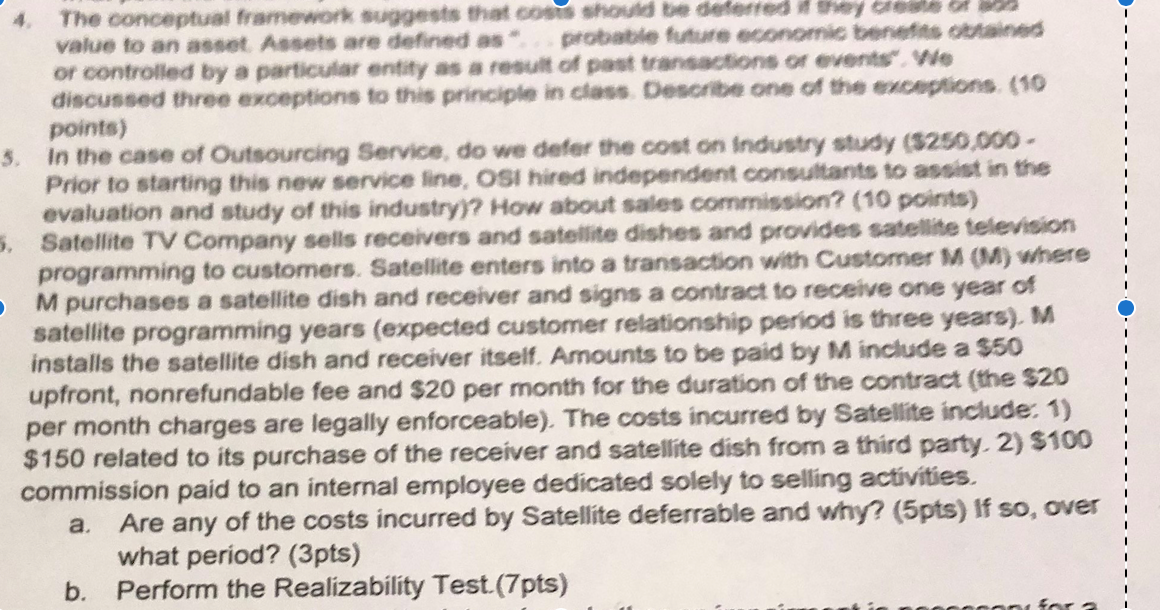

Question: 4. The conceptual framework suggests that costs should be deferred they c n value to an asset Assets are defined as probable future economic benefits

4. The conceptual framework suggests that costs should be deferred they c n value to an asset Assets are defined as probable future economic benefits obtained or controlled by a particular entity as a result of past transactions of events We discussed three exceptions to this principle in class Describe one of the exceptions (10 points) In the case of Outsourcing Service, do we defer the cost on Industry study ($250.000 Prior to starting this new service line, OSI hired independent consultants to assist in the evaluation and study of this industry)? How about sales commission? (10 points) Satellite TV Company sells receivers and satellite dishes and provides satellite television programming to customers. Satellite enters into a transaction with Customer M (M) where M purchases a satellite dish and receiver and signs a contract to receive one year of satellite programming years (expected customer relationship period is three years). M installs the satellite dish and receiver itself. Amounts to be paid by M include a $50 upfront, nonrefundable fee and $20 per month for the duration of the contract (the $20 per month charges are legally enforceable). The costs incurred by Satellite include: 1) $150 related to its purchase of the receiver and satellite dish from a third party. 2) $100 commission paid to an internal employee dedicated solely to selling activities a. Are any of the costs incurred by Satellite deferrable and why? (5pts) If so, over! what period? (3pts) b. Perform the Realizability Test.(7pts) 4. The conceptual framework suggests that costs should be deferred they c n value to an asset Assets are defined as probable future economic benefits obtained or controlled by a particular entity as a result of past transactions of events We discussed three exceptions to this principle in class Describe one of the exceptions (10 points) In the case of Outsourcing Service, do we defer the cost on Industry study ($250.000 Prior to starting this new service line, OSI hired independent consultants to assist in the evaluation and study of this industry)? How about sales commission? (10 points) Satellite TV Company sells receivers and satellite dishes and provides satellite television programming to customers. Satellite enters into a transaction with Customer M (M) where M purchases a satellite dish and receiver and signs a contract to receive one year of satellite programming years (expected customer relationship period is three years). M installs the satellite dish and receiver itself. Amounts to be paid by M include a $50 upfront, nonrefundable fee and $20 per month for the duration of the contract (the $20 per month charges are legally enforceable). The costs incurred by Satellite include: 1) $150 related to its purchase of the receiver and satellite dish from a third party. 2) $100 commission paid to an internal employee dedicated solely to selling activities a. Are any of the costs incurred by Satellite deferrable and why? (5pts) If so, over! what period? (3pts) b. Perform the Realizability Test.(7pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts