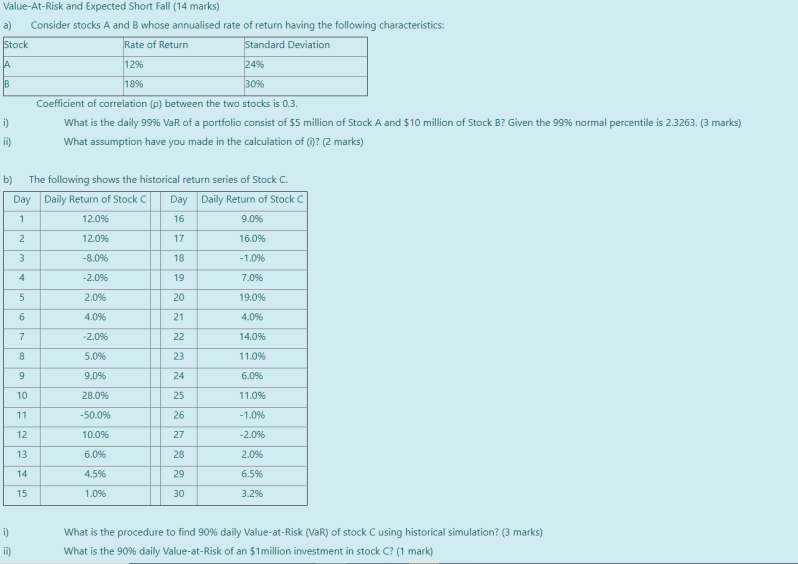

Question: Value-At-Risk and Expected Short Fall (14 marks) a) Consider stocks A and B whose annualised rate of retum having the following characteristics: Stock Rate of

Value-At-Risk and Expected Short Fall (14 marks) a) Consider stocks A and B whose annualised rate of retum having the following characteristics: Stock Rate of Return Standard Deviation 12% 249 18% 30% Coefficient of correlation (p) between the two stocks is 0.3. 1) What is the daily 99% VaR of a portfolio consist of $5 million of Stock A and $10 million of Stock B? Given the 99% normal percentile is 2.3263. (3 marks) ii) What assumption have you made in the calculation of (? (2 marks) b) The following shows the historical return series of Stock C. Day Daily Return of Stock C Day Daily Return of Stock 12.0% 16 9.096 2 12.0% 17 16.09 3 -8.0% 18 -1.0% 1 -2.096 19 7.096 5 2.096 20 19.0% 6 4.0% 21 4.096 7 -2.096 22 14.0% 8 5.0% 23 11.0% 9 9.0% 24 6.0% 10 28.0% 25 11.09 11 -50.0% 26 -1.0% 12 10.09 27 -2.0% 13 6.096 28 2.096 14 4.5% 29 6.5% 15 1.096 30 3.296 i) What is the procedure to find 90% daily Value-at-Risk (VaR) of stock C using historical simulation? (3 marks) What is the 90% daily Value-at-Risk of an $1 million investment in stock C? (1 mark) it)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts