Question: 4 points QUESTION 13 1. Management that wanted to increase the financial leverage of its firm would: A use excess cash to purchase preferred stock

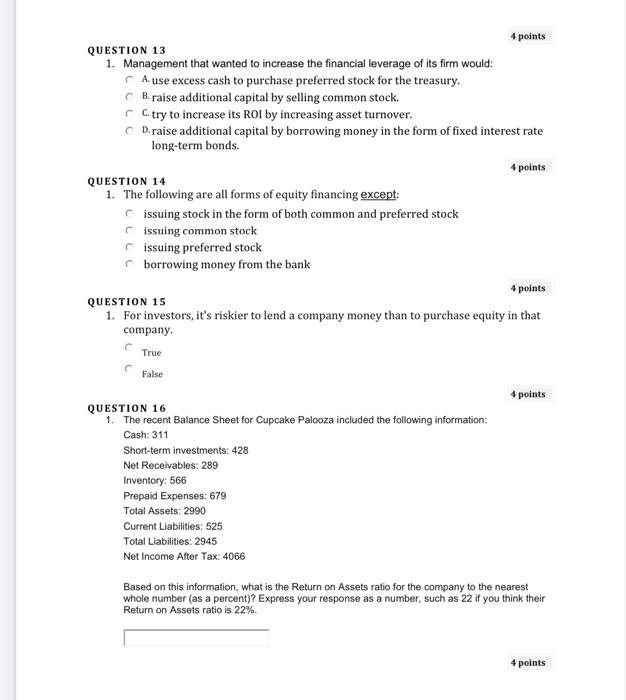

4 points QUESTION 13 1. Management that wanted to increase the financial leverage of its firm would: A use excess cash to purchase preferred stock for the treasury. B. raise additional capital by selling common stock. Ctry to increase its ROI by increasing asset turnover. D.raise additional capital by borrowing money in the form of fixed interest rate long-term bonds. 4 points QUESTION 14 1. The following are all forms of equity financing except: issuing stock in the form of both common and preferred stock issuing common stock issuing preferred stock borrowing money from the bank 4 points QUESTION 15 1. For investors, it's riskier to lend a company money than to purchase equity in that company. True False 4 points QUESTION 16 1. The recent Balance Sheet for Cupcake Palooza included the following information: Cash: 311 Short-term investments: 428 Net Receivables: 289 Inventory: 566 Prepaid Expenses: 679 Total Assets: 2990 Current Liabilities: 525 Total Liabilities: 2945 Net Income After Tax: 4066 Based on this information, what is the Return on Assets ratio for the company to the nearest whole number (as a percent)? Express your response as a number, such as 22 if you think their Return on Assets ratio is 22% 4 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts