Question: Section 3: Calculation for Budget Planning and Forecasting Budget calculations for planning and forecasting of Labour Expenses The Vice President of HR asked you to

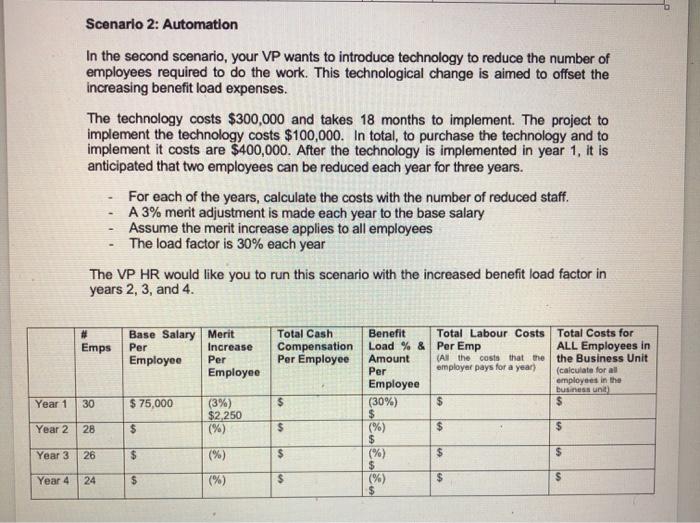

Section 3: Calculation for Budget Planning and Forecasting Budget calculations for planning and forecasting of Labour Expenses The Vice President of HR asked you to run two scenarios. The two scenarios are below. First, calculate the budget plan and forecast based on the information provided. Then answer the questions that follow the calculations for both scenario 1 and 2. General Information The business unit has one type of role; data analyst. There are currently: 30 employees in the data analyst position in the unit . the average base salary per employee is $ 75,000 . a merit bonus of 3% is paid and is applied to base salary annually (include in year 1) currently the benefit load (for allowances, insurances, pension) is 25% (calculate this amount based on the "Total Case Compensation" for the year you are working in) . There are no relational returns in terms of direct monetary expenses at present The Vice President of HR has completed a consultation exercise with the providers of employee benefit services. She has run a number of scenarios and based on the information she now knows that benefits will increase from a load factor of 25% per employee annually to 30%. As a result, she has been asked to consider ways to maintain or decrease the current cost structure for this business unit. She is working with the manager of the business unit to generate different ways to achieve this goal. Scenario 2: Automation In the second scenario, your VP wants to introduce technology to reduce the number of employees required to do the work. This technological change is aimed to offset the increasing benefit load expenses. The technology costs $300,000 and takes 18 months to implement. The project to implement the technology costs $100,000. In total, to purchase the technology and to implement it costs are $400,000. After the technology is implemented in year 1, it is anticipated that two employees can be reduced each year for three years. For each of the years, calculate the costs with the number of reduced staff. A 3% merit adjustment is made each year to the base salary Assume the merit increase applies to all employees The load factor is 30% each year The VP HR would like you to run this scenario with the increased benefit load factor in years 2, 3, and 4. Emps Base Salary Merit Per Increase Employee Per Employee Year 1 30 $ 75,000 (3%) $2,250 (%) Total Cash Benefit Total Labour Costs Total Costs for Compensation Load % & Per Emp ALL Employees in Per Employee Amount (All the costs that the the Business Unit Per employer pays for a year) (calculate for all Employee employees in the business unit) $ (30%) $ $ $ $ (%) $ $ $ $ (%) $ $ $ (%) $ $ $ Year 2 28 $ Year 3 26 $ Year 4 24 $ (%) lon Section 3: Calculation for Budget Planning and Forecasting Budget calculations for planning and forecasting of Labour Expenses The Vice President of HR asked you to run two scenarios. The two scenarios are below. First, calculate the budget plan and forecast based on the information provided. Then answer the questions that follow the calculations for both scenario 1 and 2. General Information The business unit has one type of role; data analyst. There are currently: 30 employees in the data analyst position in the unit . the average base salary per employee is $ 75,000 . a merit bonus of 3% is paid and is applied to base salary annually (include in year 1) currently the benefit load (for allowances, insurances, pension) is 25% (calculate this amount based on the "Total Case Compensation" for the year you are working in) . There are no relational returns in terms of direct monetary expenses at present The Vice President of HR has completed a consultation exercise with the providers of employee benefit services. She has run a number of scenarios and based on the information she now knows that benefits will increase from a load factor of 25% per employee annually to 30%. As a result, she has been asked to consider ways to maintain or decrease the current cost structure for this business unit. She is working with the manager of the business unit to generate different ways to achieve this goal. Scenario 2: Automation In the second scenario, your VP wants to introduce technology to reduce the number of employees required to do the work. This technological change is aimed to offset the increasing benefit load expenses. The technology costs $300,000 and takes 18 months to implement. The project to implement the technology costs $100,000. In total, to purchase the technology and to implement it costs are $400,000. After the technology is implemented in year 1, it is anticipated that two employees can be reduced each year for three years. For each of the years, calculate the costs with the number of reduced staff. A 3% merit adjustment is made each year to the base salary Assume the merit increase applies to all employees The load factor is 30% each year The VP HR would like you to run this scenario with the increased benefit load factor in years 2, 3, and 4. Emps Base Salary Merit Per Increase Employee Per Employee Year 1 30 $ 75,000 (3%) $2,250 (%) Total Cash Benefit Total Labour Costs Total Costs for Compensation Load % & Per Emp ALL Employees in Per Employee Amount (All the costs that the the Business Unit Per employer pays for a year) (calculate for all Employee employees in the business unit) $ (30%) $ $ $ $ (%) $ $ $ $ (%) $ $ $ (%) $ $ $ Year 2 28 $ Year 3 26 $ Year 4 24 $ (%) lon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts