Question: Search this course 'Ch 09: Blueprint Problems - Stocks and Their Valuation The value of a share of common stock depends on the cash flows

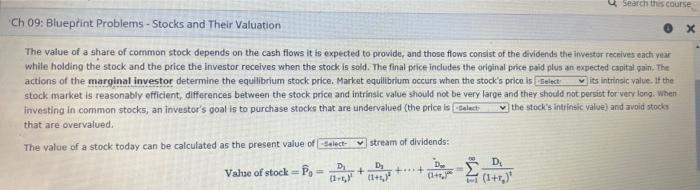

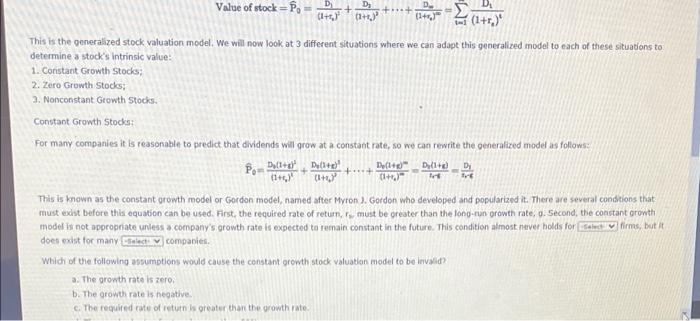

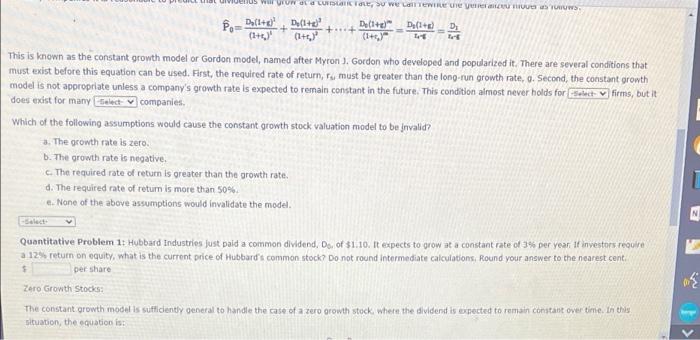

Search this course 'Ch 09: Blueprint Problems - Stocks and Their Valuation The value of a share of common stock depends on the cash flows it to expected to provide, and those flows consist of the dividends the investor recnives each year while holding the stock and the price the investor receives when the stock is sold. The final price includes the original price paid plus an expected capital gain. The actions of the marginal investor determine the equilibrium stock price. Markat equilibrium occurs when the stock's prica is Select its intrinsic value. If the stock market is reasonably efficient, differences between the stock price and intrinsle value should not be very large and they should not persist for very long. When investing in common stocks, an investor's goal is to purchase stocks that are undervalued (the price is -Salect that are overvalued. The value of a stock today can be calculated as the present value of Select stream of dividends: Value of stock P. D. + (H. the stock's Intrinsic value) and avoid stocks D D + + Value of stock - Po- + D (1+4)*(+) D- (146) This is the generalized stock valuation model. We will now look at 3 different situations where we can adope this generalized model to each of these situations to determine a stock's intrinsic value: 1. Constant Growth Stocks 2. Zero Growth Stodes: 2. Nonconstant Growth Stocks. Constant Growth Stocks For many companies it is reasonable to predict that dividends will grow at a constant rate, so we can rewrite the generalized model as follows: De D(14) D (1) ++ (1) 1.) This is known as the constant growth model or Gordon model, named after Myron ). Gordon who developed and popularized it. There are several conditions that mustedst before this equation can be used. First, the required rate of return, r, must be greater than the long-run growth rate, o. Second, the constant growth model is not appropriate unless a company's growth rate is expected to remain constant in the future. This condition almost never holds for Saleet wirme, but it does exist for many Creed companies. Which of the following assumptions would cause the constant growth stock valuation modul to be Invalid? a. The growth rate is zero. b. The growth rate is negative c. The required rate of return is greater than the growth rate Polina + US WF VUN OLLUT TO SU WEWE U VEZU TUWS Po Dalla D(14 D D(1+ + Do(1) ++ (1+) (14) This is known as the constant growth model or Gordon model, named after Myron ). Gordon who developed and popularized it. There are several conditions that must exist before this equation can be used. First, the required rate of return, must be greater than the long-run growth rate, 0. Second, the constant growth model is not appropriate unless a company's growth rate is expected to remain constant in the future. This condition almost never holds for select y firms, but it does exist for many that companies Which of the following assumptions would cause the constant growth stock valuation model to be Invalid? 3. The growth rate is zero b. The growth rate is negative. The required rate of return is greater than the growth rate. d. The required rate of return is more than 50% c. None of the above assumptions would invalidate the model Quantitative Problem 1: Hubbard Industries just paid a common dividend. De of $1.10. It expects to grow at a constant rate of 3% per year of investors require a 12% return on equity, what is the current price of Hubbard's common stock? Do not round Intermediate calculations, Round your answer to the nearest cent $ per share Zero Growth Stocks The constant growth model is sufficiently general to handle the case of a zero growth stock, where the dividend is expected to remain constant over time. In this situation, the equation is >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts