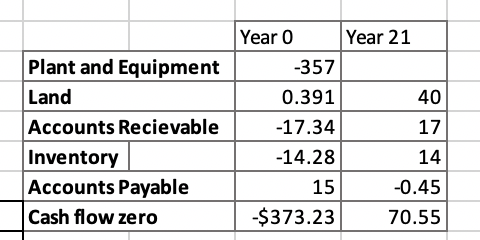

Question: 4. The CFO is particularly concerned about the potential impact of future tax increases and that the expenses may have been systematically understated. In order

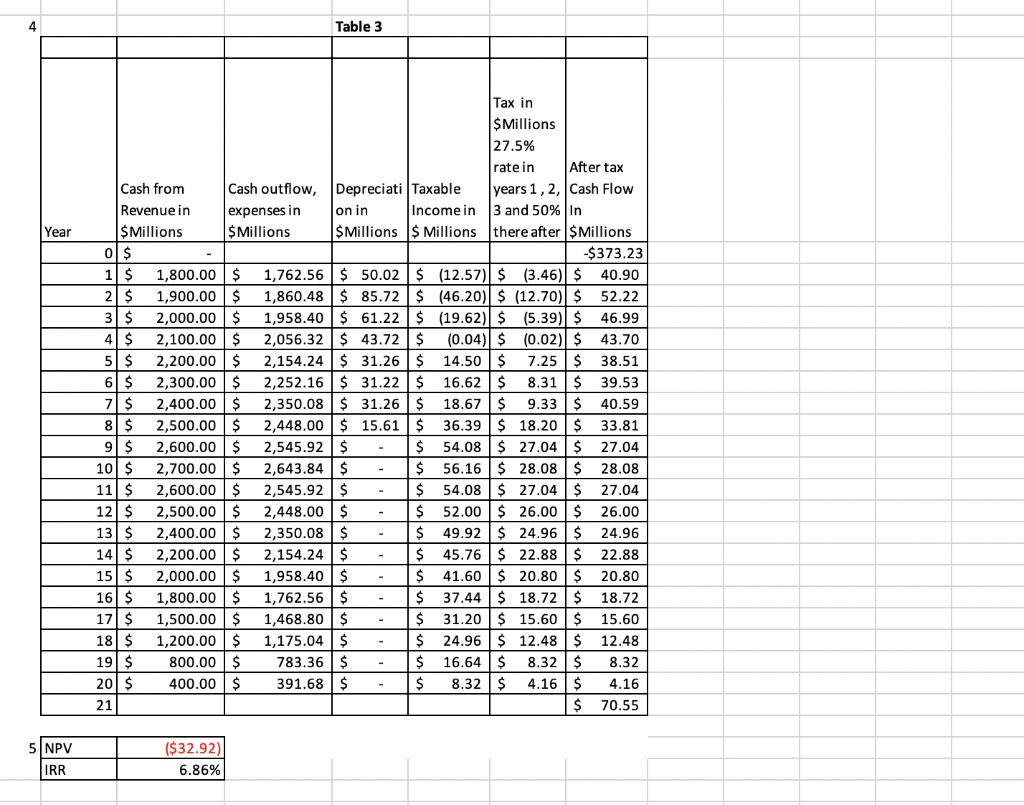

4. The CFO is particularly concerned about the potential impact of future tax increases and that the expenses may have been systematically understated. In order to undertake an objective evaluation of the project's risk, she asks you to prepare a second analysis with a less favorable set of assumptions. She asks, "What would happen to the NPV and IRR calculations if the cash outflow for expenses comes in 2% higher than estimated for the entire life of the project and if the tax rate increases to 50% (combined Federal and Maryland state rates) starting in year 4?" Create an after-tax cash flow timeline for the proposed factory with these new assumptions in Table 3 below.

Details of McCormick Plant Proposal

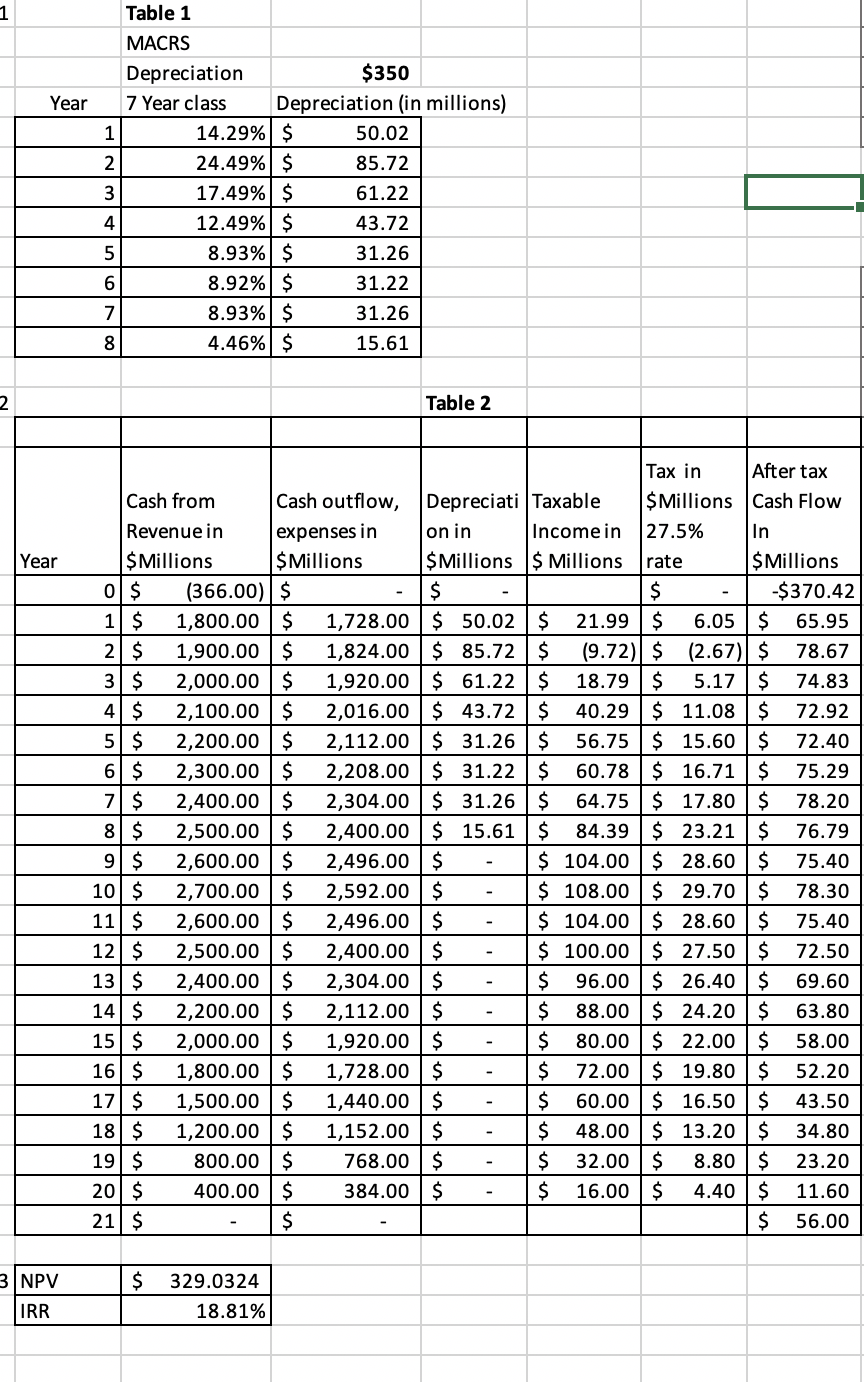

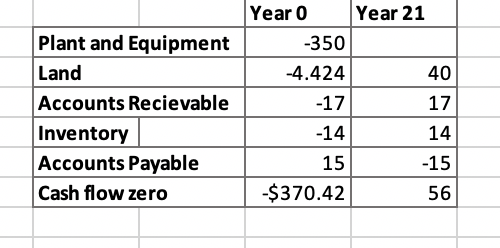

As you know from Project 4, McCormick & Company is considering building a new factory in Largo, Maryland. McCormick & Company decided to offer $4,424,000 to obtain the land for this project. The new factory will require an initial investment of $350 million to build the new plant and purchase equipment.

You have been asked to continue your work from project 4 with a full analysis of the proposed factory, including the start-up costs, the projected net cash flows from operations, the tax impact of depreciation, and the cash flow impacts of changes in working capital.

The investment will be depreciated as a modified accelerated cost recovery system (MACRS) seven-year class asset. The correct depreciation table is included below.

The company will need to finance some of the cash to fund $17 million in accounts receivable and $14 million in Inventory starting at year zero. The company expects vendors to give free credit on purchases of $15 million (accounts payable). The CFO wants you to consider the net cash outflows for working capital as well as the cash outflows for the plant, equipment, and land in year zero.

Note: The $17 million for accounts receivable and the $14 million for Inventory are cash outflows. The $15 million for accounts payable is a cash inflow.

The CFO has indicated that this net working capital will be recovered as a cash inflow in year 21. She also estimates that the company will be able to sell the factory, equipment, and land in year 21 for $40 million.

The company estimates that the cash flows from operations will be as shown in Table 2. Note: Only the cash flows related to operations (years 1-20) will generate accounting profits and thus taxable income (or losses).

Use the WACC that you recommended in question 5 of the Cost of Capital tab for the discount rate.

****

Tables 1 & 2

Year o Year 21 Plant and Equipment -357 Land 0.391 40 Accounts Recievable -17.34 17 Inventory -14.28 Accounts Payable 15 -0.45 Cash flow zero $373.23 70.55 14 Table 3 Year Tax in $ Millions 27.5% rate in After tax Cash from Cash outflow, Depreciati Taxable years 1, 2, Cash Flow Revenue in expenses in on in Income in 3 and 50% In $Millions $ Millions $ Millions $ Millions there after Millions 0$ $373.23 1 1,800.00 $ 1,762.56 $ 50.02 $ (12.57) $ (3.46) $ 40.90 2 $ 1,900.00 $ 1,860.48 $ 85.72 $ (46.20) $ (12.70) $ 52.22 3 2,000.00 $ 1,958.40 $ 61.22 $ (19.62) $ (5.39) $ 46.99 4 2,100.00 $ 2,056.32 $ 43.72 $ (0.04) $ (0.02) $ 43.70 50 $ 2,200.00 $ 2,154.24 $ 31.26 $ 14.50 $ 7.25$ 38.51 6 2,300.00 $ 2,252.16 $ 31.22 $ 16.62 8.31 $ 39.53 71 $ 2,400.00 $ 2,350.08 $ 31.26 $ 18.67$ 9.33 $ 40.59 8 $ 2,500.00 $ 2,448.00 $ 15.61 $ 36.39 $ 18.20 $ 33.81 9 $ 2,600.00 $ 2,545.92 $ $ 54.08 $ 27.04 $ 27.04 10 $ 2,700.00 $ 2,643.84 $ $ 56.16 $ 28.08$ 28.08 11 $ 2,600.00 $ 2,545.92 $ $ 54.08 $ 27.04 $ 27.04 121 $ 2,500.00 $ 2,448.00 $ $ 52.00 $ 26.00 $ 26.00 13 $ 2,400.00 $ 2,350.08$ $ 49.92 $ 24.96 $ 24.96 14 $ 2,200.00 $ 2,154.24 $ $ 45.76 $ 22.88 $ 22.88 151 $ 2,000.00 $ 1,958.40 $ $ 41.60 $ 20.80 $ 20.80 16 $ 1,800.00 $ 1,762.56 $ $ 37.44 $ 18.72 $ 18.72 171 $ 1,500.00 $ 1,468.80 $ $ 31.20 $ 15.60 $ 15.60 18$ 1,200.00 $ 1,175.04 $ $ 24.96 $ 12.48$ 12.48 19 $ 800.00 $ 783.36 $ $ 16.64 $ 8.32$ 8.32 201$ 400.00 $ 391.68 $ $ 8.32 $ 4.16 $ 4.16 21 S 70.55 - NPV IRR ($32.92) 6.86% 1 Table 1 Year MACRS Depreciation $350 7 Year class Depreciation (in millions) 1 14.29% $ 50.02 2. 24.49% $ 85.72 3 17.49% $ 61.22 4 12.49% $ 43.72 5 8.93% $ 31.26 6 8.92% $ 31.22 7 8.93% $ 31.26 8 4.46% $ 15.61 2 Table 2 Year Tax in After tax Cash from Cash outflow, Depreciati Taxable $ Millions Cash Flow Revenue in expenses in on in Income in 27.5% In $ Millions $ Millions $ Millions $ Millions rate $ Millions 0$ (366.00) $ $ $ -$370.42 1 $ 1,800.00 $ 1,728.00 $ 50.02 $ 21.99 $ 6.05 $ 65.95 2 $ 1,900.00 $ 1,824.00 $ 85.72 $ (9.72) $ (2.67) $ 78.67 3 $ 2,000.00 $ 1,920.00 $ 61.22 $ 18.79$ 5.17 $ 74.83 4 $ 2,100.00 $ 2,016.00 $ 43.72 $ 40.29 $ 11.08 $ 72.92 5 $ 2,200.00 $ 2,112.00 $ 31.26 $ 56.75 $ 15.60 $ 72.40 6 $ 2,300.00 $ 2,208.00$ 31.22 $ 60.78 $ 16.71 $ 75.29 7 $ 2,400.00 $ 2,304.00 $ 31.26 $ 64.75 $ 17.80 $ 78.20 8 $ 2,500.00 $ 2,400.00 $ 15.61 $ 84.39 $ 23.21 $ 76.79 9 $ 2,600.00 $ 2,496.00 $ $ 104.00 $ 28.60 $ 75.40 10 $ 2,700.00 $ 2,592.00 $ $ 108.00 $ 29.70 $ 78.30 11 $ 2,600.00 $ 2,496.00 $ $ 104.00 $ 28.60 $ 75.40 12 $ 2,500.00 $ 2,400.00 $ $ 100.00 $ 27.50 $ 72.50 13 $ 2,400.00 $ 2,304.00 $ $ 96.00 $ 26.40$ 69.60 14 $ 2,200.00 $ 2,112.00$ $ 88.00 $ 24.20 $ 63.80 15$ 2,000.00 $ 1,920.00 $ $ 80.00 $ 22.00 58.00 16 $ 1,800.00 $ 1,728.00 $ $ 72.00 $ 19.80 $ 52.20 17 $ 1,500.00 $ 1,440.00 $ $ 60.00 $ 16.50 $ 43.50 18 $ 1,200.00 $ 1,152.00 $ $ 48.00 $ 13.20 $ 34.80 19 $ 800.00 $ 768.00 $ $ 32.00 $ 8.80 $ 23.20 201$ 400.00 $ 384.00 $ $ 16.00 $ 4.40 $ 11.60 21 $ $ $ 56.00 $ 3 NPV IRR 329.0324 18.81% Plant and Equipment Land Accounts Recievable Inventory Accounts Payable Cash flow zero Year o Year 21 -350 -4.424 40 -17 17 -14 14 15 -15 -$370.42 56 Year o Year 21 Plant and Equipment -357 Land 0.391 40 Accounts Recievable -17.34 17 Inventory -14.28 Accounts Payable 15 -0.45 Cash flow zero $373.23 70.55 14 Table 3 Year Tax in $ Millions 27.5% rate in After tax Cash from Cash outflow, Depreciati Taxable years 1, 2, Cash Flow Revenue in expenses in on in Income in 3 and 50% In $Millions $ Millions $ Millions $ Millions there after Millions 0$ $373.23 1 1,800.00 $ 1,762.56 $ 50.02 $ (12.57) $ (3.46) $ 40.90 2 $ 1,900.00 $ 1,860.48 $ 85.72 $ (46.20) $ (12.70) $ 52.22 3 2,000.00 $ 1,958.40 $ 61.22 $ (19.62) $ (5.39) $ 46.99 4 2,100.00 $ 2,056.32 $ 43.72 $ (0.04) $ (0.02) $ 43.70 50 $ 2,200.00 $ 2,154.24 $ 31.26 $ 14.50 $ 7.25$ 38.51 6 2,300.00 $ 2,252.16 $ 31.22 $ 16.62 8.31 $ 39.53 71 $ 2,400.00 $ 2,350.08 $ 31.26 $ 18.67$ 9.33 $ 40.59 8 $ 2,500.00 $ 2,448.00 $ 15.61 $ 36.39 $ 18.20 $ 33.81 9 $ 2,600.00 $ 2,545.92 $ $ 54.08 $ 27.04 $ 27.04 10 $ 2,700.00 $ 2,643.84 $ $ 56.16 $ 28.08$ 28.08 11 $ 2,600.00 $ 2,545.92 $ $ 54.08 $ 27.04 $ 27.04 121 $ 2,500.00 $ 2,448.00 $ $ 52.00 $ 26.00 $ 26.00 13 $ 2,400.00 $ 2,350.08$ $ 49.92 $ 24.96 $ 24.96 14 $ 2,200.00 $ 2,154.24 $ $ 45.76 $ 22.88 $ 22.88 151 $ 2,000.00 $ 1,958.40 $ $ 41.60 $ 20.80 $ 20.80 16 $ 1,800.00 $ 1,762.56 $ $ 37.44 $ 18.72 $ 18.72 171 $ 1,500.00 $ 1,468.80 $ $ 31.20 $ 15.60 $ 15.60 18$ 1,200.00 $ 1,175.04 $ $ 24.96 $ 12.48$ 12.48 19 $ 800.00 $ 783.36 $ $ 16.64 $ 8.32$ 8.32 201$ 400.00 $ 391.68 $ $ 8.32 $ 4.16 $ 4.16 21 S 70.55 - NPV IRR ($32.92) 6.86% 1 Table 1 Year MACRS Depreciation $350 7 Year class Depreciation (in millions) 1 14.29% $ 50.02 2. 24.49% $ 85.72 3 17.49% $ 61.22 4 12.49% $ 43.72 5 8.93% $ 31.26 6 8.92% $ 31.22 7 8.93% $ 31.26 8 4.46% $ 15.61 2 Table 2 Year Tax in After tax Cash from Cash outflow, Depreciati Taxable $ Millions Cash Flow Revenue in expenses in on in Income in 27.5% In $ Millions $ Millions $ Millions $ Millions rate $ Millions 0$ (366.00) $ $ $ -$370.42 1 $ 1,800.00 $ 1,728.00 $ 50.02 $ 21.99 $ 6.05 $ 65.95 2 $ 1,900.00 $ 1,824.00 $ 85.72 $ (9.72) $ (2.67) $ 78.67 3 $ 2,000.00 $ 1,920.00 $ 61.22 $ 18.79$ 5.17 $ 74.83 4 $ 2,100.00 $ 2,016.00 $ 43.72 $ 40.29 $ 11.08 $ 72.92 5 $ 2,200.00 $ 2,112.00 $ 31.26 $ 56.75 $ 15.60 $ 72.40 6 $ 2,300.00 $ 2,208.00$ 31.22 $ 60.78 $ 16.71 $ 75.29 7 $ 2,400.00 $ 2,304.00 $ 31.26 $ 64.75 $ 17.80 $ 78.20 8 $ 2,500.00 $ 2,400.00 $ 15.61 $ 84.39 $ 23.21 $ 76.79 9 $ 2,600.00 $ 2,496.00 $ $ 104.00 $ 28.60 $ 75.40 10 $ 2,700.00 $ 2,592.00 $ $ 108.00 $ 29.70 $ 78.30 11 $ 2,600.00 $ 2,496.00 $ $ 104.00 $ 28.60 $ 75.40 12 $ 2,500.00 $ 2,400.00 $ $ 100.00 $ 27.50 $ 72.50 13 $ 2,400.00 $ 2,304.00 $ $ 96.00 $ 26.40$ 69.60 14 $ 2,200.00 $ 2,112.00$ $ 88.00 $ 24.20 $ 63.80 15$ 2,000.00 $ 1,920.00 $ $ 80.00 $ 22.00 58.00 16 $ 1,800.00 $ 1,728.00 $ $ 72.00 $ 19.80 $ 52.20 17 $ 1,500.00 $ 1,440.00 $ $ 60.00 $ 16.50 $ 43.50 18 $ 1,200.00 $ 1,152.00 $ $ 48.00 $ 13.20 $ 34.80 19 $ 800.00 $ 768.00 $ $ 32.00 $ 8.80 $ 23.20 201$ 400.00 $ 384.00 $ $ 16.00 $ 4.40 $ 11.60 21 $ $ $ 56.00 $ 3 NPV IRR 329.0324 18.81% Plant and Equipment Land Accounts Recievable Inventory Accounts Payable Cash flow zero Year o Year 21 -350 -4.424 40 -17 17 -14 14 15 -15 -$370.42 56

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts