Question: 4. Suppose you decide to immunize against this liability using g, bonds of type B and q, bonds of type D. Bonds of type I

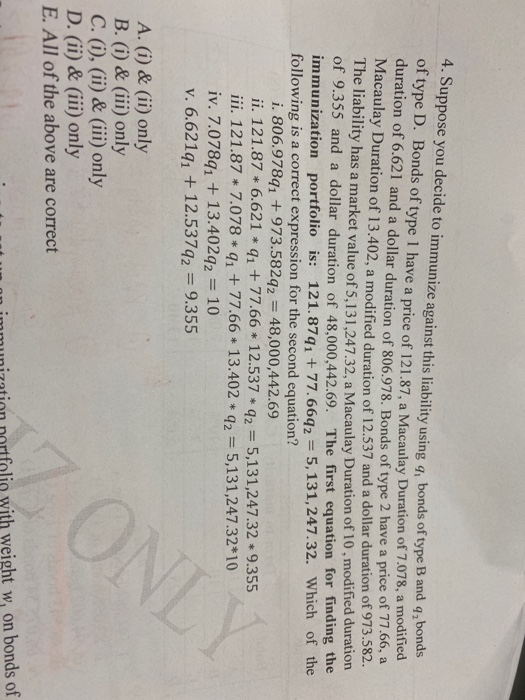

4. Suppose you decide to immunize against this liability using g, bonds of type B and q, bonds of type D. Bonds of type I have a price of 121.87, a Macaulay Duration of 7.078, a modified duration of 6.621 and a dollar duration of 806.978. Bonds of type 2 have a price of 77.66, a Macaulay Duration of 13.402, a modified duration of 12.537 and a dollar duration of 973.582. The liability has a market value of 5,131,247.32, a Macaulay Duration of 10, modified duration of 9.355 and a dollar duration of 48,000,442.69. The first equation for finding the immunization portfolio is: 121.87q1 + 77.66q2 = 5,131,247.32. Which of the following is a correct expression for the second equation? i. 806.97891 +973.582q2 = 48,000,442.69 ii. 121.87 * 6.621 * 91 + 77.66 * 12.537 * 92 = 5,131,247.32 * 9.355 iii. 121.87 * 7.078 * 41 + 77.66 * 13.402 * 92 = 5,131,247.32*10 iv. 7.078q1 + 13.40292 = 10 v. 6.6219 + 12.53792 = 9.355 ONLY A. (i) & (ii) only B. (i) & (iii) only C. (i), (ii) & (iii) only D. (ii) & (iii) only E. All of the above are correct with weight w, on bonds of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts