Question: No data is needed for solving this question. Q6 Use the prepaid forward contract to prove the put-call parity formula for the case of underlying

No data is needed for solving this question.

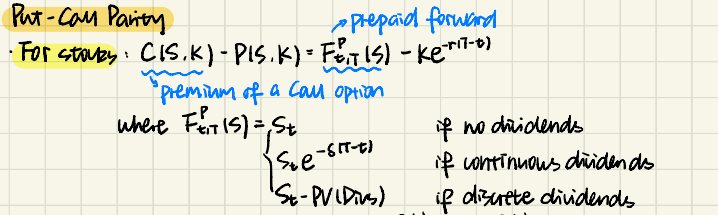

Q6 Use the prepaid forward contract to prove the put-call parity formula for the case of underlying stock paying propotional dividends. Put-Can Party prepaid forward For stovky. CIS.K)-PIS.K) - FEITIS) - Kemi-o) "Premium of a can option where Fertis) St if no dividends if continuous dividends St-PriDins) if dizuete dividends Ste-sitt Q6 Use the prepaid forward contract to prove the put-call parity formula for the case of underlying stock paying propotional dividends. Put-Can Party prepaid forward For stovky. CIS.K)-PIS.K) - FEITIS) - Kemi-o) "Premium of a can option where Fertis) St if no dividends if continuous dividends St-PriDins) if dizuete dividends Ste-sitt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts