Question: ? ?? ? ?? Use Worksheet 2.2. Robyn and Matthew Scott are about to construct their income and expense statement for the year ending December

? ??

??

? ??

??

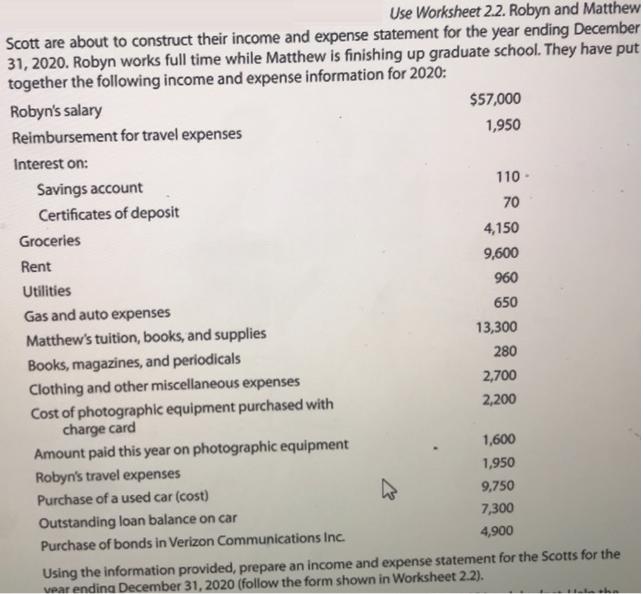

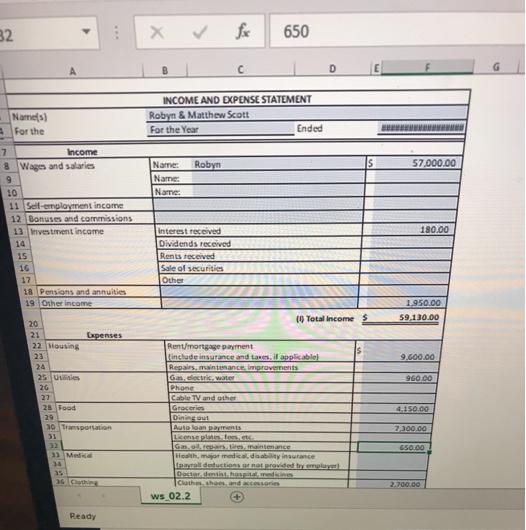

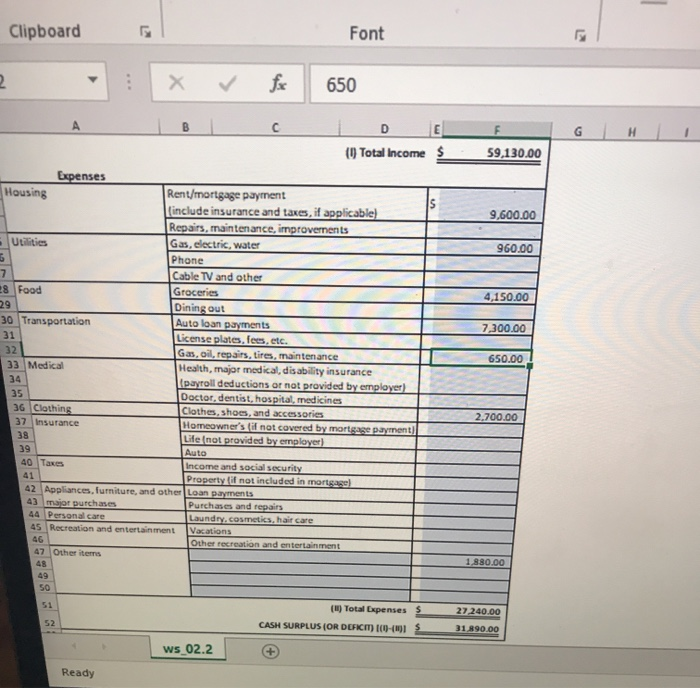

Use Worksheet 2.2. Robyn and Matthew Scott are about to construct their income and expense statement for the year ending December 31, 2020. Robyn works full time while Matthew is finishing up graduate school. They have put together the following income and expense information for 2020: Robyn's salary Reimbursement for travel expenses Interest on: Savings account Certificates of deposit Groceries Rent Utilities Gas and auto expenses Matthew's tuition, books, and supplies Books, magazines, and periodicals Clothing and other miscellaneous expenses Cost of photographic equipment purchased with charge card Amount paid this year on photographic equipment Robyn's travel expenses Purchase of a used car (cost) Outstanding loan balance on car Purchase of bonds in Verizon Communications Inc. $57,000 1,950 110- 70 4,150 9,600 960 650 13,300 280 2,700 2,200 1,600 1,950 9,750 7,300 4,900 Using the information provided, prepare an income and expense statement for the Scotts for the vear ending December 31, 2020 (follow the form shown in Worksheet 2.2). tha 32 4 Name(s) For the 7 Income 8 Wages and salaries 9 10 11 Self-employment income 12 Bonuses and commissions 13 Investment income 14 15 16 17 18 Pensions and annuities 19 Other income 20 21 22 Housing 23 24 25 Usiis 26 27 28 Food Expenses 29 30 Transportation 31 32 33 Medical 34 35 36 Clothing Ready X Name: Robyn Name: Name: INCOME AND EXPENSE STATEMENT Robyn & Matthew Scott For the Year Interest ceive Dividends received Rents received Sale of securities Other C Phone Cable TV and other 650 Groceries Dining out Auto loan payments fom Rent/mortgage payment include insurance and taxes, if applicable) Repairs, maintenance improvements Gas, electric, water se Ga, oil, repairs, tires, maintenance ws_02.2 Ended D (1) Total Income $ Health, major medical, disability insurance (payroll defustions or not provided by emplayer) Doctar, dentist, hospital, medicines Clothes, shoes, and accessories $ 3 S 57,000.00 180.00 1.950.00 59,130.00 9.600.00 960.00 4.150.00 7,300.00 650.00 2.700.00 2 Clipboard Housing Utilities 6 7 28 Food 29 30 Transportation 31 32 33 Medical 34 Expenses 49 50 51 52 : 5 Ready X 35 36 Clothing 37 Insurance 38 39 40 Taxes 41 42 Appliances, furniture, and other Loan payments 43 major purchases 44 Personal care 45 Recreation and entertainment 46 47 Other items 48 Phone Cable TV and other fx C Rent/mortgage payment (include insurance and taxes, if applicable) Repairs, maintenance, improvements Gas, electric, water ws_02.2 Font 650 Groceries Dining out Auto loan payments License plates, fees, etc. Gas, oil, repairs, tires, maintenance Health, major medical, disability insurance (payroll deductions or not provided by employer) Doctor, dentist, hospital, medicines Clothes, shoes, and accessories Homeowner's (if not covered by mortgage payment) Life (not provided by employer) Auto D (I) Total Income Purchases and repairs Laundry, cosmetics, hair care Vacations Other recreation and entertainment Income and social security Property (if not included in mortgage) (I) Total Expenses S CASH SURPLUS (OR DEFICIT) [(1)-(0)1 59,130.00 9,600.00 960.00 4,150.00 7,300.00 650.00 2,700.00 1,880.00 27,240.00 31,890.00 LA

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts