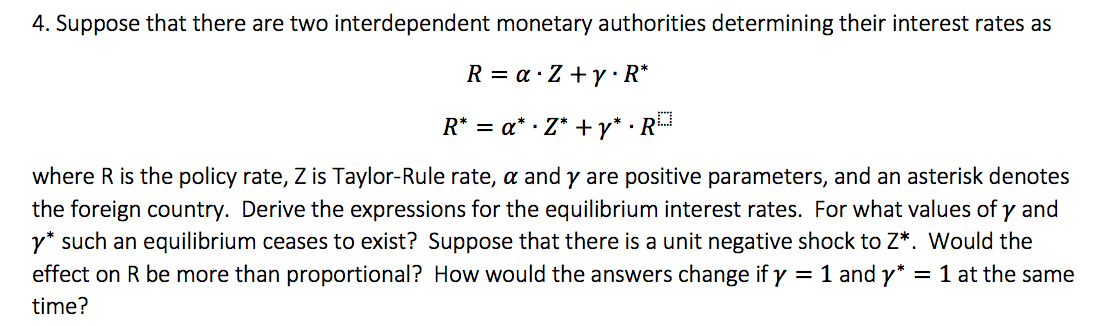

Question: 4. Suppose that there are two interdependent monetary authorities determining their interest rates as R = a.Z+y:R* R* = a* Z* +y*.R. where R is

4. Suppose that there are two interdependent monetary authorities determining their interest rates as R = a.Z+y:R* R* = a* Z* +y*.R. where R is the policy rate, Z is Taylor-Rule rate, a and y are positive parameters, and an asterisk denotes the foreign country. Derive the expressions for the equilibrium interest rates. For what values of y and y* such an equilibrium ceases to exist? Suppose that there is a unit negative shock to Z*. Would the effect on R be more than proportional? How would the answers change if y = 1 and y* = 1 at the same time? 4. Suppose that there are two interdependent monetary authorities determining their interest rates as R = a.Z+y:R* R* = a* Z* +y*.R. where R is the policy rate, Z is Taylor-Rule rate, a and y are positive parameters, and an asterisk denotes the foreign country. Derive the expressions for the equilibrium interest rates. For what values of y and y* such an equilibrium ceases to exist? Suppose that there is a unit negative shock to Z*. Would the effect on R be more than proportional? How would the answers change if y = 1 and y* = 1 at the same time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts