bond #3 8. All else being equal, if the shape of the yield curve changes from upward sloping to flat- 4.6470% 3.5930% % 2.5000% 3.8046% 2.9417% 3.1150% The risk-return characteristics of a convertible bond depend on the underlying share price relative to the conversion price. When the underlying share price is well below the conver- sion price, the convertible bond is "busted and exhibits mostly bond risk-return charac- teristics. Thus, it is mainly sensitive to interest rate movements. In contrast, when the un- derlying share price is well above the conversion price, the convertible bond exhibits mostly stock risk-return characteristics. Thus, its price follows similar movements to the price of the underlying stock. In between these two extremes, the convertible bond trades like a hybrid instrument. On 19 October 20X0, Ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the market prices of Pro Star's convertible bond and common stock are $1,060 and $37.50, respectively. EXHIBIT 3 Convertible Bond Issued by Pro Star, Inc. Issue Date: 6 6 December 20X0 Maturity Date: 6 December 20X4 Coupon Rate: Issue Price: $1,000 Conversion Ratio: 31 2% PROBLEMS The following information relates to Questions 1-10 Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. On 1 October 20X0, Steele Ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, Inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating, EXHIBIT 1 Fixed-Rate Bonds Issued by Pro Star, Inc. - Bond Maturity Coupon Bond #1 1 October 20X3 4.40% annual Bond #2 1 October 20X3 4.40% annual 1. The call feature of Bond #2 is best described as: A. European style. B. American style. C. Bermudan style. 2. The bond that would most likely protect investors against a significant increase in interest rates is: A. Bond #1. B. Bond #2. C. Bond #3. 3. A fall in interest rates would most likely result in: A. a decrease in the effective duration of Bond #3. B. Bond #2.having more mide notential than Bond #2. gume CONVEN nd #3 from positive to negative. 4. The value of Bond #2 is closest to: A. 102.103% of par. B. 103.121% of par. C. 103.744% of par. Type of Bond Option-free Callable at par on 1 October 20X1 and on 1 October 20X2 Putable at par on 1 October 20X1 and on 1 October 20X2 Bond #3 1 October 20X3 4.40% annual The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, re- spectively. Based on an estimated interest rate volatility of 10%, Ferguson constructs the bino- mial interest rate tree shown in Exhibit 2. 2 EXHIBIT 2 Binomial Interest Rate Tree Year 0 Year 1 1 Year 2 A. 102.10340 on pau. B. 103.688% of par. C. 103.744% of par. 6. All else being equal, a rise in interest rates will most likely result the value of the option embedded in Bond #3: A. decreasing. B. remaining unchanged. C. increasing 7. All else being equal, if Ferguson assumes an interest rate volatility of 15% instead of 10%, the bond that would most likely increase in value is: A. Bond #1. B. Bond #2. C. Bond #3 8. All else being equal, if the shape of the yield curve changes from upward sloping to flat- 4.6470% 3.5930% % 2.5000% 3.8046% 2.9417% 3.1150%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts