Question: 4. Which values should be used as a starting point to estimate the mean and standard deviation of NOI growth for an income producing property

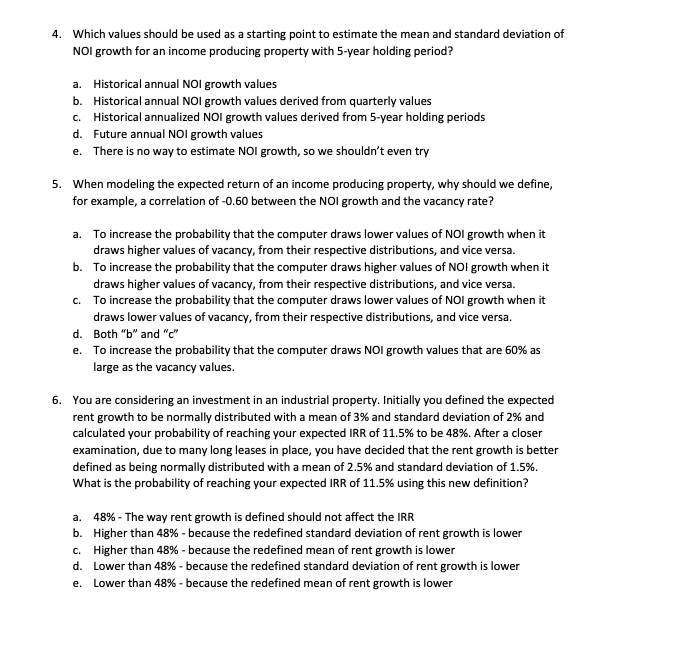

4. Which values should be used as a starting point to estimate the mean and standard deviation of NOI growth for an income producing property with 5-year holding period? a. Historical annual Nol growth values b. Historical annual Nol growth values derived from quarterly values c. Historical annualized Nol growth values derived from 5-year holding periods d. Future annual NOI growth values e. There is no way to estimate Nol growth, so we shouldn't even try 5. When modeling the expected return of an income producing property, why should we define, for example, a correlation of -0.60 between the Nol growth and the vacancy rate? a. To increase the probability that the computer draws lower values of Nol growth when it draws higher values of vacancy, from their respective distributions, and vice versa. b. To increase the probability that the computer draws higher values of Nol growth when it draws higher values of vacancy, from their respective distributions, and vice versa. C. To increase the probability that the computer draws lower values of NOI growth when it draws lower values of vacancy, from their respective distributions, and vice versa. d. Both "b" and "c" e. To increase the probability that the computer draws NOI growth values that are 60% as large as the vacancy values. 6. You are considering an investment in an industrial property. Initially you defined the expected rent growth to be normally distributed with a mean of 3% and standard deviation of 2% and calculated your probability of reaching your expected IRR of 11.5% to be 48%. After a closer examination, due to many long leases in place, you have decided that the rent growth is better defined as being normally distributed with a mean of 2.5% and standard deviation of 1.5%. What is the probability of reaching your expected IRR of 11.5% using this new definition? a. 48% - The way rent growth is defined should not affect the IRR b. Higher than 48%-because the redefined standard deviation of rent growth is lower C. Higher than 48% - because the redefined mean of rent growth is lower d. Lower than 48%- because the redefined standard deviation of rent growth is lower e. Lower than 48%- because the redefined mean of rent growth is lower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts