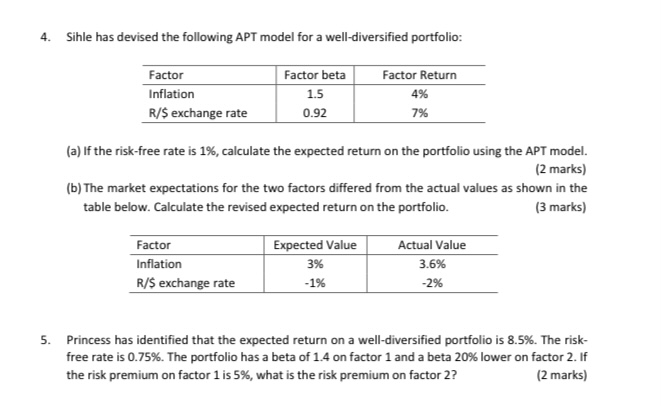

Question: 4. Sihle has devised the following APT model for a well-diversified portfolio: Factor Factor beta Factor Return Inflation 1.5 4% R/$ exchange rate 0.92 7%

4. Sihle has devised the following APT model for a well-diversified portfolio: Factor Factor beta Factor Return Inflation 1.5 4% R/$ exchange rate 0.92 7% (a) If the risk-free rate is 1%, calculate the expected return on the portfolio using the APT model. (2 marks) (b) The market expectations for the two factors differed from the actual values as shown in the table below. Calculate the revised expected return on the portfolio. (3 marks) Factor Expected Value Actual Value Inflation 3% 3.6% R/$ exchange rate -1% -2% 5. Princess has identified that the expected return on a well-diversified portfolio is 8.5%. The risk- free rate is 0.75%. The portfolio has a beta of 1.4 on factor 1 and a beta 20% lower on factor 2. If the risk premium on factor 1 is 5%, what is the risk premium on factor 2? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts