Question: 4. Small questions (25 points): 1) A call option on euros is written with a strike price of $1.20/euro. Which spot price maximizes your profit

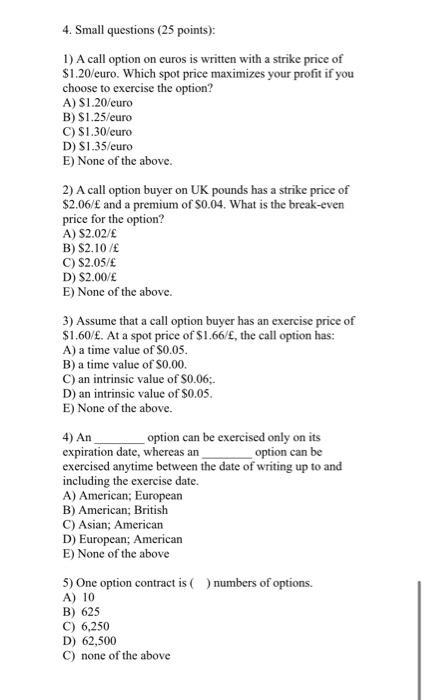

4. Small questions (25 points): 1) A call option on euros is written with a strike price of $1.20/euro. Which spot price maximizes your profit if you choose to exercise the option? A) $1.20/euro B) $1.25/euro C) $1.30/euro D) $1.35/euro E) None of the above. 2) A call option buyer on UK pounds has a strike price of $2.06/ and a premium of $0.04. What is the break-even price for the option? A) S2.02/ B) $2.10/ C) $2.05/ D) S2.00/ E) None of the above. 3) Assume that a call option buyer has an exercise price of $1.60/. At a spot price of $1.66/, the call option has: A) a time value of 0.05. B) a time value of $0.00. C) an intrinsic value of $0.06;. D) an intrinsic value of $0.05. E) None of the above. 4) An option can be exercised only on its expiration date, whereas an option can be exercised anytime between the date of writing up to and including the exercise date. A) American; European B) American; British C) Asian; American D) European; American E) None of the above 5) One option contract is ( ) numbers of options. A) 10 B) 625 C) 6,250 D) 62,500 C) none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts