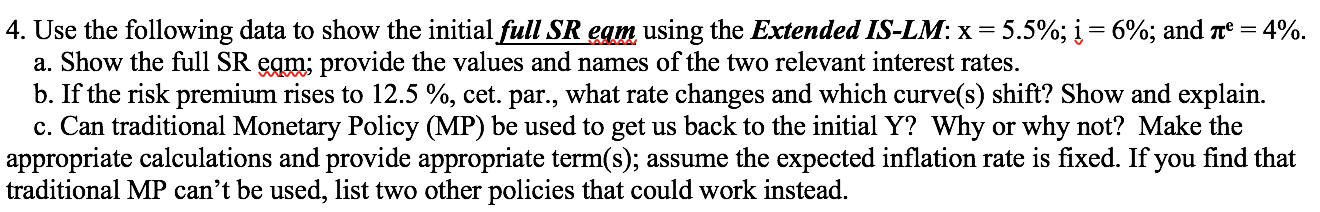

Question: 4. Use the following data to show the initial [all SR ggm using the Extended IS-LM: x = 5.5%; i: 6%; and are = 4%.

4. Use the following data to show the initial [all SR ggm using the Extended IS-LM: x = 5.5%; i: 6%; and are = 4%. a. Show the full SR egg]; provide the values and names of the two relevant interest rates. b. If the risk premium rises to 12.5 %, cet. par., what rate changes and which curve(s) shift? Show and explain. 0. Can traditional Monetary Policy (MP) be used to get us back to the initial Y? Why or why not? Make the appropriate calculations and provide appropriate term(s); assume the expected ination rate is xed. If you nd that traditional MP can't be used, list two other policies that could work instead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts