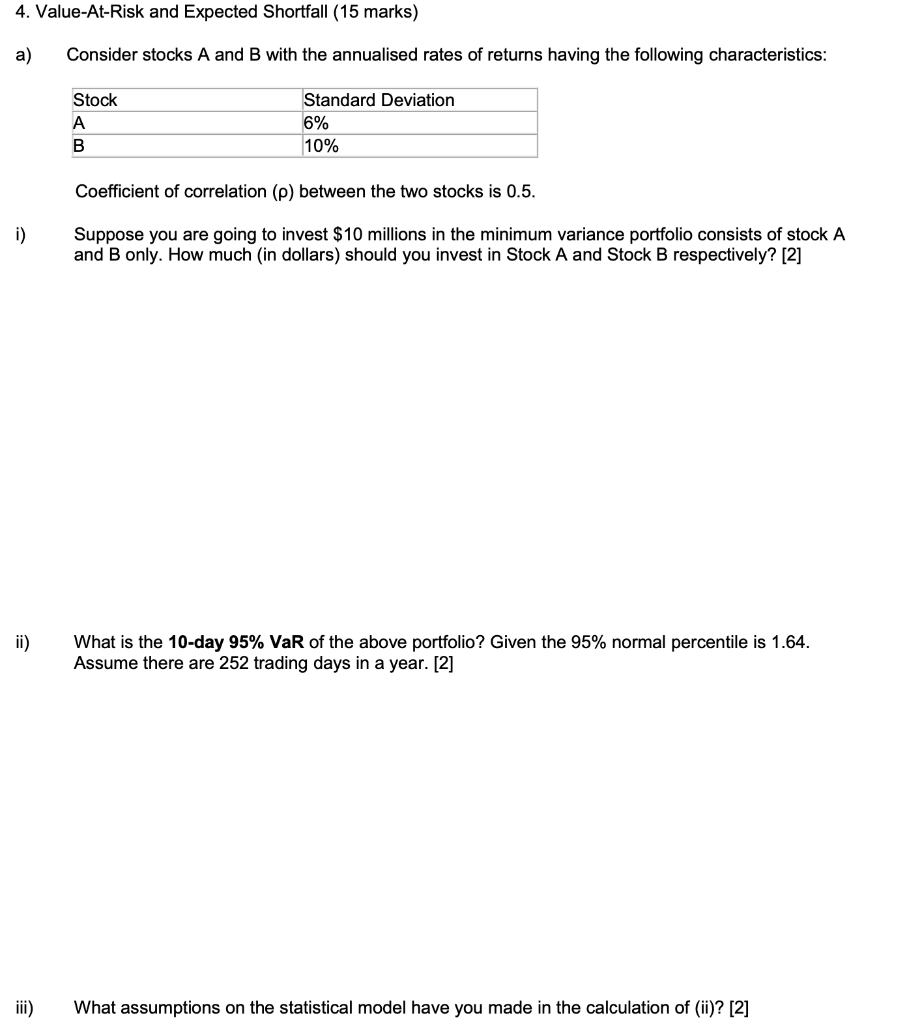

Question: 4. Value-At-Risk and Expected Shortfall (15 marks) a) Consider stocks A and B with the annualised rates of returns having the following characteristics: Coefficient of

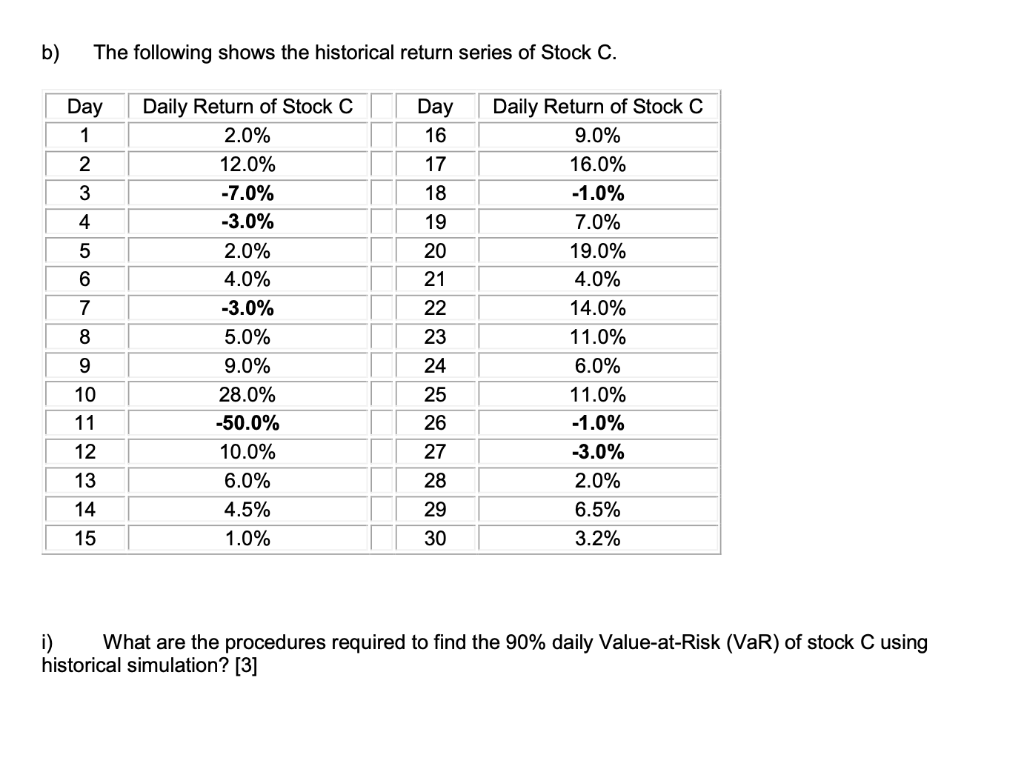

4. Value-At-Risk and Expected Shortfall (15 marks) a) Consider stocks A and B with the annualised rates of returns having the following characteristics: Coefficient of correlation () between the two stocks is 0.5. Suppose you are going to invest $10 millions in the minimum variance portfolio consists of stock A and B only. How much (in dollars) should you invest in Stock A and Stock B respectively? [2] ii) What is the 10-day 95\% VaR of the above portfolio? Given the 95\% normal percentile is 1.64. Assume there are 252 trading days in a year. [2] iii) What assumptions on the statistical model have you made in the calculation of (ii)? [2] b) The following shows the historical return series of Stock C. i) What are the procedures required to find the 90% daily Value-at-Risk (VaR) of stock C using historical simulation? [3]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts