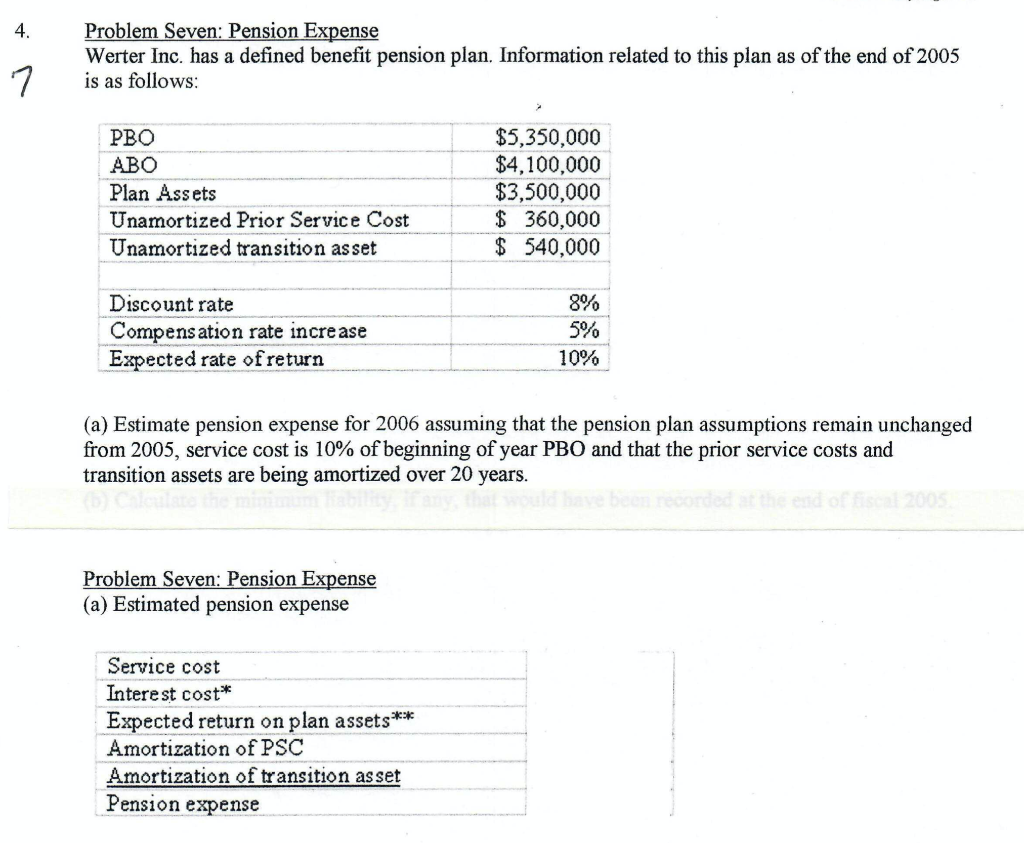

Question: 4. Problem Seven: Pension Expense Werter Inc. has a defined benefit pension plan. Information related to this plan as of the end of 2005 is

4. Problem Seven: Pension Expense Werter Inc. has a defined benefit pension plan. Information related to this plan as of the end of 2005 is as follows: 7 PBO ABO Plan Assets Unamortized Prior Service Cost Unamortized transition asset $5,350,000 $4,100,000 $3,500,000 $ 360,000 $ 540,000 Discount rate Compensation rate increase Expected rate of return 8% 5% 10% (a) Estimate pension expense for 2006 assuming that the pension plan assumptions remain unchanged from 2005, service cost is 10% of beginning of year PBO and that the prior service costs and transition assets are being amortized over 20 years. Problem Seven: Pension Expense (a) Estimated pension expense Service cost Interest cost* Expected return on plan assets** Amortization of PSC Amortization of transition as set Pension expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts