Question: 4. Using the BlackScholes formula and the cumulative normal distribution (i.e. see Table 21.2, p. 7'40 of the prescribed textbook], compute the call and put

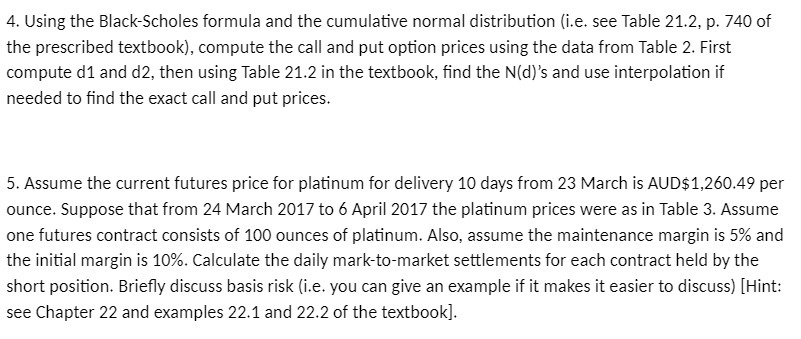

4. Using the BlackScholes formula and the cumulative normal distribution (i.e. see Table 21.2, p. 7'40 of the prescribed textbook], compute the call and put option prices using the data from Table 2. First compute d1 and d2, then using Table 21.2 in the textbook, nd the Nld)'s and use interpolation if needed to nd the exact call and put prices. 5. Assume the current futures price for platinum for delivery 10 days from 23 March is AUD$1,260.49 per ounce. Suppose that from 24 March 2G1? to 6 April 2U1?' the platinum prices were as in Table 3. Assume one futures contract consists of 100 ounces of platinum. Also, assume the maintenance margin is 5% and the initial margin is 10%. Calculate the daily markto-madcet settlements for each contract held by the short position. Briey discuss basis risk [i.e. you can give an example if it makes it easier to discuss) [Hint: see Chapter 22 and examples 22.1 and 22.2 of the textbook]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts