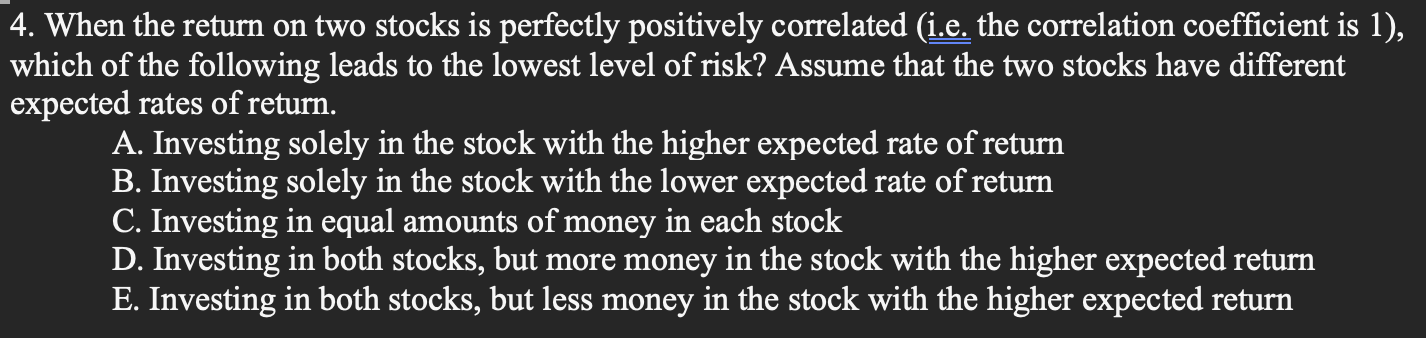

Question: 4. When the return on two stocks is perfectly positively correlated (i.e. the correlation coefficient is 1 ), which of the following leads to the

4. When the return on two stocks is perfectly positively correlated (i.e. the correlation coefficient is 1 ), which of the following leads to the lowest level of risk? Assume that the two stocks have different expected rates of return. A. Investing solely in the stock with the higher expected rate of return B. Investing solely in the stock with the lower expected rate of return C. Investing in equal amounts of money in each stock D. Investing in both stocks, but more money in the stock with the higher expected return E. Investing in both stocks, but less money in the stock with the higher expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts