Question: 4. (Using common-size financial statements) The S&H Construction Company expects to have total sales next year totaling $15,500,000. In addition, the firm pays taxes at

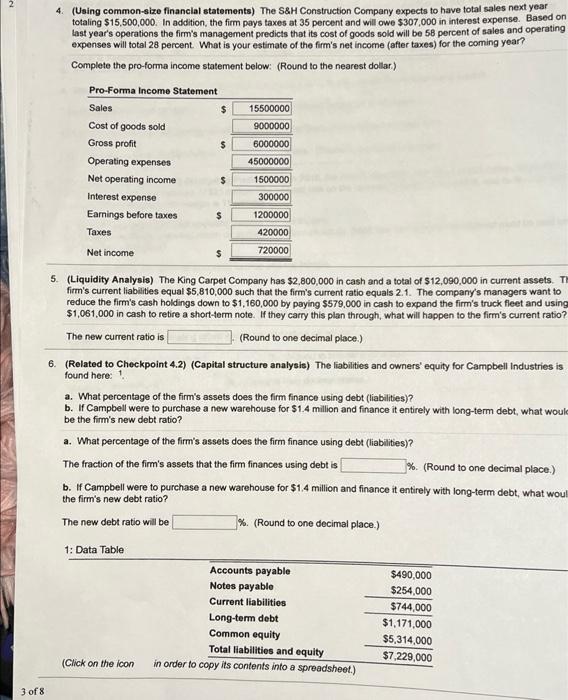

4. (Using common-size financial statements) The S&H Construction Company expects to have total sales next year totaling $15,500,000. In addition, the firm pays taxes at 35 percent and will owe $307,000 in interest expense. Based on Last year's operations the firm's management predicts that its cost of goods sold will be 58 percent of sales and operating expenses will total 28 percent. What is your estimate of the firm's net income (after taxes) for the coming year? Complete the pro-forma income statement below: (Round to the nearest dollar) Pro-Forma Income Statement Sales $ 15500000 Cost of goods sold 9000000 Gross profit s 6000000 Operating expenses 45000000 Net operating income $ 1500000 Interest expense 300000 Earnings before taxes $ 1200000 Taxes 420000 Net income 720000 a. 5. (Liquidity Analysis) The King Carpet Company has $2,800,000 in cash and a total of $12,090,000 in current assets. T firm's current liabilities equal $5,810,000 such that the firm's current ratio equals 2.1. The company's managers want to reduce the firm's cash holdings down to $1,160,000 by paying $579,000 in cash to expand the firm's truck fleet and using $1,061,000 in cash to retire a short-term note. If they carry this plan through, what will happen to the firm's current ratio? The new current ratio is (Round to one decimal place.) 6. (Related to Checkpoint 4.2) (Capital structure analysis) The liabilities and owners' equity for Campbell Industries is found here: 1 a. What percentage of the firm's assets does the firm finance using debt liabilities)? b. If Campbell were to purchase a new warehouse for $1.4 million and finance it entirely with long-term debt, what would be the firm's new debt ratio? a. What percentage of the firm's assets does the firm finance using debt (liabilities)? The fraction of the firm's assets that the firm finances using debt is % (Round to one decimal place.) b. If Campbell were to purchase a new warehouse for $1.4 million and finance it entirely with long-term debt, what woul the firm's new debt ratio? The new debt ratio will be 1% (Round to one decimal place.) 1: Data Table Accounts payable $490,000 Notes payable $254,000 Current liabilities $744,000 Long-term debt $1,171,000 Common equity $5,314,000 Total liabilities and equity $7.229.000 (Click on the icon in order to copy its contents into a spreadsheet.) 3 of 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts