Question: 4. . . . Which of the listed items would normally be excluded from an individual's gross income on Form 1040? Punitive damages received Dividends

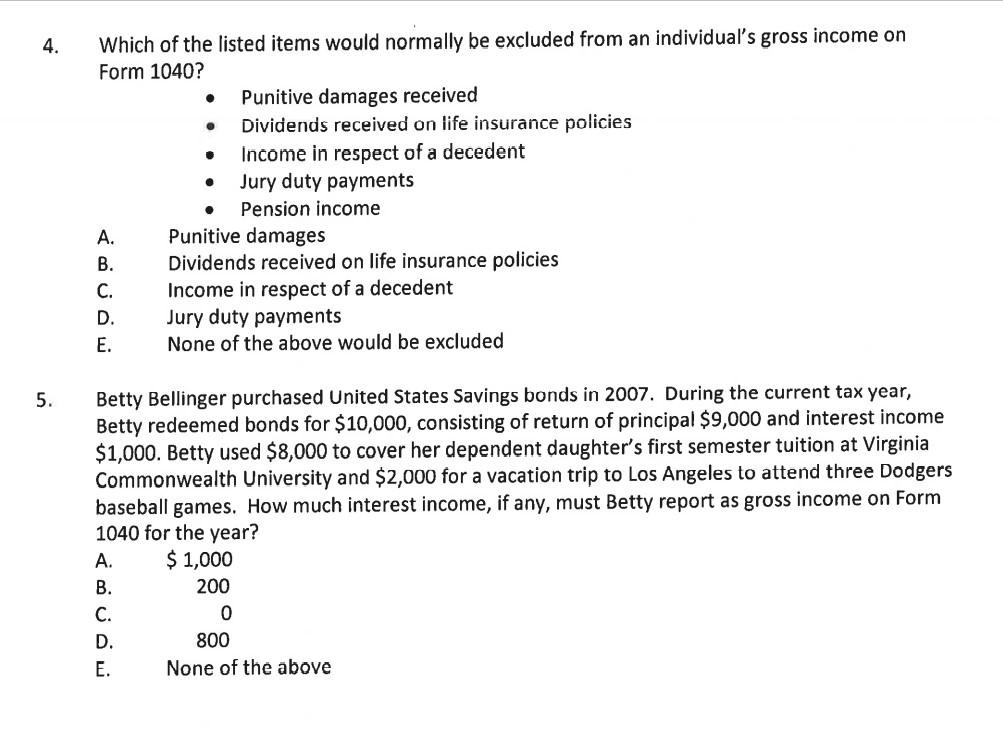

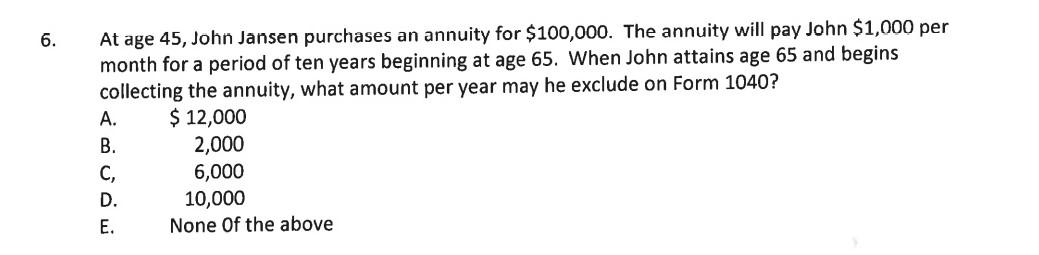

4. . . . Which of the listed items would normally be excluded from an individual's gross income on Form 1040? Punitive damages received Dividends received on life insurance policies Income in respect of a decedent Jury duty payments Pension income A. Punitive damages B. Dividends received on life insurance policies C. Income in respect of a decedent D. Jury duty payments E. None of the above would be excluded 5. Betty Bellinger purchased United States Savings bonds in 2007. During the current tax year, Betty redeemed bonds for $10,000, consisting of return of principal $9,000 and interest income $1,000. Betty used $8,000 to cover her dependent daughter's first semester tuition at Virginia Commonwealth University and $2,000 for a vacation trip to Los Angeles to attend three Dodgers baseball games. How much interest income, if any, must Betty report as gross income on Form 1040 for the year? A. $ 1,000 B. 200 C. 0 D. 800 E. None of the above 6. At age 45, John Jansen purchases an annuity for $100,000. The annuity will pay John $1,000 per month for a period of ten years beginning at age 65. When John attains age 65 and begins collecting the annuity, what amount per year may he exclude on Form 1040? $ 12,000 2,000 C, 6,000 D. 10,000 E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts