Question: 4. True or False: For a given depreciable asset, a company may not use a different depreciation method for income tax purposes than they do

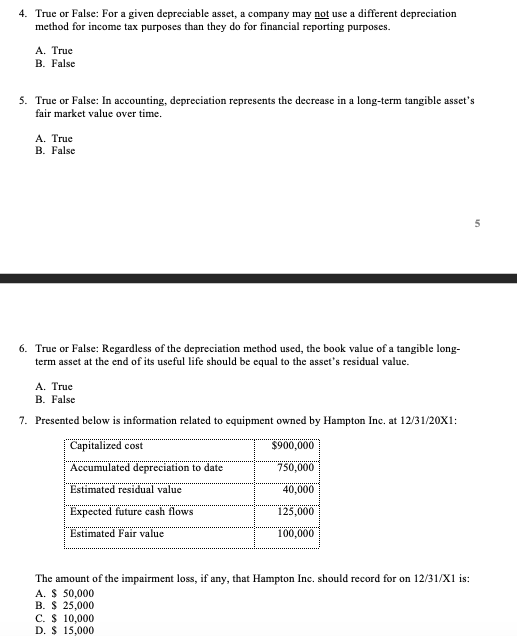

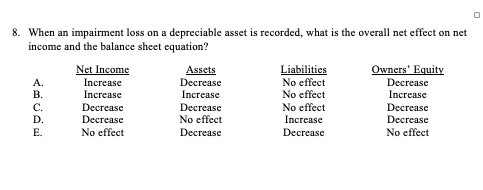

4. True or False: For a given depreciable asset, a company may not use a different depreciation method for income tax purposes than they do for financial reporting purposes. A. True B. False 5. True or False: In accounting, depreciation represents the decrease in a long-term tangible asset's fair market value over time. A True B. False 5 6. True or False: Regardless of the depreciation method used, the book value of a tangible long- term asset at the end of its useful life should be equal to the asset's residual value. A. True B. False 7. Presented below is information related to equipment owned by Hampton Inc. at 12/31/20X1: Capitalized cost $900,000 Accumulated depreciation to date 750,000 Estimated residual value 40,000 Expected future cash flows 125,000 Estimated Fair value 100,000 The amount of the impairment loss, if any, that Hampton Inc. should record for on 12/31/X1 is: A. $ 50,000 B. $ 25,000 C. $ 10,000 D. $ 15,000 8. When an impairment loss on a depreciable asset is recorded, what is the overall net effect on net income and the balance sheet equation? Net Income Assets Liabilities Owners' Equity A. Increase Decrease No effect Decrease B. Increase Increase No effect Increase C. Decrease Decrease No effect Decrease D. Decrease No effect Increase Decrease E. No effect Decrease Decrease No effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts