Question: Note: This problem is for the 2019 tax year. On November 1, 2008, Janet Morton and Kim Wong formed Pet Kingdom, Inc., to sell pets

Note: This problem is for the 2019 tax year.

On November 1, 2008, Janet Morton and Kim Wong formed Pet Kingdom, Inc., to sell pets and pet supplies. Pertinent information regarding Pet Kingdom is summarized as follows:

- Pet Kingdom's business address is 1010 Northwest Parkway, Dallas, TX 75225; its telephone number is (214) 555-2211; and its e-mail address is petkingdom@pki.com.

- The employer identification number is 11-1111112, and the principal business activity code is 453910.

- Janet and Kim each own 50% of the common stock; Janet is president and Kim is vice president of the company. No other class of stock is authorized.

- Both Janet and Kim are full-time employees of Pet Kingdom. Janet's Social Security number is 123-45-6788, and Kim's Social Security number is 123-45-6787.

- Pet Kingdom is an accrual method, calendar year taxpayer. Inventories are determined using FIFO and the lower of cost or market method. Pet Kingdom uses the straight-line method of depreciation for book purposes and accelerated depreciation (MACRS) for tax purposes.

- During 2019, the corporation distributed cash dividends of $250,000.

Pet Kingdom's financial statements for 2019 are shown below.

| Income Statement | |||||

| Income | |||||

| Gross sales | $5,750,000 | ||||

| Sales returns and allowances | (200,000) | ||||

| Net sales | $5,550,000 | ||||

| Cost of goods sold | (2,300,000) | ||||

| Gross profit | $3,250,000 | ||||

| Dividends received from stock | |||||

| investments in less-than-20%- owned U.S. corporations | 43,750 | ||||

| Interest income: | |||||

| State bonds | $15,000 | ||||

| Certificates of deposit | 20,000 | 35,000 | |||

| Total income | $3,328,750 | ||||

| Expenses | |||||

| Salariesofficers: | |||||

| Janet Morton | $262,500 | ||||

| Kim Wong | 262,500 | $525,000 | |||

| Salariesclerical and sales | 725,000 | ||||

| Taxes (state, local, and payroll) | 238,000 | ||||

| Repairs and maintenance | 140,000 | ||||

| Interest expense: | |||||

| Loan to purchase state bonds | $9,000 | ||||

| Other business loans | 207,000 | 216,000 | |||

| Advertising | 58,000 | ||||

| Rental expense | 109,000 | ||||

| Depreciation* | 106,000 | ||||

| Charitable contributions | 38,000 | ||||

| Employee benefit programs | 60,000 | ||||

| Premiums on term life insurance | |||||

| policies on lives of Janet Morton and Kim Wong; Pet Kingdom is the designated beneficiary | 40,000 | ||||

| Total expenses | (2,255,000) | ||||

| Net income before taxes | $1,073,750 | ||||

| Federal income tax | (221,734) | ||||

| Net income per books | $852,016 | ||||

| * Depreciation for tax purposes is $136,000. You are not provided enough detailed data to complete a Form 4562 (depreciation). If you solve this problem using Intuit ProConnect, enter the amount of depreciation on line 20 of Form 1120. | |||||

| Balance Sheet | |||||||

| Assets | January 1, 2019 | December 31, 2019 | |||||

| Cash | $1,200,000 | $1,039,461 | |||||

| Trade notes and accounts receivable | 2,062,500 | 2,147,000 | |||||

| Inventories | 2,750,000 | 3,030,000 | |||||

| Stock investment | 1,125,000 | 1,125,000 | |||||

| State bonds | 375,000 | 375,000 | |||||

| Certificates of deposit | 400,000 | 400,000 | |||||

| Prepaid Federal tax | 0 | 2,266 | |||||

| Buildings and other depreciable assets | 5,455,000 | 5,455,000 | |||||

| Accumulated depreciation | (606,000) | (712,000) | |||||

| Land | 812,500 | 812,500 | |||||

| Other assets | 140,000 | 128,500 | |||||

| Total assets | $13,714,000 | $13,802,727 | |||||

| Liabilities and Equity | January 1, 2019 | December 31, 2019 | |||||

| Accounts payable | $2,284,000 | $1,840,711 | |||||

| Other current liabilities | 175,000 | 155,000 | |||||

| Mortgages | 4,625,000 | 4,575,000 | |||||

| Capital stock | 2,500,000 | 2,500,000 | |||||

| Retained earnings | 4,130,000 | 4,732,016 | |||||

| Total liabilities and equity | $13,714,000 | $13,802,727 | |||||

Required:

During 2019, Pet Kingdom made estimated tax payments of $56,000 each quarter to the IRS. Prepare a Form 1120 for Pet Kingdom for tax year 2019.

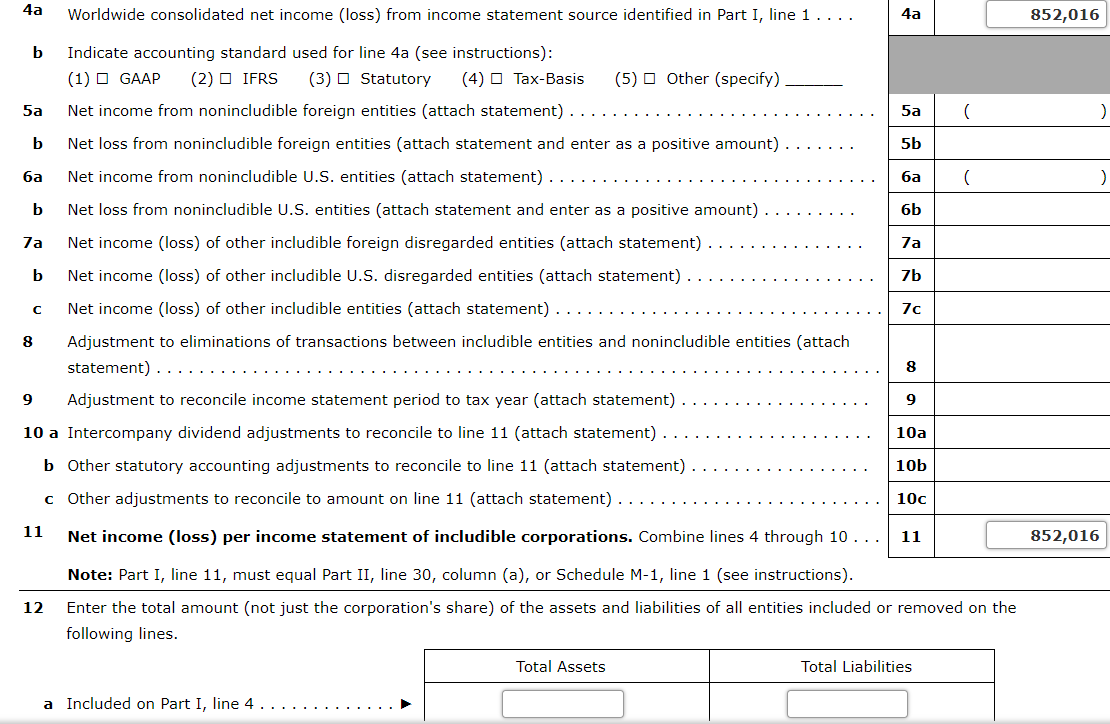

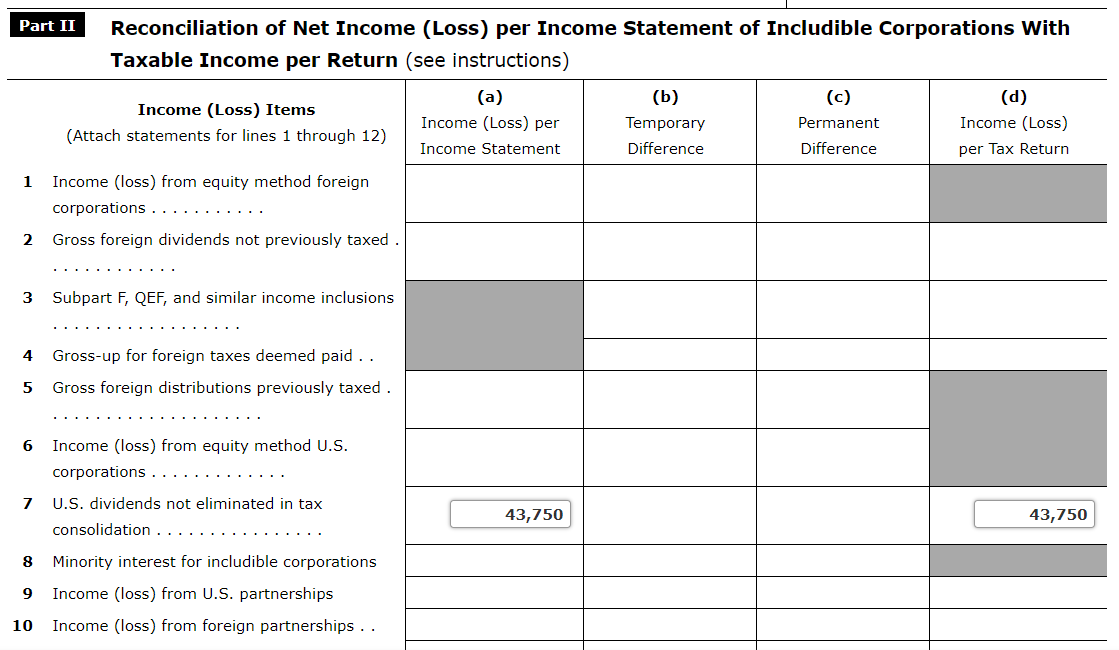

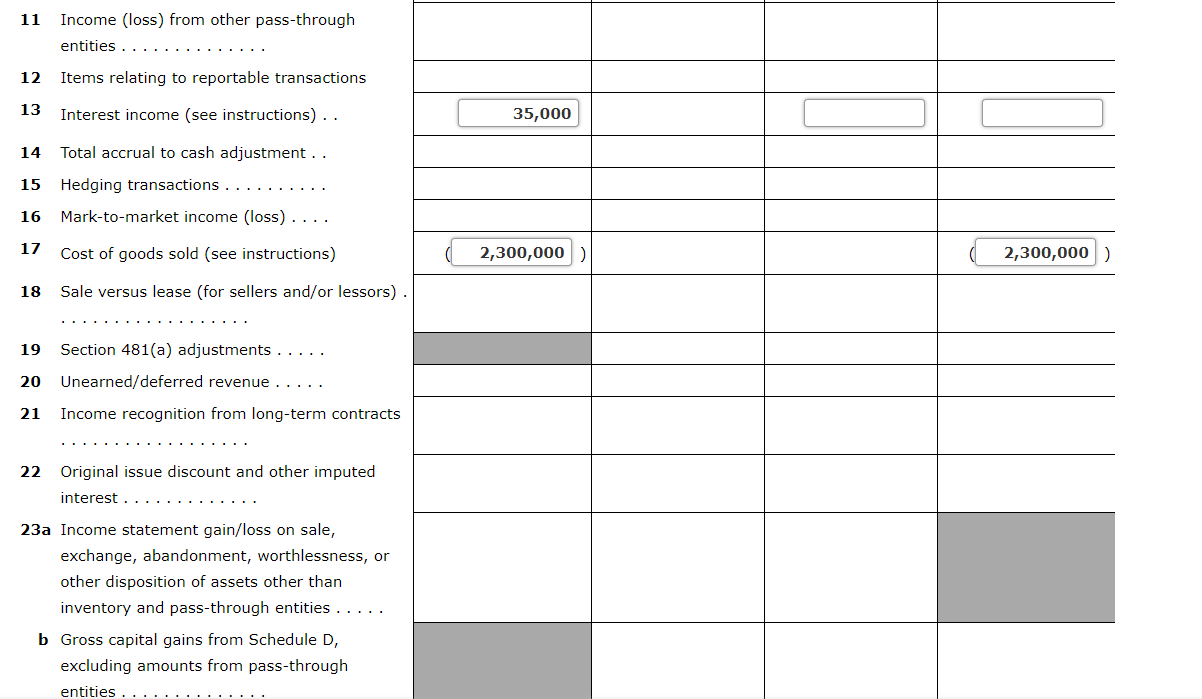

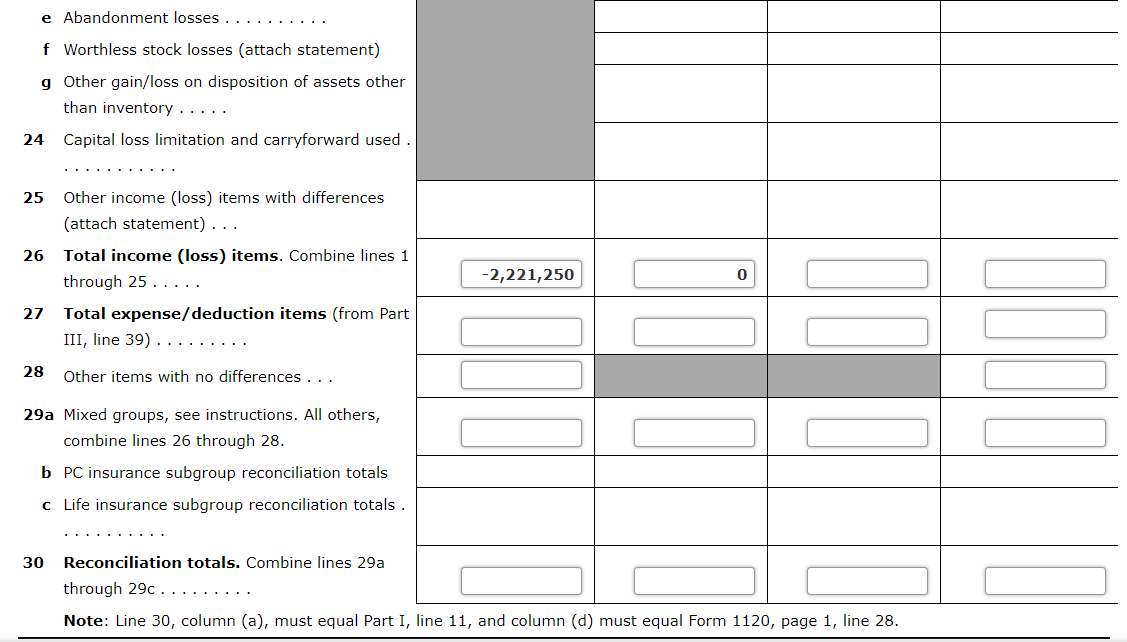

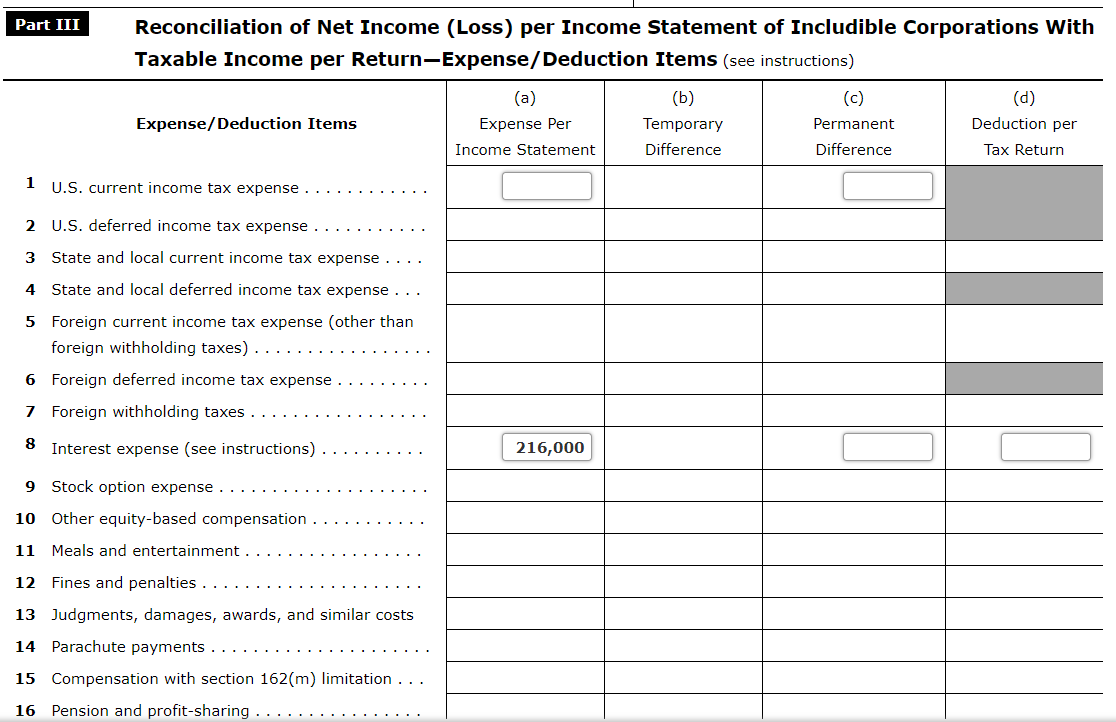

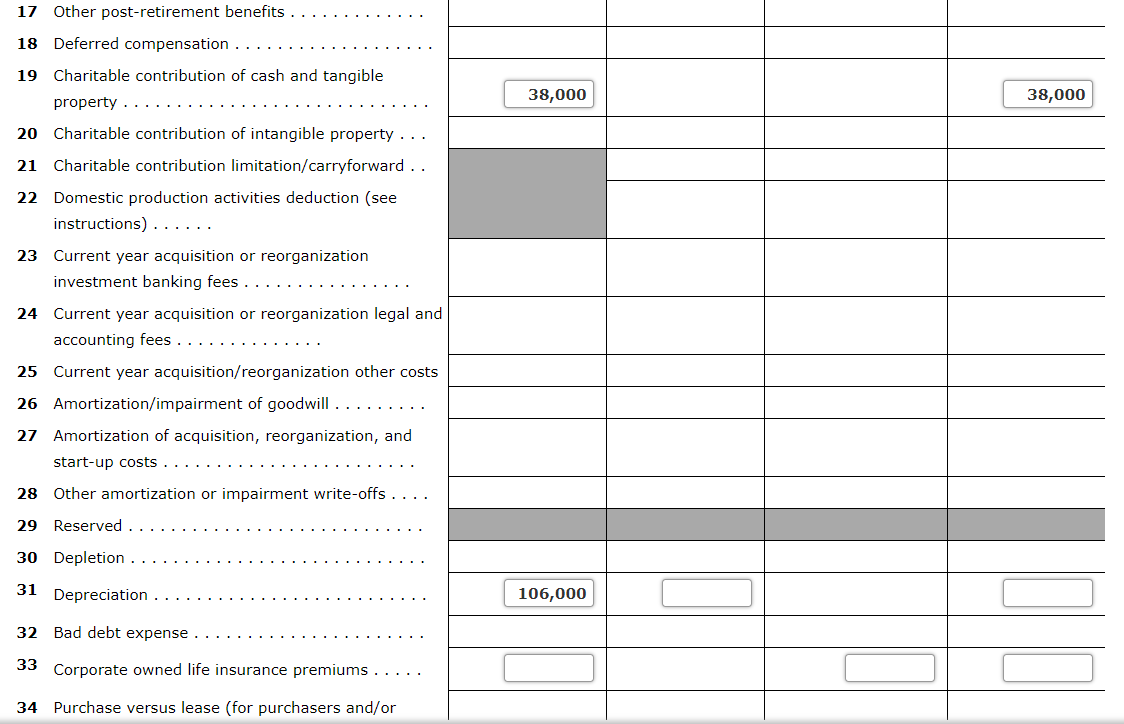

****** HELP WITH SCEDULE M-3 ***********

4a Worldwide consolidated net income (loss) from income statement source identified in Part I, line 1 .... 4a 852,016 5a ( 5b ) 6b 7a b Indicate accounting standard used for line 4a (see instructions): (1) GAAP (2) O IFRS (3) 0 Statutory (4) Tax-Basis (5) Other (specify) 5a Net income from nonincludible foreign entities (attach statement) b Net loss from nonincludible foreign entities (attach statement and enter as a positive amount) Net income from nonincludible U.S. entities (attach statement) b Net loss from nonincludible U.S. entities (attach statement and enter as a positive amount) 7a Net income (loss) of other includible foreign disregarded entities (attach statement) b Net income (loss) of other includible U.S. disregarded entities (attach statement) Net income (loss) of other includible entities (attach statement).. 8 Adjustment to eliminations of transactions between includible entities and nonincludible entities (attach statement) 9 Adjustment to reconcile income statement period to tax year (attach statement) 10 a Intercompany dividend adjustments to reconcile to line 11 (attach statement) b Other statutory accounting adjustments to reconcile to line 11 (attach statement) c Other adjustments to reconcile to amount on line 11 (attach statement) 7b 7c 8 9 10a 10b 10c 11 Net income (loss) per income statement of includible corporations. Combine lines 4 through 10... 11 852,016 12 Note: Part I, line 11, must equal Part II, line 30, column (a), or Schedule M-1, line 1 (see instructions). Enter the total amount (not just the corporation's share) of the assets and liabilities of all entities included or removed on the following lines. Total Assets Total Liabilities a Included on Part I, line 4 Part II Reconciliation of Net Income (Loss) per Income Statement of Includible Corporations With Taxable Income per Return (see instructions) (c) (d) Income (Loss) Items Income (Loss) per Temporary Permanent Income (Loss) (Attach statements for lines 1 through 12) Income Statement Difference Difference per Tax Return (a) (b) 1 Income (loss) from equity method foreign corporations. Gross foreign dividends not previously taxed . 2 3 Subpart F, QEF, and similar income inclusions 4 Gross-up for foreign taxes deemed paid .. Gross foreign distributions previously taxed. 5 6 Income (loss) from equity method U.S. corporations .. 7 U.S. dividends not eliminated in tax consolidation 43,750 43,750 8 Minority interest for includible corporations Income (loss) from U.S. partnerships 10 Income (loss) from foreign partnerships .. 9 11 Income (loss) from other pass-through entities 12 Items relating to reportable transactions 13 Interest income (see instructions).. 35,000 14 15 Total accrual to cash adjustment.. Hedging transactions.. Mark-to-market income (loss).... 16 17 Cost of goods sold (see instructions) 2,300,000 2,300,000 18 Sale versus lease (for sellers and/or lessors). 19 Section 481(a) adjustments ... 20 Unearned/deferred revenue 21 Income recognition from long-term contracts 22 Original issue discount and other imputed interest 23a Income statement gain/loss on sale, exchange, abandonment, worthlessness, or other disposition of assets other than inventory and pass-through entities b Gross capital gains from Schedule D, excluding amounts from pass-through entities e Abandonment losses. f Worthless stock losses (attach statement) g Other gain/loss on disposition of assets other than inventory ..... 24 Capital loss limitation and carryforward used. 25 26 Other income (loss) items with differences (attach statement)... Total income (loss) items. Combine lines 1 through 25..... Total expense/deduction items (from Part III, line 39)......... -2,221,250 0 27 28 Other items with no differences ... 29a Mixed groups, see instructions. All others, combine lines 26 through 28. b PC insurance subgroup reconciliation totals c Life insurance subgroup reconciliation totals . 30 Reconciliation totals. Combine lines 29a through 29c Note: Line 30, column (a), must equal Part I, line 11, and column (d) must equal Form 1120, page 1, line 28. Part III Reconciliation of Net Income (Loss) per Income Statement of Includible Corporations With Taxable Income per Return-Expense/Deduction Items (see instructions) Expense/Deduction Items (a) Expense Per Income Statement (b) Temporary Difference (c) Permanent Difference (d) Deduction per Tax Return 1 U.S. current income tax expense 2 U.S. deferred income tax expense 3 State and local current income tax expense 4. State and local deferred income tax expense ... 5 Foreign current income tax expense (other than foreign withholding taxes).. 6 Foreign deferred income tax expense 1 Foreign withholding taxes ... 8 Interest expense (see instructions) 216,000 9 Stock option expense. 10 Other equity-based compensation. 11 Meals and entertainment 12 Fines and penalties ... 13 Judgments, damages, awards, and similar costs 14 Parachute payments. 15 Compensation with section 162(m) limitation ... 16 Pension and profit-sharing 17 Other post-retirement benefits. 18 Deferred compensation .. 38,000 38,000 19 Charitable contribution of cash and tangible property .... 20 Charitable contribution of intangible property .. 21 Charitable contribution limitation/carryforward .. 22 Domestic production activities deduction (see instructions) ...... 23 Current year acquisition or reorganization investment banking fees .... 24 Current year acquisition or reorganization legal and accounting fees .. 25 Current year acquisition/reorganization other costs 26 Amortization/impairment of goodwill 27 Amortization of acquisition, reorganization, and start-up costs. 28 Other amortization or impairment write-offs 29 Reserved 30 Depletion. 31 Depreciation 106,000 32 Bad debt expense 33 Corporate owned life insurance premiums 34 Purchase versus lease (for purchasers and/or 4a Worldwide consolidated net income (loss) from income statement source identified in Part I, line 1 .... 4a 852,016 5a ( 5b ) 6b 7a b Indicate accounting standard used for line 4a (see instructions): (1) GAAP (2) O IFRS (3) 0 Statutory (4) Tax-Basis (5) Other (specify) 5a Net income from nonincludible foreign entities (attach statement) b Net loss from nonincludible foreign entities (attach statement and enter as a positive amount) Net income from nonincludible U.S. entities (attach statement) b Net loss from nonincludible U.S. entities (attach statement and enter as a positive amount) 7a Net income (loss) of other includible foreign disregarded entities (attach statement) b Net income (loss) of other includible U.S. disregarded entities (attach statement) Net income (loss) of other includible entities (attach statement).. 8 Adjustment to eliminations of transactions between includible entities and nonincludible entities (attach statement) 9 Adjustment to reconcile income statement period to tax year (attach statement) 10 a Intercompany dividend adjustments to reconcile to line 11 (attach statement) b Other statutory accounting adjustments to reconcile to line 11 (attach statement) c Other adjustments to reconcile to amount on line 11 (attach statement) 7b 7c 8 9 10a 10b 10c 11 Net income (loss) per income statement of includible corporations. Combine lines 4 through 10... 11 852,016 12 Note: Part I, line 11, must equal Part II, line 30, column (a), or Schedule M-1, line 1 (see instructions). Enter the total amount (not just the corporation's share) of the assets and liabilities of all entities included or removed on the following lines. Total Assets Total Liabilities a Included on Part I, line 4 Part II Reconciliation of Net Income (Loss) per Income Statement of Includible Corporations With Taxable Income per Return (see instructions) (c) (d) Income (Loss) Items Income (Loss) per Temporary Permanent Income (Loss) (Attach statements for lines 1 through 12) Income Statement Difference Difference per Tax Return (a) (b) 1 Income (loss) from equity method foreign corporations. Gross foreign dividends not previously taxed . 2 3 Subpart F, QEF, and similar income inclusions 4 Gross-up for foreign taxes deemed paid .. Gross foreign distributions previously taxed. 5 6 Income (loss) from equity method U.S. corporations .. 7 U.S. dividends not eliminated in tax consolidation 43,750 43,750 8 Minority interest for includible corporations Income (loss) from U.S. partnerships 10 Income (loss) from foreign partnerships .. 9 11 Income (loss) from other pass-through entities 12 Items relating to reportable transactions 13 Interest income (see instructions).. 35,000 14 15 Total accrual to cash adjustment.. Hedging transactions.. Mark-to-market income (loss).... 16 17 Cost of goods sold (see instructions) 2,300,000 2,300,000 18 Sale versus lease (for sellers and/or lessors). 19 Section 481(a) adjustments ... 20 Unearned/deferred revenue 21 Income recognition from long-term contracts 22 Original issue discount and other imputed interest 23a Income statement gain/loss on sale, exchange, abandonment, worthlessness, or other disposition of assets other than inventory and pass-through entities b Gross capital gains from Schedule D, excluding amounts from pass-through entities e Abandonment losses. f Worthless stock losses (attach statement) g Other gain/loss on disposition of assets other than inventory ..... 24 Capital loss limitation and carryforward used. 25 26 Other income (loss) items with differences (attach statement)... Total income (loss) items. Combine lines 1 through 25..... Total expense/deduction items (from Part III, line 39)......... -2,221,250 0 27 28 Other items with no differences ... 29a Mixed groups, see instructions. All others, combine lines 26 through 28. b PC insurance subgroup reconciliation totals c Life insurance subgroup reconciliation totals . 30 Reconciliation totals. Combine lines 29a through 29c Note: Line 30, column (a), must equal Part I, line 11, and column (d) must equal Form 1120, page 1, line 28. Part III Reconciliation of Net Income (Loss) per Income Statement of Includible Corporations With Taxable Income per Return-Expense/Deduction Items (see instructions) Expense/Deduction Items (a) Expense Per Income Statement (b) Temporary Difference (c) Permanent Difference (d) Deduction per Tax Return 1 U.S. current income tax expense 2 U.S. deferred income tax expense 3 State and local current income tax expense 4. State and local deferred income tax expense ... 5 Foreign current income tax expense (other than foreign withholding taxes).. 6 Foreign deferred income tax expense 1 Foreign withholding taxes ... 8 Interest expense (see instructions) 216,000 9 Stock option expense. 10 Other equity-based compensation. 11 Meals and entertainment 12 Fines and penalties ... 13 Judgments, damages, awards, and similar costs 14 Parachute payments. 15 Compensation with section 162(m) limitation ... 16 Pension and profit-sharing 17 Other post-retirement benefits. 18 Deferred compensation .. 38,000 38,000 19 Charitable contribution of cash and tangible property .... 20 Charitable contribution of intangible property .. 21 Charitable contribution limitation/carryforward .. 22 Domestic production activities deduction (see instructions) ...... 23 Current year acquisition or reorganization investment banking fees .... 24 Current year acquisition or reorganization legal and accounting fees .. 25 Current year acquisition/reorganization other costs 26 Amortization/impairment of goodwill 27 Amortization of acquisition, reorganization, and start-up costs. 28 Other amortization or impairment write-offs 29 Reserved 30 Depletion. 31 Depreciation 106,000 32 Bad debt expense 33 Corporate owned life insurance premiums 34 Purchase versus lease (for purchasers and/or

Step by Step Solution

There are 3 Steps involved in it

To assist with completing Schedule M3 Form 1120 for Pet Kingdom Inc well reconcile the book net income with taxable income by walking through Part I I... View full answer

Get step-by-step solutions from verified subject matter experts