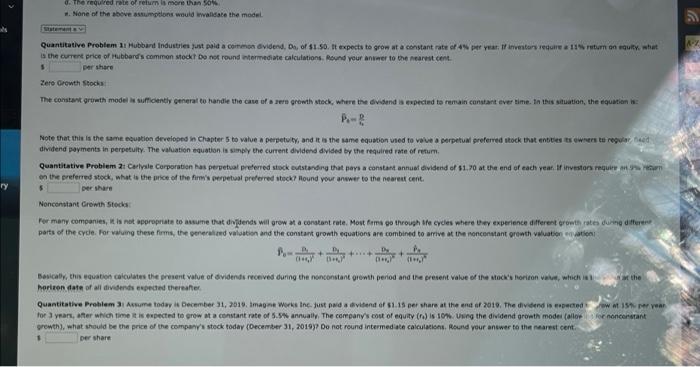

Question: 4. The required to return is more than so . None of the above sumption would inwalidate the model Quantitative Problem 11 Hubbard Industries just

4. The required to return is more than so . None of the above sumption would inwalidate the model Quantitative Problem 11 Hubbard Industries just paid a common dvidend, De, of $1.50. It expects to grow at a constant rate of year I investors require a 11 um on wout what is the current price of Hubbard's common stockt Do not round ormediate calculations. Round your answer to the nearest.cent per share 1 Zero Growth Stock The constant growth model w ucently generat to handle the case of a ver growth stock, where the vidend is expected to remain constant over time. In the situation, the equation : PB Note that this is the same ecuation developed an Chapter 5 to vale a perpetuky, and the same equation used to vee perpetua preferred stock that entitles towers to regulated dividend payments in perpetuity. The valuation equation is simply the current dividend divided by the required rate of return Quantitative Problem 21 Carlyle Corporation has perpetual preferred stock outstanding that per a constant annut vidend et 81.0 at the end of each year. It investors requiremen on the preferred stock, what is the price of the firm's perpetual preferred stock? Hound your answer to the nearest cent TY Der share Nonconstant Growth Stock For many companies, it is not appropriate to assume that didends will grow a constant rate. Most fema go through the cycles where they experience different crowth rates during different parts of the code. For aung these firms, the venerated valtion and the constant growth equations are combined to arrive at the nonconstant growth luation nation B- + + Basically, this equation calculates the present value of Gvidends received during the nonconstant growth period and the present Value of the stocks horien art, which the horizon date of all dividends expected thereafter Quantitative Problem Assume today December 31, 2019. Imagine works Inc. Just nude vident of $1.15 per share at the end of 2010. The dividend is spected151 year for nars, after which time is expected to grow at a constant rate of 5.5annually. The company's cost of equity () is 10%. Ung the dividend growth model (alloprononceratant growth, what should be the price of the company's stock today (December 31, 2019? Do not round intermediate calculations. Round your answer to the nearest cent per share 4. The required to return is more than so . None of the above sumption would inwalidate the model Quantitative Problem 11 Hubbard Industries just paid a common dvidend, De, of $1.50. It expects to grow at a constant rate of year I investors require a 11 um on wout what is the current price of Hubbard's common stockt Do not round ormediate calculations. Round your answer to the nearest.cent per share 1 Zero Growth Stock The constant growth model w ucently generat to handle the case of a ver growth stock, where the vidend is expected to remain constant over time. In the situation, the equation : PB Note that this is the same ecuation developed an Chapter 5 to vale a perpetuky, and the same equation used to vee perpetua preferred stock that entitles towers to regulated dividend payments in perpetuity. The valuation equation is simply the current dividend divided by the required rate of return Quantitative Problem 21 Carlyle Corporation has perpetual preferred stock outstanding that per a constant annut vidend et 81.0 at the end of each year. It investors requiremen on the preferred stock, what is the price of the firm's perpetual preferred stock? Hound your answer to the nearest cent TY Der share Nonconstant Growth Stock For many companies, it is not appropriate to assume that didends will grow a constant rate. Most fema go through the cycles where they experience different crowth rates during different parts of the code. For aung these firms, the venerated valtion and the constant growth equations are combined to arrive at the nonconstant growth luation nation B- + + Basically, this equation calculates the present value of Gvidends received during the nonconstant growth period and the present Value of the stocks horien art, which the horizon date of all dividends expected thereafter Quantitative Problem Assume today December 31, 2019. Imagine works Inc. Just nude vident of $1.15 per share at the end of 2010. The dividend is spected151 year for nars, after which time is expected to grow at a constant rate of 5.5annually. The company's cost of equity () is 10%. Ung the dividend growth model (alloprononceratant growth, what should be the price of the company's stock today (December 31, 2019? Do not round intermediate calculations. Round your answer to the nearest cent per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts