Question: 4 - Recommended Time Allocation: 55 Minutes, 21 Marks Tiger Limited is a manufacturer of high-powered computers. Tiger's computers are sold with a typical assurance-type

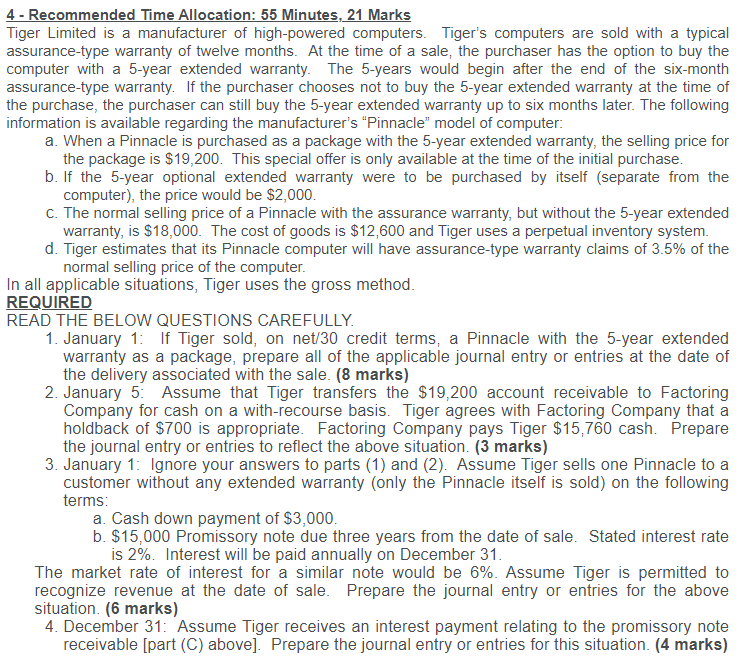

4 - Recommended Time Allocation: 55 Minutes, 21 Marks Tiger Limited is a manufacturer of high-powered computers. Tiger's computers are sold with a typical assurance-type warranty of twelve months. At the time of a sale, the purchaser has the option to buy the computer with a 5-year extended warranty. The 5-years would begin after the end of the six-month assurance-type warranty. If the purchaser chooses not to buy the 5-year extended warranty at the time of the purchase, the purchaser can still buy the 5-year extended warranty up to six months later. The following information is available regarding the manufacturer's "Pinnacle" model of computer: a. When a Pinnacle is purchased as a package with the 5-year extended warranty, the selling price for the package is $19,200. This special offer is only available at the time of the initial purchase. b. If the 5-year optional extended warranty were to be purchased by itself (separate from the computer), the price would be $2,000. C. The normal selling price of a Pinnacle with the assurance warranty, but without the 5-year extended warranty, is $18,000. The cost of goods is $12,600 and Tiger uses a perpetual inventory system. d. Tiger estimates that its Pinnacle computer will have assurance-type warranty claims of 3.5% of the normal selling price of the computer. In all applicable situations, Tiger uses the gross method. REQUIRED READ THE BELOW QUESTIONS CAREFULLY. 1. January 1: If Tiger sold, on net/30 credit terms, a Pinnacle with the 5-year extended warranty as a package, prepare all of the applicable journal entry or entries at the date of the delivery associated with the sale. (8 marks) 2. January 5. Assume that Tiger transfers the $19,200 account receivable to Factoring Company for cash on a with-recourse basis. Tiger agrees with Factoring Company that a holdback of $700 is appropriate. Factoring Company pays Tiger $15,760 cash. Prepare the journal entry or entries to reflect the above situation. (3 marks) 3. January 1: Ignore your answers to parts (1) and (2). Assume Tiger sells one Pinnacle to a customer without any extended warranty (only the Pinnacle itself is sold) on the following terms: a. Cash down payment of $3,000. b. $15,000 Promissory note due three years from the date of sale. Stated interest rate is 2%. Interest will be paid annually on December 31. The market rate of interest for a similar note would be 6%. Assume Tiger is permitted to recognize revenue at the date of sale. Prepare the journal entry or entries for the above situation. (6 marks) 4. December 31: Assume Tiger receives an interest payment relating to the promissory note receivable [part (C) above). Prepare the journal entry or entries for this situation. (4 marks) 4 - Recommended Time Allocation: 55 Minutes, 21 Marks Tiger Limited is a manufacturer of high-powered computers. Tiger's computers are sold with a typical assurance-type warranty of twelve months. At the time of a sale, the purchaser has the option to buy the computer with a 5-year extended warranty. The 5-years would begin after the end of the six-month assurance-type warranty. If the purchaser chooses not to buy the 5-year extended warranty at the time of the purchase, the purchaser can still buy the 5-year extended warranty up to six months later. The following information is available regarding the manufacturer's "Pinnacle" model of computer: a. When a Pinnacle is purchased as a package with the 5-year extended warranty, the selling price for the package is $19,200. This special offer is only available at the time of the initial purchase. b. If the 5-year optional extended warranty were to be purchased by itself (separate from the computer), the price would be $2,000. C. The normal selling price of a Pinnacle with the assurance warranty, but without the 5-year extended warranty, is $18,000. The cost of goods is $12,600 and Tiger uses a perpetual inventory system. d. Tiger estimates that its Pinnacle computer will have assurance-type warranty claims of 3.5% of the normal selling price of the computer. In all applicable situations, Tiger uses the gross method. REQUIRED READ THE BELOW QUESTIONS CAREFULLY. 1. January 1: If Tiger sold, on net/30 credit terms, a Pinnacle with the 5-year extended warranty as a package, prepare all of the applicable journal entry or entries at the date of the delivery associated with the sale. (8 marks) 2. January 5. Assume that Tiger transfers the $19,200 account receivable to Factoring Company for cash on a with-recourse basis. Tiger agrees with Factoring Company that a holdback of $700 is appropriate. Factoring Company pays Tiger $15,760 cash. Prepare the journal entry or entries to reflect the above situation. (3 marks) 3. January 1: Ignore your answers to parts (1) and (2). Assume Tiger sells one Pinnacle to a customer without any extended warranty (only the Pinnacle itself is sold) on the following terms: a. Cash down payment of $3,000. b. $15,000 Promissory note due three years from the date of sale. Stated interest rate is 2%. Interest will be paid annually on December 31. The market rate of interest for a similar note would be 6%. Assume Tiger is permitted to recognize revenue at the date of sale. Prepare the journal entry or entries for the above situation. (6 marks) 4. December 31: Assume Tiger receives an interest payment relating to the promissory note receivable [part (C) above). Prepare the journal entry or entries for this situation. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts