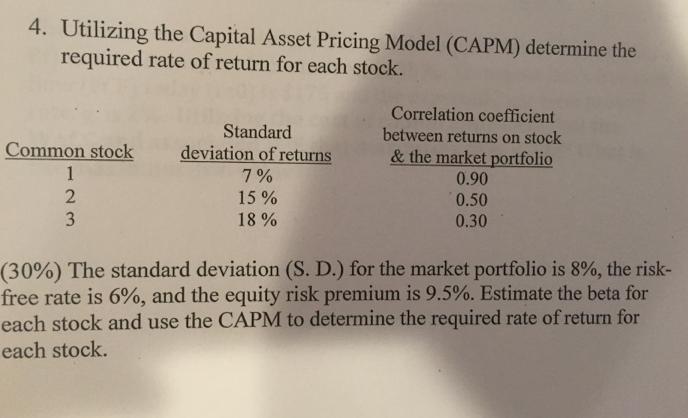

Question: 4. Utilizing the Capital Asset Pricing Model (CAPM) determine the required rate of return for each stock. Standard Common stock deviation of returns Correlation

4. Utilizing the Capital Asset Pricing Model (CAPM) determine the required rate of return for each stock. Standard Common stock deviation of returns Correlation coefficient between returns on stock & the market portfolio 1 7% 0.90 23 2 15% 0.50 3 18% 0.30 (30%) The standard deviation (S. D.) for the market portfolio is 8%, the risk- free rate is 6%, and the equity risk premium is 9.5%. Estimate the beta for each stock and use the CAPM to determine the required rate of return for each stock.

Step by Step Solution

There are 3 Steps involved in it

To determine the required rate of return for each stock using the Capital Asset Pricing Model CAPM we need to estimate the beta for each stock and use ... View full answer

Get step-by-step solutions from verified subject matter experts