Question: 4. Use the options prices for Apple, Inc. to create a bull spread using Apple call options with 155 and 160 strike prices. Be sure

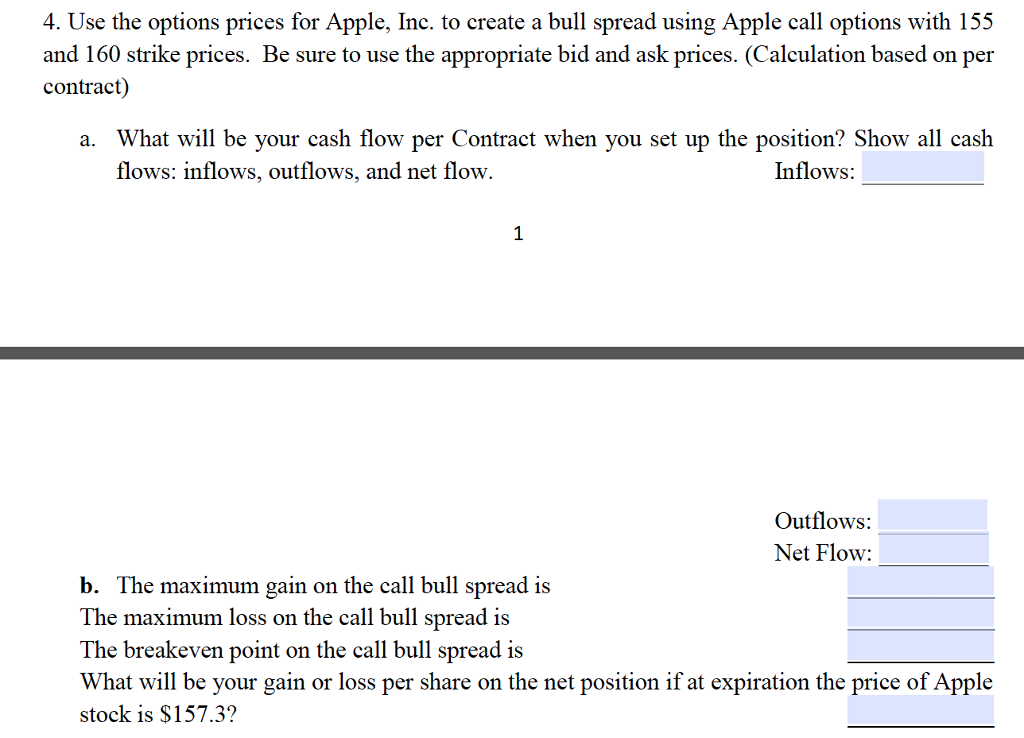

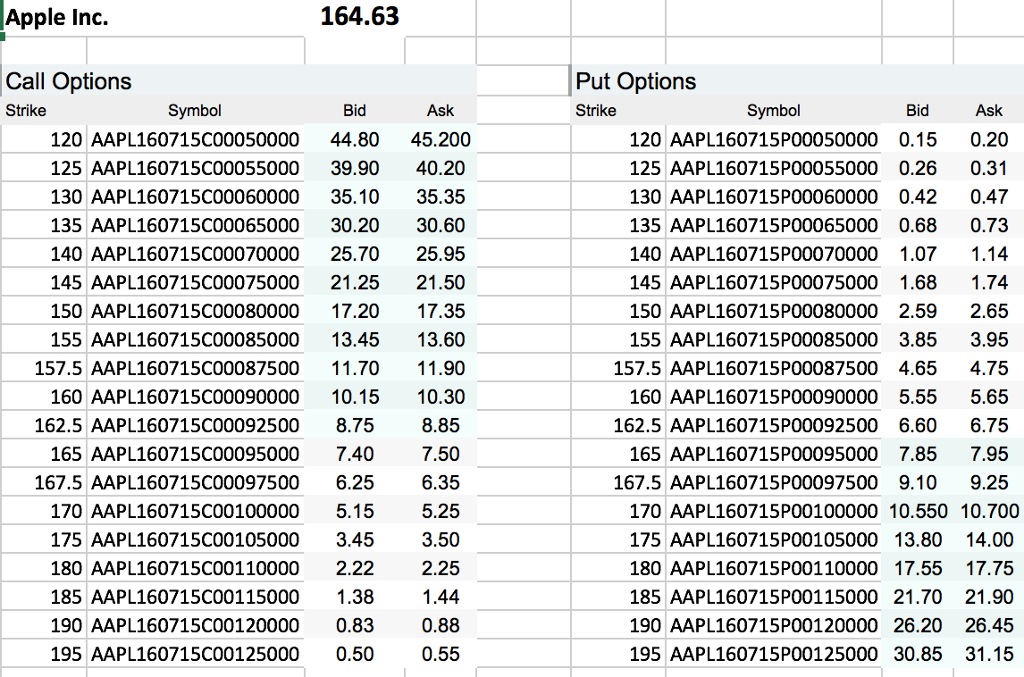

4. Use the options prices for Apple, Inc. to create a bull spread using Apple call options with 155 and 160 strike prices. Be sure to use the appropriate bid and ask prices. (Calculation based on per contract) a. What will be your cash flow per Contract when you set up the position? Show all cash flows: inflows, outflows, and net flow. Inflows: Outflows: Net Flow: b. The maximum gain on the call bull spread is The maximum loss on the call bull spread is The breakeven point on the call bull spread is What will be your gain or loss per share on the net position if at expiration the price of Apple stock is $157.3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts