Question: 4. Using the information below for Mrs. T's Pizza Shop, (a) prepare a bank reconciliation as of October 31, 2019 and (b) record the necessary

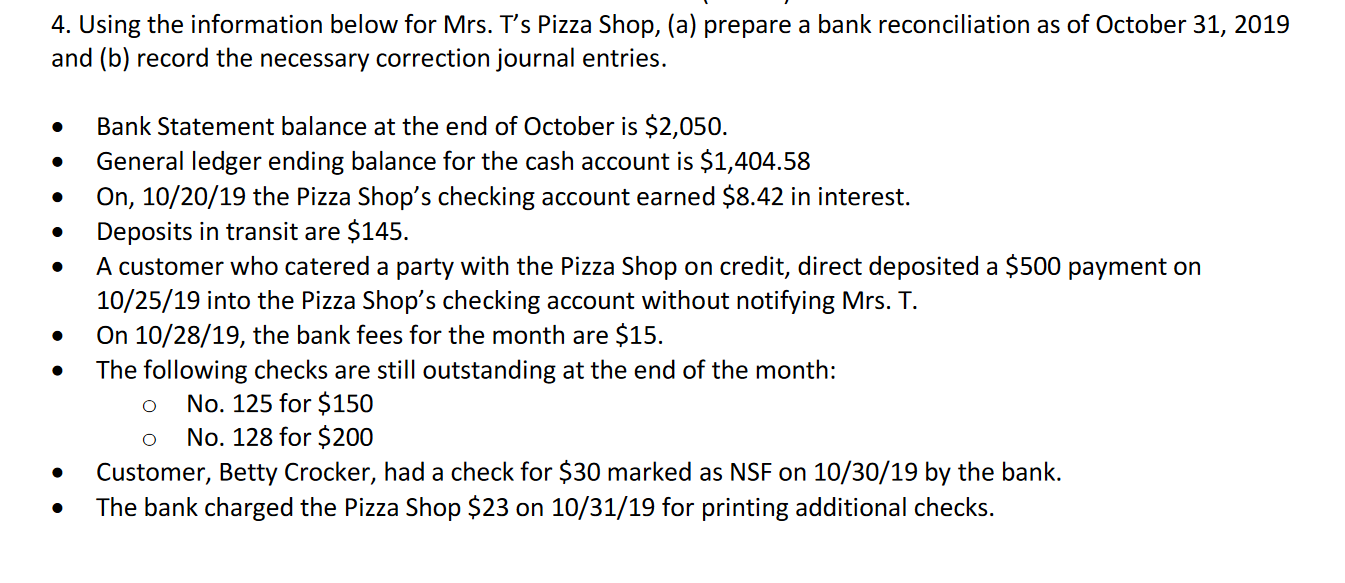

4. Using the information below for Mrs. T's Pizza Shop, (a) prepare a bank reconciliation as of October 31, 2019 and (b) record the necessary correction journal entries. . . . Bank Statement balance at the end of October is $2,050. General ledger ending balance for the cash account is $1,404.58 On, 10/20/19 the Pizza Shop's checking account earned $8.42 in interest. Deposits in transit are $145. A customer who catered a party with the Pizza Shop on credit, direct deposited a $500 payment on 10/25/19 into the Pizza Shop's checking account without notifying Mrs. T. On 10/28/19, the bank fees for the month are $15. The following checks are still outstanding at the end of the month: No. 125 for $150 No. 128 for $200 Customer, Betty Crocker, had a check for $30 marked as NSF on 10/30/19 by the bank. The bank charged the Pizza Shop $23 on 10/31/19 for printing additional checks. . O O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts