Question: 4. Use the following Average Return and Standard Deviation numbers for each of the asset classes below to calculate the range of one standard deviation

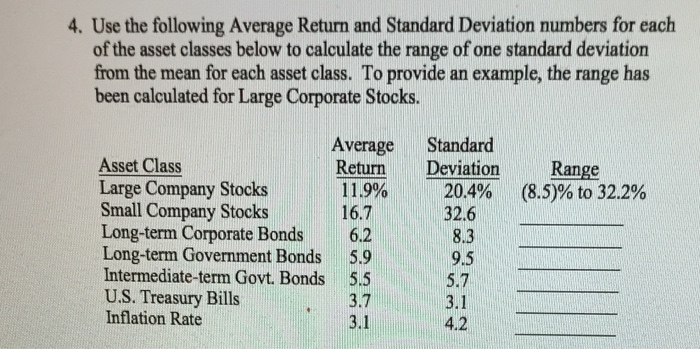

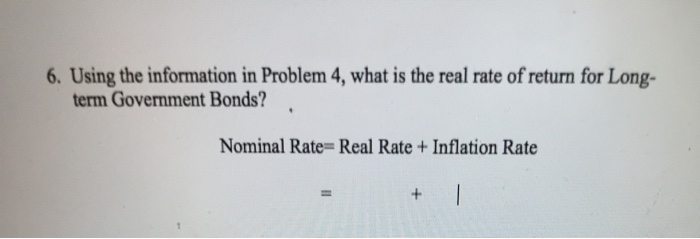

4. Use the following Average Return and Standard Deviation numbers for each of the asset classes below to calculate the range of one standard deviation from the mean for each asset class. To provide an example, the range has been calculated for Large Corporate Stocks. Range (8.5)% to 32.2% Average Asset Class Return Large Company Stocks 11.9% Small Company Stocks 16.7 Long-term Corporate Bonds 6.2 Long-term Government Bonds 5.9 Intermediate-term Govt. Bonds 5.5 U.S. Treasury Bills 3.7 Inflation Rate 3.1 Standard Deviation 20.4% 32.6 8.3 9.5 5.7 3.1 4.2 6. Using the information in Problem 4, what is the real rate of return for Long- term Government Bonds? . Nominal Rate= Real Rate + Inflation Rate + 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts