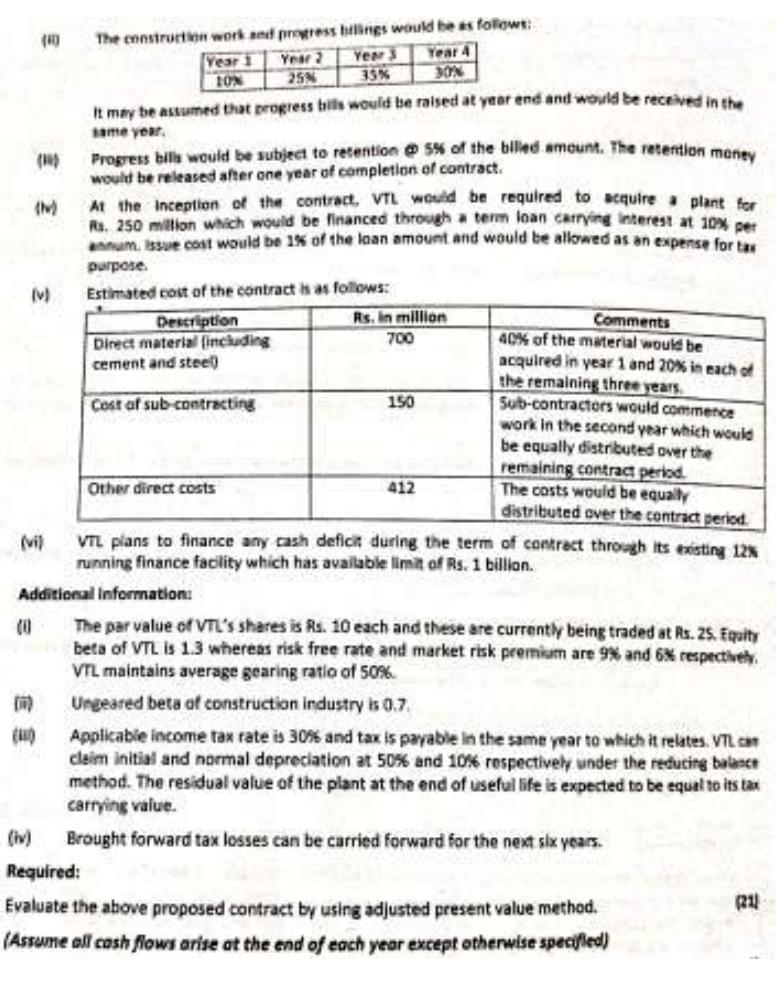

Question: (40) (14) (N) (v) (vi) (7) (1) The construction work and progress bilings would be as follows: Year 1 Year 4 10% 30% Year

(40) (14) (N) (v) (vi) (7) (1) The construction work and progress bilings would be as follows: Year 1 Year 4 10% 30% Year 2 25% It may be assumed that progress bills would be raised at year end and would be received in the same year. Year 3 35% Progress bills would be subject to retention @ 5% of the billed amount. The retention money would be released after one year of completion of contract. Direct material (including cement and steel) Cost of sub-contracting At the Inception of the contract, VTL would be required to acquire a plant for Rs. 250 million which would be financed through a term loan carrying interest at 10% per annum, issue cost would be 1% of the loan amount and would be allowed as an expense for tax purpose. Estimated cost of the contract is as follows: Description Other direct costs Rs. in million 700 150 412 Comments 40% of the material would be acquired in year 1 and 20% in each of the remaining three years. Sub-contractors would commence work in the second year which would be equally distributed over the remaining contract period. The costs would be equally distributed over the contract period. VTL plans to finance any cash deficit during the term of contract through its existing 12% running finance facility which has available limit of Rs. 1 billion. Additional Information: The par value of VTL's shares is Rs. 10 each and these are currently being traded at Rs. 25. Equity beta of VTL is 1.3 whereas risk free rate and market risk premium are 9% and 6 % respectively. VTL maintains average gearing ratio of 50%. Ungeared beta of construction industry is 0.7. Applicable income tax rate is 30% and tax is payable in the same year to which it relates. VTL.can claim initial and normal depreciation at 50% and 10% respectively under the reducing balance method. The residual value of the plant at the end of useful life is expected to be equal to its tax carrying value. Brought forward tax losses can be carried forward for the next six years. (iv) Required: Evaluate the above proposed contract by using adjusted present value method. (Assume all cash flows arise at the end of each year except otherwise specified) (21)

Step by Step Solution

3.32 Rating (146 Votes )

There are 3 Steps involved in it

To evaluate the proposed contract using the adjusted present value APV method we need to calculate the present value of cash flows including the tax s... View full answer

Get step-by-step solutions from verified subject matter experts