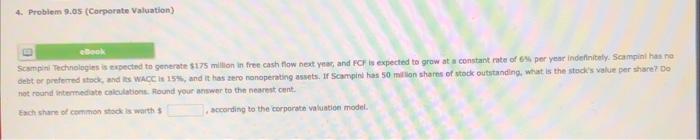

Question: 4. Problem 9.05 (Corporate Valuation) ebook Scampin Technologies is expected to generate $175 million in free cash flow next year, and FCF is expected to

4. Problem 9.05 (Corporate Valuation) ebook Scampin Technologies is expected to generate $175 million in free cash flow next year, and FCF is expected to grow at a constant rate of per year indefinitely. Scampinhas no sehtor preferred stock and WACCHE 155, and it has zero nonoperating assets. If Scampinhas 50 million shares of stock outstanding, what is the sto's value per share not round intermediate calculation Round your answer to the nearest cent Each share of common stock is worth $ according to the corporate valuation model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts