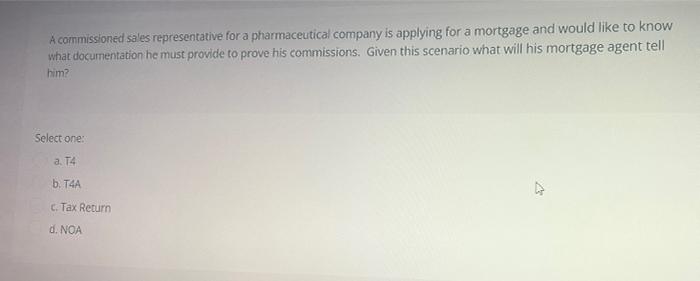

Question: This is a case study two part question A commissioned sales representative for a pharmaceutical company is applying for a mortgage and would like to

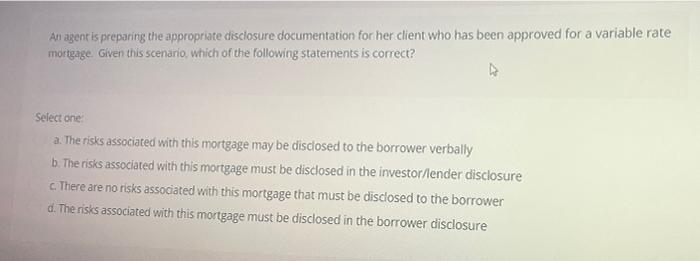

A commissioned sales representative for a pharmaceutical company is applying for a mortgage and would like to know what documentation he must provide to prove his commissions. Given this scenario what will his mortgage agent tell him? Select one: a T4 b. T4A C. Tax Return 1. NGA An agent is preparing the appropriate disclosure documentation for her client who has been approved for a variable rate mortgage. Given this scenario which of the following statements is correct? Select one a. The risks associated with this mortgage may be disclosed to the borrower verbally b. The risks associated with this mortgage must be disclosed in the investor/ender disclosure cThere are no risks associated with this mortgage that must be disclosed to the borrower d. The risks associated with this mortgage must be disclosed in the borrower disclosure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts