Question: 4. Which statement of the four (from a recent article July 22 on beta's) is incorrect? Here's how to read stock betas: 1. A beta

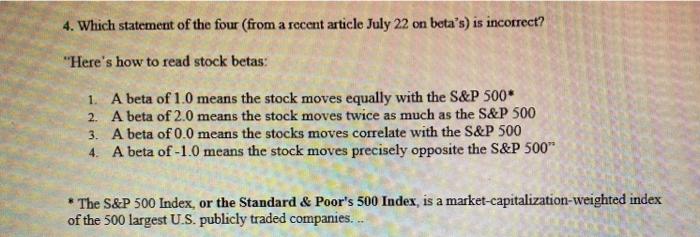

4. Which statement of the four (from a recent article July 22 on beta's) is incorrect? "Here's how to read stock betas: 1. A beta of 1.0 means the stock moves equally with the S&P 500* 2. A beta of 2.0 means the stock moves twice as much as the S&P 500 3. A beta of 0.0 means the stocks moves correlate with the S&P 500 4. A beta of -1.0 means the stock moves precisely opposite the S&P 500" The S&P 500 Index, or the Standard & Poor's 500 Index, is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts