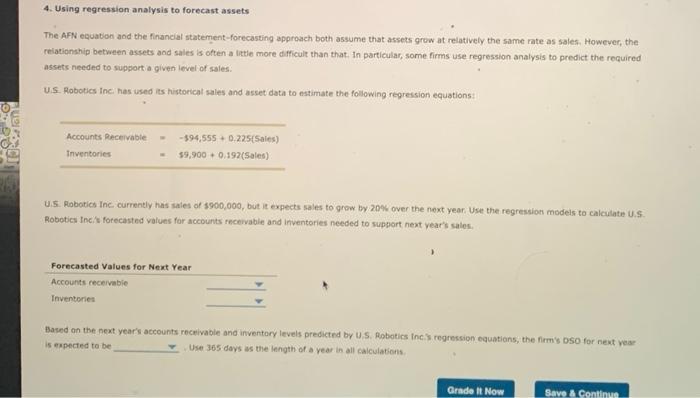

Question: 4. Using regression analysis to forecast assets The AFN equation aod the financial statement-forecasting approach both assume that assets grow at relatively the same rate

4. Using regression analysis to forecast assets The AFN equation aod the financial statement-forecasting approach both assume that assets grow at relatively the same rate as sales, Howewer, the relationship between assets and sales is often a little more difficult than that. In particular, some firms use regression analysis to predict the required assets needed to support a given level of sales: US. Robotics Inci has used its historical sales and asset data to estimate the following regression equations: U.5. Pobotics Inc. currently has sates of $900,000, but it expects sales to grow by 20% over the next year. Use the regression models to caiculate U. 5 . Robotics Inci's forecasted values for accounts recewable and inventories needed to support next vear's salos, Based an the pext year's accounts receivable and inventary levels predicted by U.S. Robatics incis regression equations, the firm's DSo for newt year is espected to be Use 365 davs as the length of a year in all calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts