Question: Question 2 (5 points) Saved According to CAPM, if the required rate of the return of Stock A obtained from the security market line (SML)

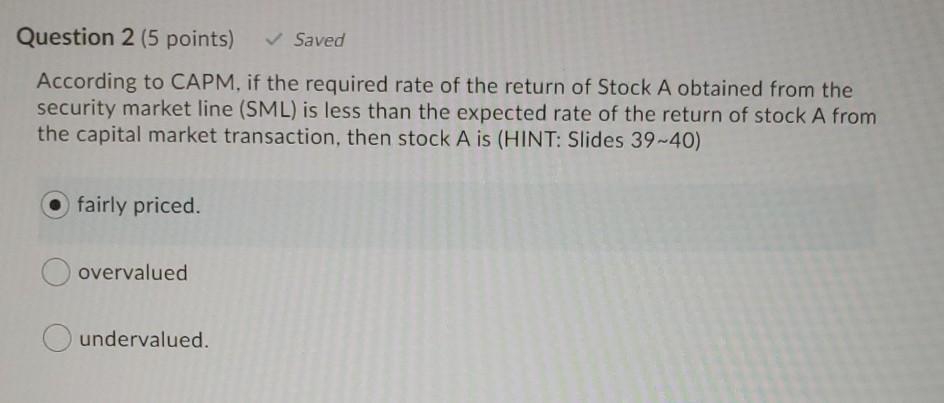

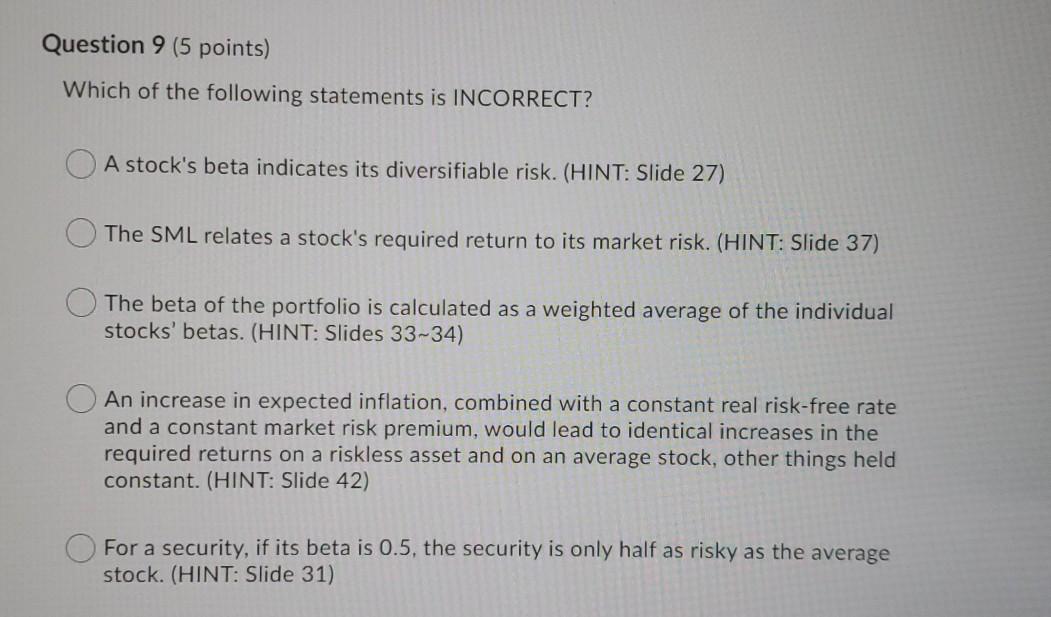

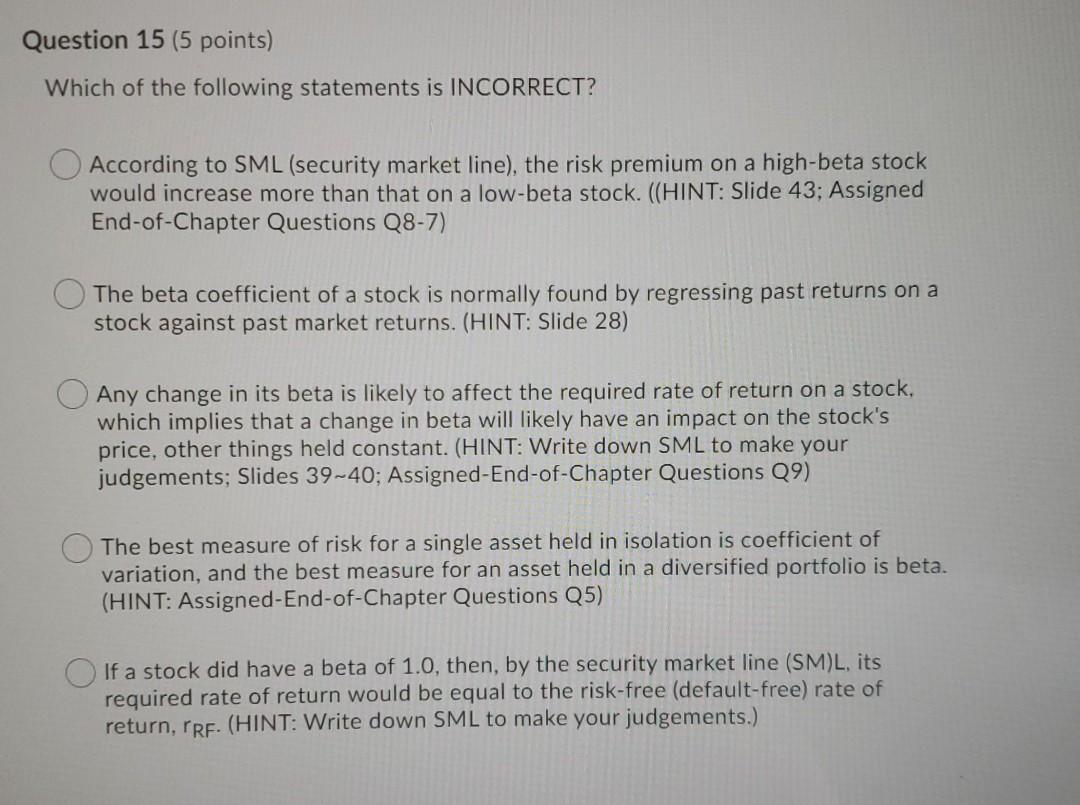

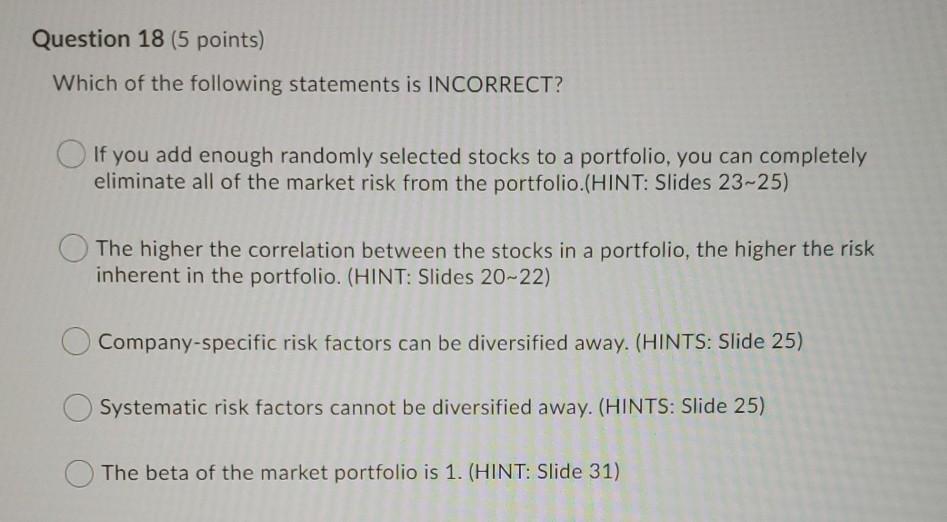

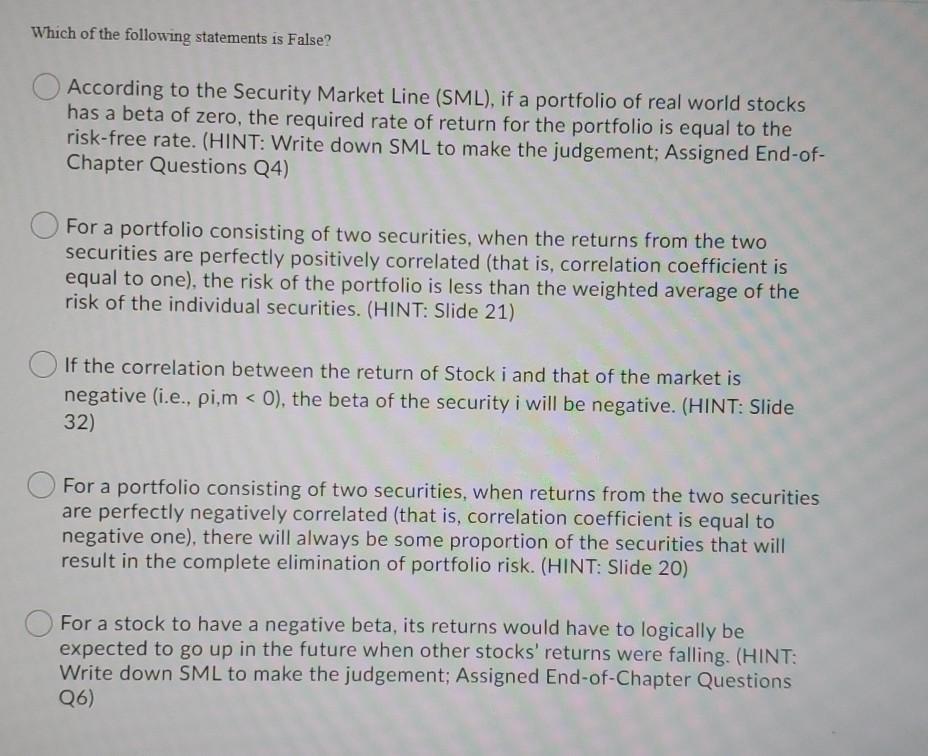

Question 2 (5 points) Saved According to CAPM, if the required rate of the return of Stock A obtained from the security market line (SML) is less than the expected rate of the return of stock A from the capital market transaction, then stock A is (HINT: Slides 39-40) fairly priced. overvalued undervalued Question 9 (5 points) Which of the following statements is INCORRECT? A stock's beta indicates its diversifiable risk. (HINT: Slide 27) The SML relates a stock's required return to its market risk. (HINT: Slide 37) The beta of the portfolio is calculated as a weighted average of the individual stocks' betas. (HINT: Slides 33-34) An increase in expected inflation, combined with a constant real risk-free rate and a constant market risk premium, would lead to identical increases in the required returns on a riskless asset and on an average stock, other things held constant. (HINT: Slide 42) For a security, if its beta is 0.5, the security is only half as risky as the average stock. (HINT: Slide 31) Question 15 (5 points) Which of the following statements is INCORRECT? According to SML (security market line), the risk premium on a high-beta stock would increase more than that on a low-beta stock. ((HINT: Slide 43; Assigned End-of-Chapter Questions Q8-7) The beta coefficient of a stock is normally found by regressing past returns on a stock against past market returns. (HINT: Slide 28) Any change in its beta is likely to affect the required rate of return on a stock, which implies that a change in beta will likely have an impact on the stock's price, other things held constant. (HINT: Write down SML to make your judgements; Slides 39-40; Assigned-End-of-Chapter Questions Q9) The best measure of risk for a single asset held in isolation is coefficient of variation, and the best measure for an asset held in a diversified portfolio is beta. (HINT: Assigned-End-of-Chapter Questions Q5) If a stock did have a beta of 1.0, then, by the security market line (SM)L, its required rate of return would be equal to the risk-free (default-free) rate of return, rRF(HINT: Write down SML to make your judgements.) Question 18 (5 points) Which of the following statements is INCORRECT? If you add enough randomly selected stocks to a portfolio, you can completely eliminate all of the market risk from the portfolio.(HINT: Slides 23-25) The higher the correlation between the stocks in a portfolio, the higher the risk inherent in the portfolio. (HINT: Slides 20-22) Company-specific risk factors can be diversified away. (HINTS: Slide 25) ) Systematic risk factors cannot be diversified away. (HINTS: Slide 25) The beta of the market portfolio is 1. (HINT: Slide 31) Which of the following statements is False? According to the Security Market Line (SML), if a portfolio of real world stocks has a beta of zero, the required rate of return for the portfolio is equal to the risk-free rate. (HINT: Write down SML to make the judgement; Assigned End-of- Chapter Questions (4) For a portfolio consisting of two securities, when the returns from the two securities are perfectly positively correlated (that is, correlation coefficient is equal to one), the risk of the portfolio is less than the weighted average of the risk of the individual securities. (HINT: Slide 21) If the correlation between the return of Stock i and that of the market is negative (i.e., pi,m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts